Weekly Buzz | Have You Caught the Chinese Market's Surge?

Hello mooers!!!

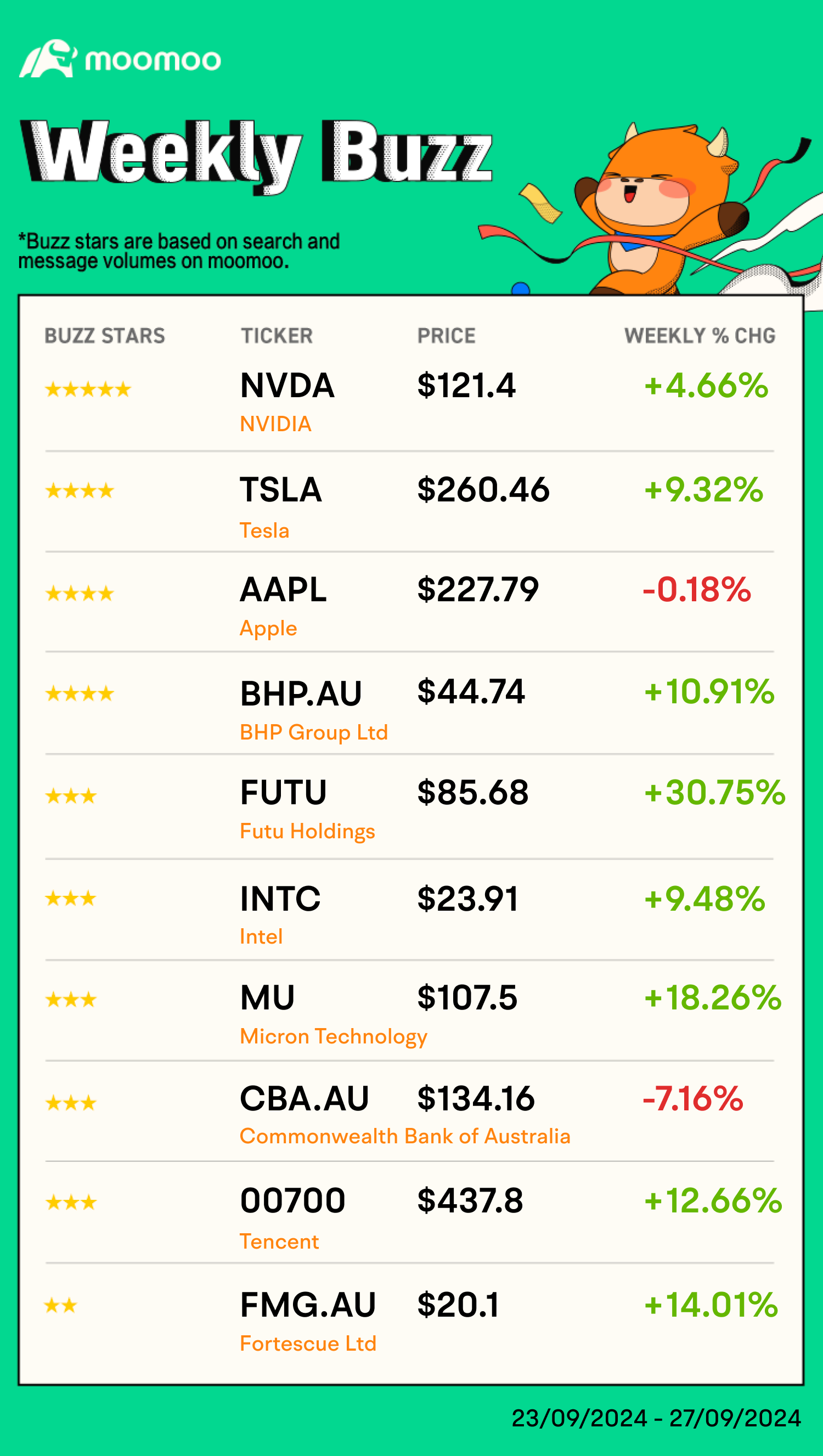

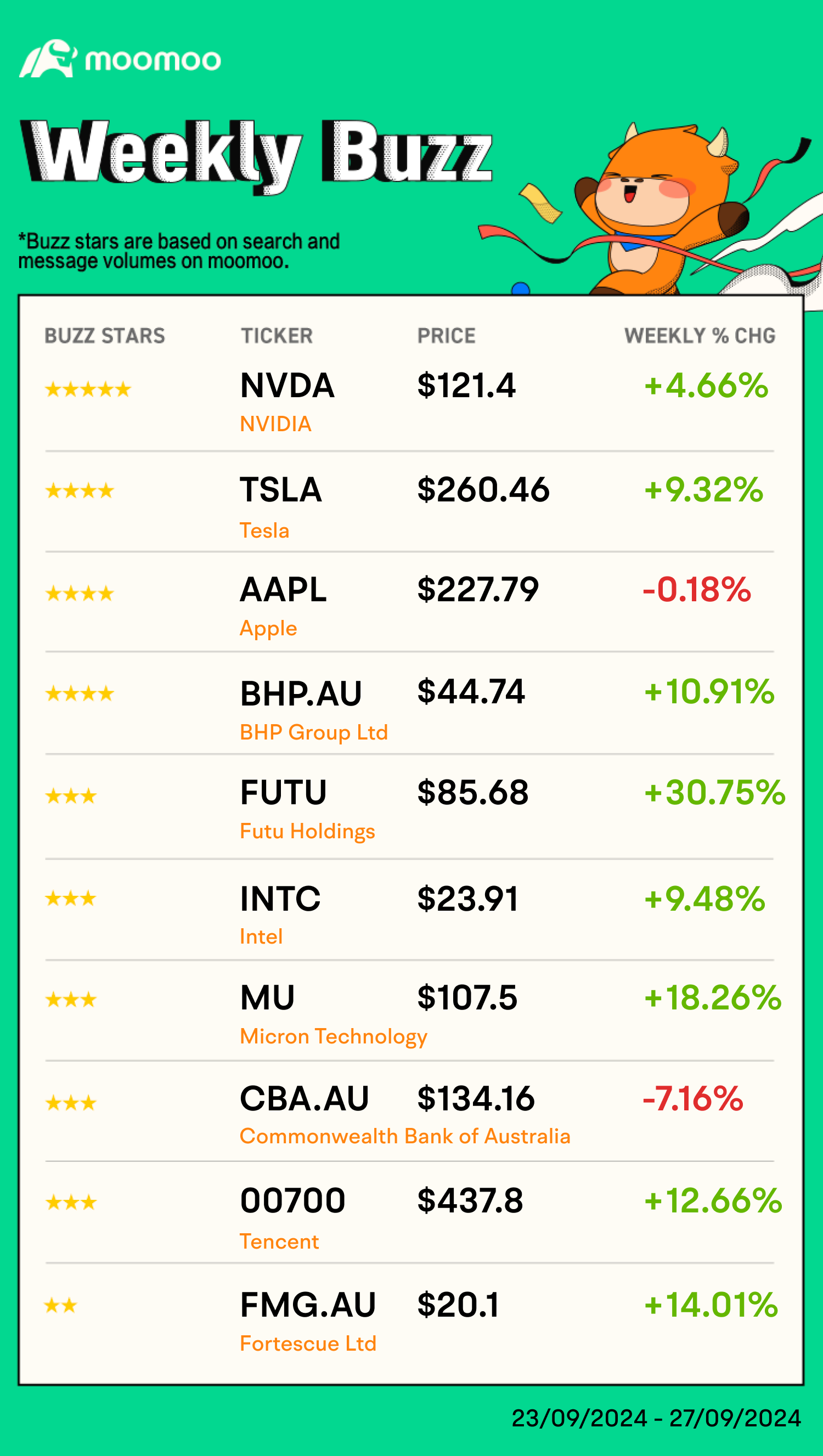

Welcome back to Aussie Weekly Buzz, where we review the news, performance, and community sentiment of the top 10 buzzing stocks on moomoo based on search and message volumes last week!

Comment below to answer the Weekly Topic question for a chance to win incentives!

Let's take a look!

Interested in the US stocks like $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, $Intel (INTC.US)$ and $Micron Technology (MU.US)$ ? Dive into the Weekly Buzz: What Pushed up Stock Prices Better than Rate Cuts? Government Stimulus! by @Kevin Travers!

Stock Analysis

Apple's stock fell by 0.18% the previous week. A UBS research report indicated that Apple experienced a 10% decrease in iPhone shipments in China during July and August, compared to the same period last year, influencing projections for September iPhone sales ahead of the iPhone 16 release. Additionally, Apple has exited talks to invest in OpenAI's potential $6.5 billion funding round, reported by WSJ.

-mooer's insights 💡

@Tony Jones820: "$Apple (AAPL.US)$ shorties getting buried. they already closing their positions . less resistance means higher stock price"

@Warren Buffetless: "$Apple (AAPL.US)$ apple daily trading shares used to be 80 million...then it dropped to 70 million then to 60 million...and now it can't even meet 40 million...do you understand the math ..if not ..then go do something else...lol"

$BHP Group Ltd (BHP.US)$ and $BHP Group Ltd (BHP.AU)$ surged by 15.28% and 10.91% respectively last week. Australian iron ore stocks have achieved a five-day rally this week, primarily driven by China's economic stimulus policies. Also, BHP is set to trial Caterpillar's dynamic energy transfer tech on its mining trucks, both battery-electric and diesel-electric, the company announced on Thursday.

-mooer's insights 💡

@Gaxsun: "$BHP Group Ltd (BHP.AU)$ Bought a nice chunk yesterday seems timing may have been right for once. I hate paying tax so meh balanced portfolio banks are going down minerals up just sitting back collecting dividends."

FUTU soared 30.75% last week. Futu's stock prices surged amid the excitement for AH shares and US-listed Chinese stocks, following China's unveiling of its biggest economic stimulus since the pandemic on September 24.

-mooer's insights 💡

@MONTA CFA: "Cathie Wood just visited moomoo's HongKong office, $Futu Holdings Ltd (FUTU.US)$ alrdy up 8% premarket following today China economic stimulus policy. Could ARK be eyeing an investment in moomoo?"

CBA decreased 7.16% last week. Despite a surge in mining stocks following China's economic stimulus announcement, Australian banks fell amid diminishing hopes for near-term Australian interest-rate cuts.

-mooer's insights 💡

152381716: "questioncan it be worth much more than $100 with a 4% return on $4 a year div at $100? can it be worth much more are people happy with a lower % return at prices higher than $100? would some sort of share buy back buy cba be on the cards? how does the shareholder benefit from here forward? hold and collect? $CommBank(CBA.AU)$ "

$TENCENT (00700.HK)$ jumped 12.66% last week. Chinese technology shares rebounded this week, reaching levels not witnessed in over a year, following the People's Bank of China's indication of imminent economic stimulus measures.

-mooer's insights 💡

"This week was crazy! My portfolio only for this week increased from $8,455 to $8,909 (+5.3%). Cummulative PL YTD - $1,235. YTD return - 19.58%. Such growth was mainly to growth of Chinese shares, including my favorite Alibaba $Alibaba (BABA.US)$ and Tencent ($TENCENT (00700.HK)$ )"

$Fortescue Ltd (FMG.AU)$ up 14.01% last week. Iron ore operations are pivotal to Fortescue's business, constituting roughly 90% of its revenue, underscoring its paramount significance in the company's strategic blueprint. The upsurge in its share prices last week was also predominantly fueled by China's economic stimulus initiatives.

-mooer's insights 💡

@MooMamaLlama: "One of my bigger shifts against my usual style, for real and papertrade, was looking at $Fortescue Ltd (FMG.AU)$ on ex date, given iron ore prices are scraping bottom of barrell. However, a big drop ex date gave me an opportunity to get in around 16. Now around 19 so happy with results so far"

@Lambert AI: "$ANZ Group Holdings Ltd (ANZ.AU)$ Overbought sooooo much for the whole year? Will adjustments be coming? $Woodside Energy Group Ltd (WDS.AU)$ $Fortescue Ltd (FMG.AU)$ Consider cheap or reasonable?"

Have you heard the dragon's roar? The US rate cut and China's political shift are fueling a winning streak for Chinese stocks.

Did you capitalize on the political shifts in US and China?

Share your top-performing stocks recently and explain why you chose them over others. ![]()

We will select up to Top 15 comments based on the interaction rates and comments quality, and deliver 200 points to each of the commentator as the incentives. You can convert your points to merchandise and coupons in your Rewards Club!

Keen to invest in your favorite US stocks, like Apple and Tesla, but have insufficient capital? Start small with big companies for as little as $5!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

MONTA CFA : ABC!(Allin Buy China

102362254 : Yes, I capitalized on the recent US-China political shifts. $Alibaba (BABA.US)$ has been my top performing stock, benefiting from improved relations and its strong fundamentals. I'm optimistic about Alibaba, thanks to the positive political climate, strong fundamentals, and rapid growth in its cloud division and AI advancements

那年我双手插兜 : Very good.

151369719 : Bear no more. Awakening and roaring Dragon.

ZnWC : Thanks for the event![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

The Fed rate cutting higher than expected (50 bps) has brought about an uptrending momentum to the US stock market. I can see almost all my stocks increase in book value. See screenshots of my P/L cumulative in Q3 and YTD. The same happened in the HK stock market.

This is the moment we have been waiting for those who take a long position in a stock or ETF. Whether we are taking profit, continue to hold for higher book value or trade options to earn short term profit, it depends on your risk appetite. Just beware not to FOMO buy (greed) and always DYODD.

Read here:

My P/L Review for Q3 & YTD and Outlook for Q4

JM2005 : Nice.

redevilgiggs :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

mr_cashcow : Yes really good news coming from China to stimulate their economy resulting in HSI rallying! I was able to benefit from it by buying HSI call warrants!

Singh_Au mr_cashcow : Great

VicTAN : Thank you

View more comments...