Weekly Buzz | Indexes Move Into Correction Territory on Earnings, Despite Powerful Q3 GDP

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

All prices and news updates as of 10/27

Make Your Choice

Weekly Buzz | Indexes Move Into Correction Territory on Earnings Despite Powerful GDP

Indexes began Friday with rallies after a crushing week. Disappointing earnings, especially from the Magnificent 7 giants, brought the market down into correction territory. Quarterly GDP data came in at 4.9%, showing stubbornly strong consumer spending that scared investors with the threat of more inflation. The $Nasdaq Composite Index (.IXIC.US)$ finished Friday up slightly buoyed by Amazon.com earnings, but the index fell nearly 7% during the week. Alphabet and Meta earnings, in particular, crushed the tech sector, showing weak growth in cloud and services.

$S&P 500 Index (.SPX.US)$ fell about 6% for the week and $Dow Jones Industrial Average (.DJI.US)$ nearly 5% for the week. Oil prices rose as Israel launched further raids into the Gaza Strip but stayed volatile as an overall ground invasion remained on hold. The banking sector fell as investors digested the latest batch of economic data and weak earnings reports.

The $Financial Select Sector SPDR Fund (XLF.US)$ dropped 6.9% on the week toward a seven-month low in afternoon trading, with 67 of 72 equity components falling back.

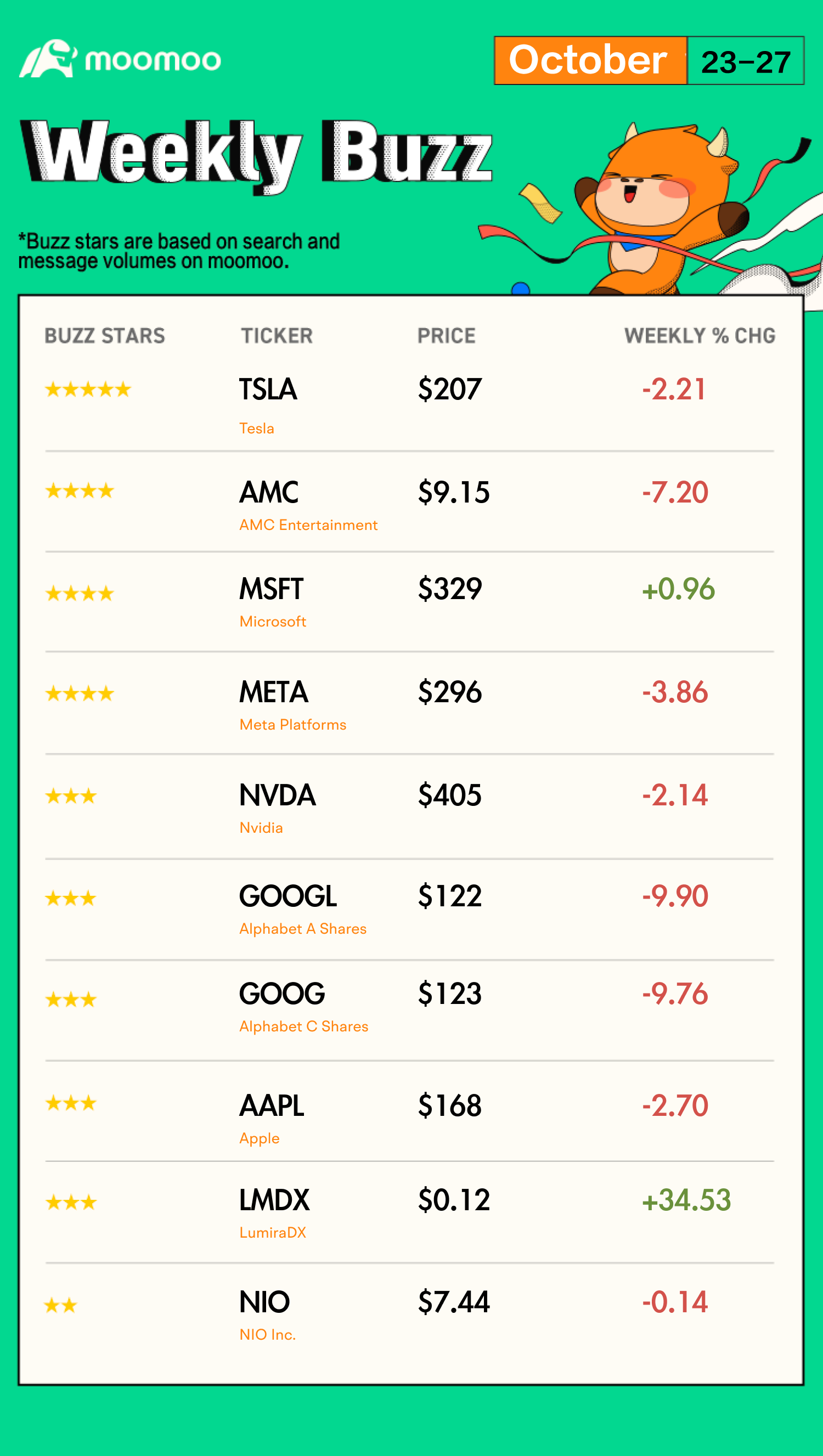

Let's dive into the weekly buzzing stock list of this week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

$Tesla (TSLA.US)$ dropped 2.2% to $207. In recent news: $Amazon (AMZN.US)$ and $Intel (INTC.US)$ also beat earnings estimates, a bright spot among the so-called "Magnificent Seven" companies after disappointing earnings from $Tesla (TSLA.US)$ and $Alphabet-A (GOOGL.US)$, along with a weak report from Facebook parent $Meta Platforms (META.US)$.

@Silverbat: Buy dips and hold for long-term

2. AMC Buzzing Stars: ⭐⭐⭐⭐

$AMC Entertainment (AMC.US)$ dropped 7.2% to $9.15. In recent news: AMC shares are on pace to snap a two-day losing streak For AMC Entertainment Holdings Inc., "Taylor Swift: The Eras Tour" is the gift that keeps on giving. Taylor Swift's record-breaking concert film, which opened Oct. 12, is in its third weekend at the box office and has already brought in more than $178 million worldwide, according to IMDbPro's Box Office Mojo.

@TheOtherGuy2022 a wise one told me you either have the money or the time when investing...i got both so calls puts and shares being bought in this fake price action

3. MSFT - Buzzing Stars: ⭐⭐⭐⭐

$Microsoft (MSFT.US)$ dropped 0.96% to $329.810. In recent news: HSBC pegs Microsoft as a future revenue-growth outperformer as analyst upgrades the stock. The stock jumped wildly as the firm announced positive earnings, but the overall tech market brought Microsoft down by the end of the week. The firm grew revenue more slowly than the overall software sector in the company's last fiscal year. The trend could be about to flip. That's the view of HSBC Securities analyst Stephen Bersey, who upgraded Microsoft's stock (MSFT) to buy from hold in a Wednesday note to clients.

@lee… Comparison of the cloud services of the three giants in the United States

4. META - Buzzing Stars: ⭐⭐⭐⭐

$Meta Platforms (META.US)$ dropped 3.86% to $296.73. In recent news: Mark Zuckerberg’s $46.5 billion loss on the metaverse. The losses over that time are big enough to be a Fortune 100 company. That $46.5 billion figure is more than the entire revenue for Best Buy, which ranks 94 on the Fortune 100. Meta has lost more money investing in the metaverse than the total revenue for mammoth companies like pharmaceutical giant Bristol-Myers Squibb and United Airlines.

@102125877 $Meta Platforms (META.US)$ - Time to move up

5. NVDA - Buzzing Stars: ⭐⭐⭐

$NVIDIA (NVDA.US)$ dropped 2.14% to $405. In recent news: On Friday, analyst Harsh Kumar reiterated his Overweight ratings for Nvidia, AMD, and ON Semiconductor, citing the positive commentary from Intel about key end markets. Kumar said that Intel's comments about healthy inventory levels for consumer and enterprise PCs could be bullish for AMD's business. "The broad PC market appears to have normalized," he wrote. "We suspect this is good news for AMD as the only other major participant in the PC [processor] market."

@Bruski2023 $NVIDIA (NVDA.US)$ complete dump, and bam green candles out of nowhere. I been done since yesterday, but it sure is wild to watch it dump dump dump and mini pump to save face

6. GOOGL - Buzzing Stars: ⭐⭐⭐

$Alphabet-A (GOOGL.US)$dropped 9.9% to $122.17. In recent news, WSJ reported Google agreed to invest up to $2 billion in Anthropic, building on its earlier investment in the artificial intelligence company and adding fuel to the race between startups trying to achieve the next big breakthrough in the emerging technology. Google invested $500 million upfront into the OpenAI rival and agreed to add $1.5 billion more over time, people familiar with the matter said.

@104467085: $Alphabet-A (GOOGL.US)$ Profit surpass expectation. Stock price surpass disappointment

7. GOOG - Buzzing Stars: ⭐⭐⭐

$Alphabet-C (GOOG.US)$ dropped 9.7% to $123.40. In recent news: Alphabet is coming under intense selling pressure Wednesday as Wall Street punishes the stock for disappointing third-quarter growth in the company's cloud computing business. Customers' continued focus on reducing costs is apparently trumping the emerging opportunity in generative artificial intelligence.

@lee… Google’s problem is that its cloud computing base is small, its growth is lower than expected, and its asset-liability ratio is relatively high.

8. AAPL - Buzzing Stars: ⭐⭐⭐

$Apple (AAPL.US)$ dropped 2.7% to $168. In recent news: Apple Inc has announced a price increase for its prime services, namely Apple TV+, Arcade, and Apple One, with immediate effect on Wednesday. Apple TV+ monthly subscription prices have been raised from $6.99 to $9.99. The yearly plan also increased its prices from $69 to $99, following a previous hike in October 2022, reported CNBC.

@Cow Moo-ney: Why the sell off? 3 angles to look at it. Let’s break it down.

9. LMDX - Buzzing Stars: ⭐⭐⭐

$LumiraDx (LMDX.US)$ rose by 34% to $0.12. In recent news: On Monday, LumiraDx Shares Are Trading Higher After the Company Announced a Strategic Collaboration With AstraZeneca and Everton in the Community to Set up England's First Community-based Heart and Lung Screening Hub.

@RampageBull_Rally Look like another bearish day. By looking at the analysis I've done it likely another 10-15% bearish and recover back on Monday.

10. NIO - Buzzing Stars: ⭐⭐

$NIO Inc (NIO.US)$ dropped 0.14% to $7.44. In recent news: Nio has reached 2,000 battery swap stations in China, moving toward its goal of completing 2,300 stations by the end of this year. The electric vehicle company today put a new battery swap station into operation in China, the 2,000th at the Baoji West service area on the G30 Lianyungang-Khorgos highway, which is known as an extension of the old Silk Road in China.

@bullrider_21 Nio has filed for the use of semi-solid batteries in more models, after it did so for three other more models five months ago.

Thanks for reading!

* All comments, links, and content posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. Please consult a qualified financial professional for your financial planning and tax situations.

Awards

Congrats to the following mooers whose comments were selected as the top comments last week!

Notice:

A reward will be sent to you this week. Please feel free to contact us if there is an issue.

Weekly Topic

When the market goes into correction, what are your go-to moves?

Comment below and share your ideas! We will select up to 15 TOP COMMENTS for a reward next week. Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

Disclaimer:

Any app images provided are not current and any securities are shown for illustrative purposes only.

This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : When the market goes into correction, I will find opportunities. Some quality stocks may be cheap and worth buying. I’ll avoid stocks in a continuous downward spiral with little chance of recovery.

Asphen : bouncing around next week

HuatLady : During market corrections, I will relax and focus on other interests instead of getting stressed by the market volatility. It's an ideal moment to take a break and conduct research on the stocks I have been closely monitoring.

HuatEver : It is not all gloom and doom when the market goes into correction. This is just the perfect time for me to seek profits by finding flexible discounts and attractive sales on good stocks.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

cola1010 : During a market correction, it is best to remain cool, focus on long-term goals, and consider exploring quality stocks that may be undervalued. This can present investment possibilities, but it is important to avoid stocks with failing fundamentals and prioritise those with potentials for recovery. Taking a break from continual monitoring and keeping a patient, well-researched attitude will help you navigate market volatility efficiently.

PassiveLearner : as the market is undergoing correction, personally I would still be building up to be invested funds into $Fullerton SGD Cash Fund (SG9999005961.MF)$ to build up my funds safely while I'm able to use the fund to make purchases when the price is right.

stay safe and always do your own research before investing.

ZnWC : If taking long position, there is nothing to worry about when the market goes into correction. If the company is fundamentally healthy, the share price will eventually rebound, the question is when and how long you can hold. There's always reason for the stock to goes into correction. Recently the market went into correction because of the following macroecomic reasons: Fed issued warning of more rate hike as inflation is still high, Israel-Hamas war may be a long and bloody war, Oil price may raise to a new high etc.

The problem with market correction is you may be affected emotionally when the share price continues to fall. When massive negative reports released by media (usually the case), some traders may sell due to panic (fear).There's other reason for stock price to fall that's earning is lower than expectation. Hence it's important to check the earning report carefully such as revenue, profit margin, debt etc. It's a good practice to find out the actual reason for the market correction and not easily manipulate by fear and greed.

Swing traders like market correction as it is a good opportunity to profit due to volatility. But time the market due to greed may make you lose more if you listen blindly to others without dyodd.