Weekly Buzz | Jolted by soft jobs report, stocks tumble to end a turbulent week

Hello mooers!!!

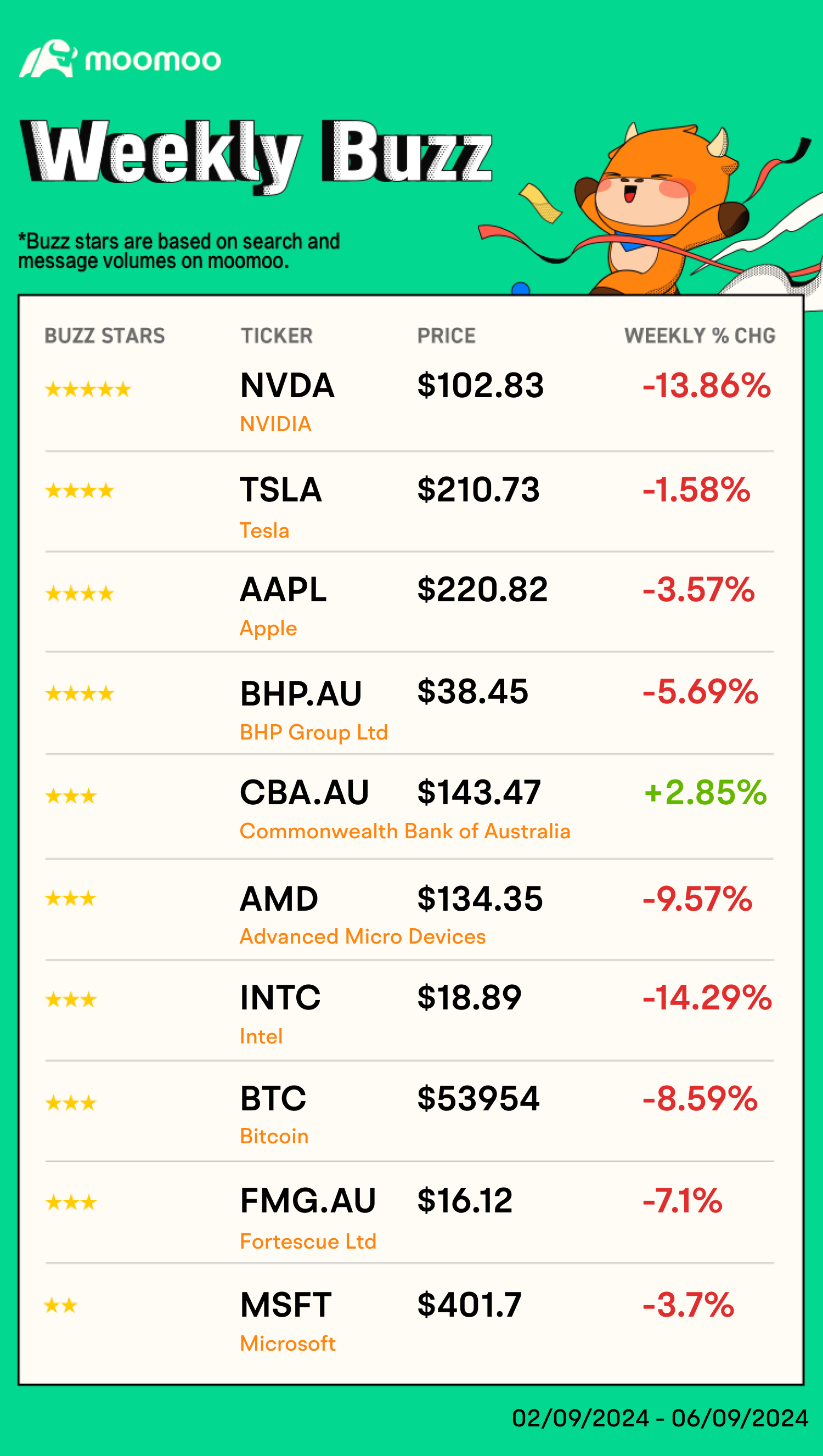

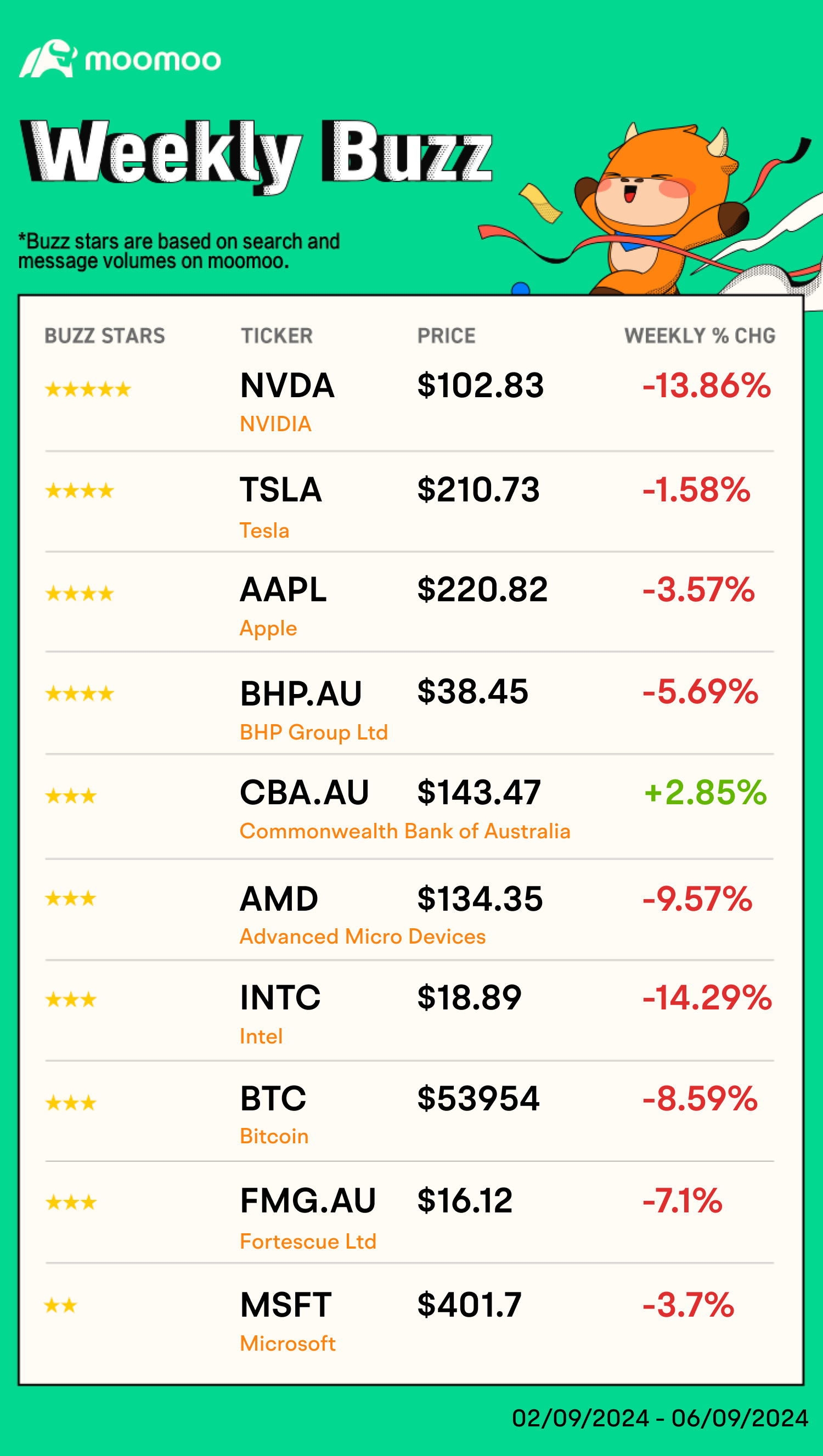

Welcome back to Aussie Weekly Buzz, where we review the news, performance, and community sentiment of the top 10 buzzing stocks on moomoo based on search and message volumes last week!

Comment below to answer the Weekly Topic question for a chance to win incentives!

Let's dive into the buzzing stocks last week!

– If you're interested in the latest development of US stocks like $NVIDIA (NVDA.US)$ , $Tesla (TSLA.US)$ , $Apple (AAPL.US)$ , $Intel (INTC.US)$ and $Bitcoin (BTC.CC)$ , pls refer to this article Weekly Buzz: September Starts with Deep Pullback, written by @Popular on moomoo.

Speaking of the Fed, investors also got word from New York Fed President John Williams Friday that it is time to cut rates. Speaking toward the Council on Foreign Relations, Williams said the economy is balanced, and inflation is tracking lower, so "it is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate." Read more>>

1. BHP Buzzing stars ⭐⭐⭐⭐

$BHP Group Ltd (BHP.US)$ shares declined by 6.78% and $BHP Group Ltd (BHP.AU)$ shares down by 5.69% last week. Following the largest iron ore price drop in three months last Monday, iron ore futures on the Singapore Exchange further declined to $91 last Thursday. This significant price drop has put pressure on the profits of the top four iron ore producers - $BHP Group Ltd (BHP.US)$, $Rio Tinto (RIO.US)$ , $Vale SA (VALE.US)$ , and $Fortescue Ltd(FMG.AU)$—resulting in an approximate $100 billion evaporation in market value.

@Liam Mitchell: I am expecting that any Oak Dam development would need to be of 100,000 tpa CuEq at least (possibly 2-3 times that) to justify itself (in terms of scale to BHP, and because of depth and moderate grades released so far).

@kakaobohne: We all know that mining and miners are cyclical. We have had a great, long season. What is probably ahead, a short-term bumpy road, is a great opportunity for long-time holders to load up some more.

2. CBA Buzzing stars ⭐⭐⭐

Shares of $CommBank (CBA.AU)$ rose by 2.85% last week. CommBank announced the appointment of Kate Howitt as an independent non-executive director, effective from Oct 1.

@Griffo_au: I wonder how many dividend investors will be rotating from banks to resources? Much higher yield to be had here and capital growth looks more realistic too given the incredibly rich valuations of banks such as CBA. $CommBank (CBA.AU)$ is on a 3.2x book with a 3.3% yield on an already high payout ratio. The $CommBank(CBA.AU)$ share price has surged 298% in 2024, reaching $143.47, driven by strong FY24 results and lending growth. The bank lent $39 billion to businesses and provided home financing to 120,000 households, with new fundings up $10 billion over the year.

@Moomoo News AU: Analysts note a strong correlation between lending growth and bank share performance. However, some brokers, including Morgans and Goldman Sachs, caution that CBA may be overvalued, setting lower price targets of $97.38 and $94.80, respectively. Despite these concerns, the stock continues to rise. Read more>>

3. AMD Buzzing stars ⭐⭐⭐

$Advanced Micro Devices (AMD.US)$ shares down by 9.57% last week. Advanced Micro Devices announced that it has hired Keith Strier, Nvidia's former vice president of worldwide AI initiatives, as its senior vice president of global artificial intelligence markets.

@Ch’ng: bought at 160 and still holding on... not planning to sell anytime soon, only will sell once I get a profit

@nerdbull1669: "AMD is well positioned to grow meaningfully with the AI total addressable market, especially initially on the inference side," TD Cowen analysts said in a report. Other potential beneficiaries for increased inference workloads include chipmakers Broadcom and Advanced Micro Devices. Read more>>

4. FMG Buzzing stars ⭐⭐⭐

$Fortescue Ltd (FMG.AU)$ shares have suffered a lot this year, and the shares of FMG slid by 7.10% last week. The downward trend of its share price has been mainly attributed to the price drop of iron ore, its key resource.

@Lambert AI: Excellent stable high yield stocks for long term holding : $Woodside Energy Group Ltd (WDS.AU)$, $ANZ Group Holdings Ltd (ANZ.AU)$ and $Fortescue Ltd (FMG.AU)$ as the Aussie Trinity. Fantastic performance Q2&3, glad that people do understand about long term investing

5. MSFT Buzzing stars ⭐⭐

$Microsoft (MSFT.US)$ shares dropped by 3.70% last week. Last Wednesday, Microsoft received clearance from the UK's Competition and Markets Authority to hire certain former employees of Inflection AI.

@Dividend Stocks Guy: when you see a big fat red candle, you know what to do: SHORT!

@tertm141: struggling at 200MA.

What's your thoughts on AU Papertrading Competition?

We will select up to Top 15 comments based on the interaction rates and comments quality, and deliver 200 points to each of the commentator as the incentives.

📖 Reading

Notes: This competition is only available for Australian users.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : The AU Papertrading Competition is a great chance for traders of all levels to sharpen their skills without risking money. With real-time quotes and data, participants can test strategies and gain confidence. Plus, there are attractive prizes like free Nvidia stocks, stock vouchers, points and cash coupons, making it both educational and rewarding. It’s certainly a fantastic way to learn, compete, and potentially win some valuable rewards.

151728235 : Au papertrading is simply providing users with a great platform for communication, cultivation, and learning of stocks and financial investment knowledge, as well as various attractive incentive mechanisms. A must-try. 'Learning by doing' is excellent.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cheesetopher : I found the AU papertrading competition to be a really fun way to try out a lot of the more aggressive (high risk / high reward) trading strategies that I'm usually to worried about trying out using real money. I used papertrading, in general, to get the hang of buying the dips in the TWE stock price, which has been really helpful. It's also a cool tool to really get the hang of the trading interface within the moomoo app.

noimplusivemoves : I really like paper trade competitions and I hope it keeps going. I like that it just gives me that motivation to keep trying out trading despite taking loss in real trades by incentivising with Real stock rewards. I actually also like to use the insight card to check out what the top leaders are buying and gain some idea of what are some good stocks to trade as well as what these people’s strategies are. I always learn a lot from that.

mrbrotherlove : I see

151737576 : I wish I had known about Papertrading before I started investing. It would have been a great way to build confidence. For now, I use it to test stocks for purchase or when to sell stocks.

curiousbird : I am glad to be learning more and more everytime I come on here

151273476 : As a novice in the stock market, this place is really helpful for me, amazing!

151390635 : great mentors to be follow

151369076 : Moo moo ji

View more comments...