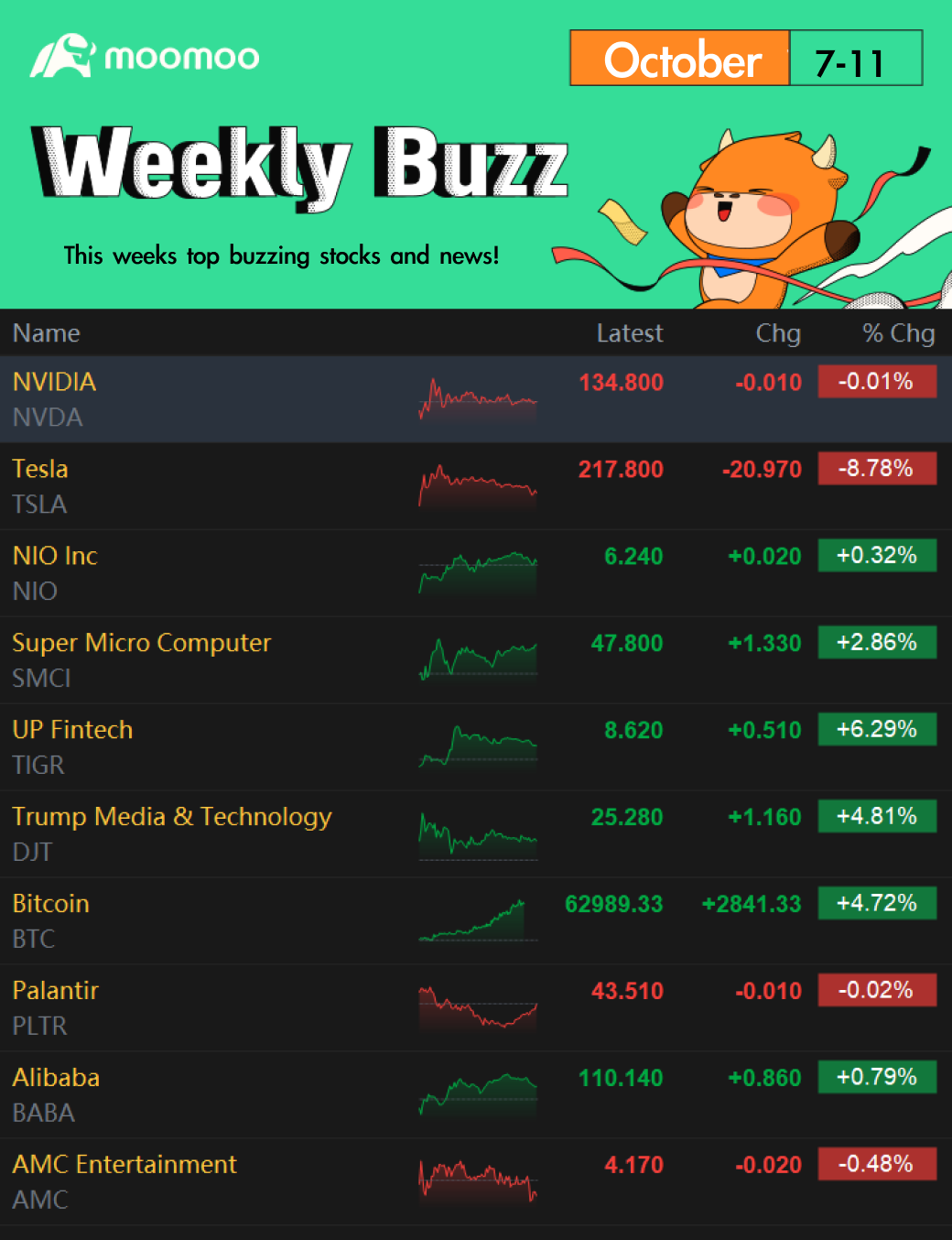

Thursday, things took a turn for the better as the People's Bank of China announced measures to boost the stability of the domestic equity market, according to Benzinga. In a statement released on its website, the PBoC said it has decided to establish the "Securities, Funds and Insurance Companies Swap Facility," or SFISF, to support qualified securities, funds and insurance companies to exchange bonds, stock exchange-traded funds and CSI 300 constituent stocks and other assets for high-grade liquid assets such as Treasury bonds and central bank bills from the central bank. Alibaba still fell all week.

EZ_money : i think retail is getting set up for a big thrown at us.

thrown at us.

HuatEver : JPM and Wells Fargo’s earnings could be a positive sign for the months ahead. It feels like the market might finally be turning a corner. If these results are any indication, we could see more stability through the end of the year, possibly even setting the stage for a Santa rally as we move into the holiday season![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Stock_Drift : It’s been a crazy and fun week @Stock_Drift HQ, with $Verb Technology (VERB.US)$ just exploding this afternoon post R/S and $MicroAlgo (MLGO.US)$ looking like it’s inside a pinball machine. Have a good and relaxing weekend, @Kevin Travers

Have a good and relaxing weekend, @Kevin Travers

102362254 : Wells Fargo and JPM earnings bring some good news but with mixed results. JPM beat expectations and raised its outlook, despite shrinking profit margins due to high interest rates. Wells Fargo also beat earnings but missed on revenue and expects lower profits from interest next year. While high rates help in some areas and hurt in others. The upcoming months, including the potential impacts of the U.S. presidential election, will be important in determining whether the positive trends can be sustained

HuatLady : Many are optimistic about the Q4 and would consider JPMorgan's and Well Fargo's robust earnings reports are positive signals that solidify most stocks to serve as gateways for wealth. Henceforth, what's the outlook for the following 4th Quarter? Or would investors be lulled on a false sense of security?

. So far for me, this is the most effective strategy for building a healthy investment portfolio

. So far for me, this is the most effective strategy for building a healthy investment portfolio ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

It's a challenging investing landscape! In my view, the key issue remains the importance of investing in great quality stocks for the long-term to overcome these challenges

102181510 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102181510 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Betterthangold EZ_money : Getting ready? You’ve been eating it for 2.5 years. At what point do ppl swallow their pride and admit they missed the “big squeeze?”

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ZnWC : Thanks for the event![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

$JPMorgan (JPM.US)$ and $Wells Fargo & Co (WFC.US)$ earnings report better than expected Q3 results that reflect resilient in the U.S. Consumers. The 2 stocks rose 4.4% and 5.6% respectively after earnings call.

As one of the biggest money lenders, I think it is a sign of a bull market coming back at least for the financial sector. This is mainly due to the Fed 50 bps rate cut. But I can't say for individual stock as it depends on the fundamentals of the company.

Beside Financial stocks, my bet on stocks that will "come back" are Tech, REIT and Energy (FRET). Some said Healthcare and Commodity. But we have to prepare for volatility risk due to market uncertainty. Hence my portfolio includes ETF (S&P500) to diversify my risk.

Having said the above the uptrending will be challenging. We must DYODD and not be misled by baseless posts. It is important to have an investment plan (and goal) and always avoid fear and greed.

View more comments...