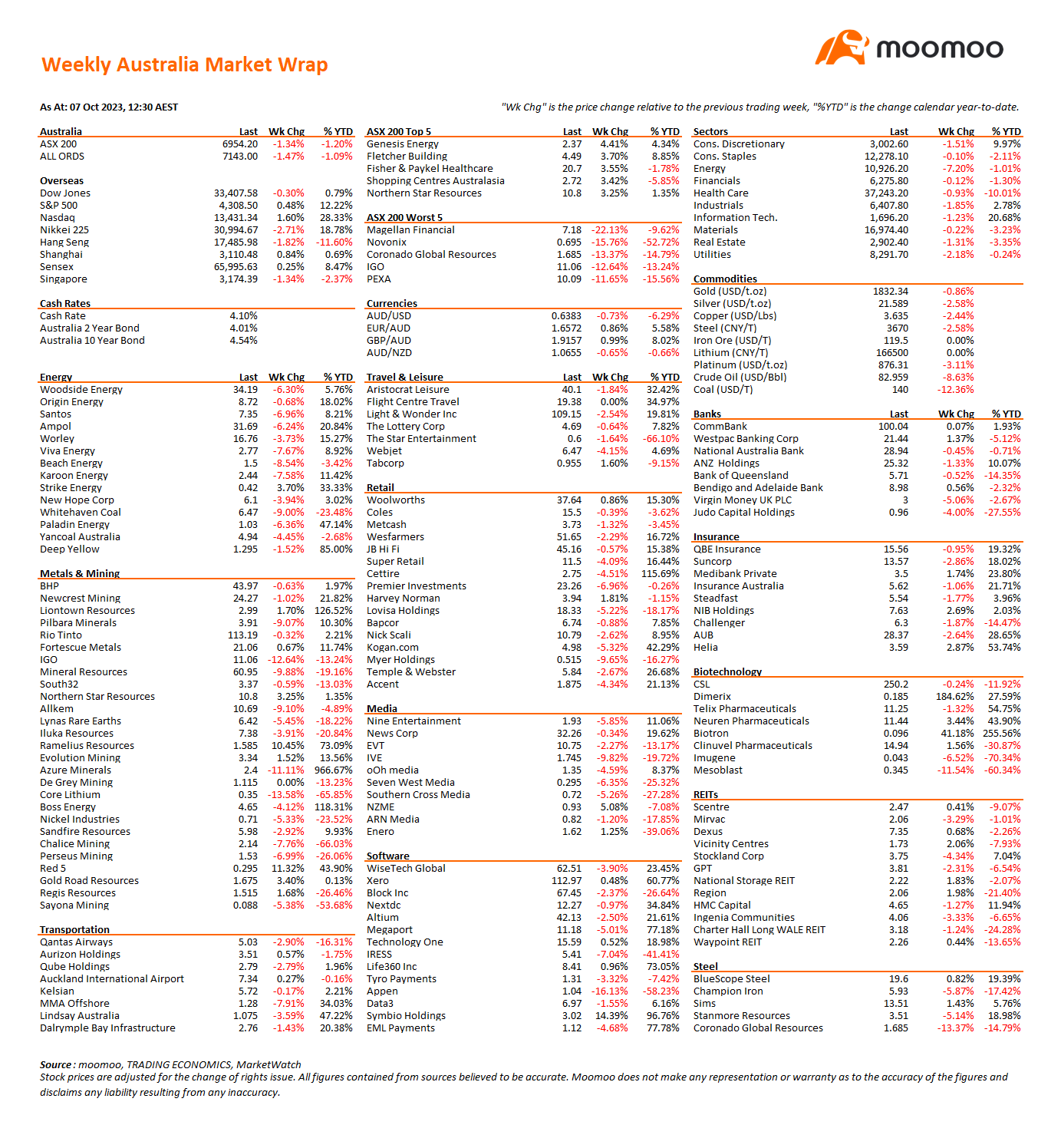

Pilbara lost 9.07%, IGO fell 12.64%, Allkem lost 9.10% and Core Lithium shed 13.58%. Liontown Resources was almost the lone riser in the Lithium sector with mining magnate Gina Rhinehart’s Hancock Prospecting completing a fourth on-market buying spree taking it to slightly more than 50 million shares at around $152 million. The stake is around 14.67% of the company and becomes a significant impediment for US battery and chemical company, Albermarle, that is attempting to takeover the company.