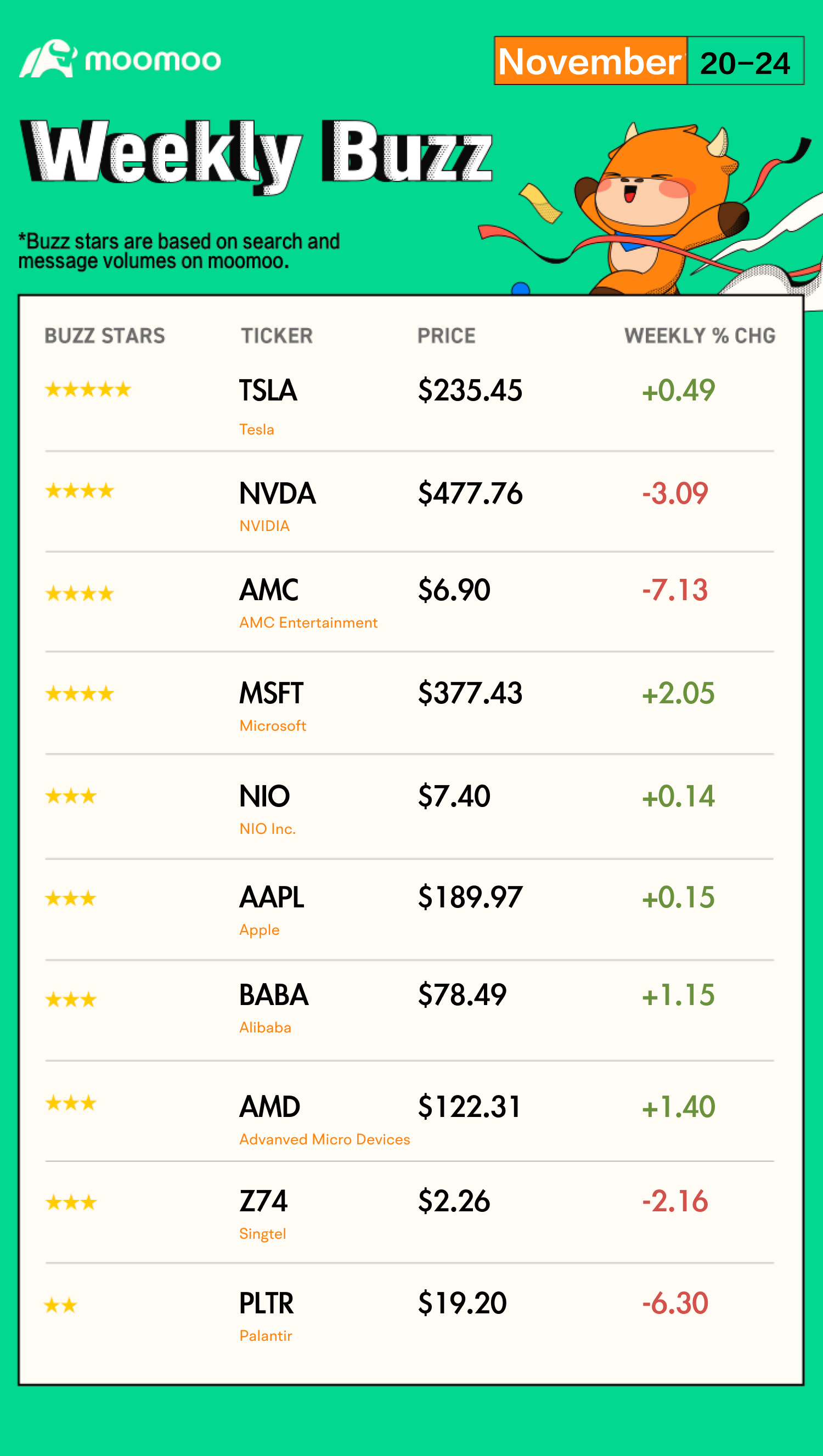

In recent news: MT Newswires reported that Ryan D. Taylor, Chief Revenue Officer and Chief Legal Officer, around November 20, 2023, sold 124,623 shares in Palantir Technologies for $2,596,654. Following the Form 4 filing with the SEC, Taylor has control over a total of 212,033 shares of the company, with 212,033 shares held directly.

102362254 : When the market shows low volume, I’ll use options strategies such as iron condors, calendars, butterflies or straddles that suit low volatility. These strategies can help me profit from a stable or slightly moving market, while limiting my risks and exposure.

Hua Moo Lan : Low volume is likely to indicate the reduced interest among investors and may result in increased price volatility hence calls for a more cautious market approach and investment strategies. Personally, I am more inclined to accumulate the stocks rather than to wait and hold.

Reason behind is that being a mid to long term investor, a low volume market which comes with higher volatility simply means there’s an opportunity to accumulate good stocks at attracted price through profound technical analysis - keeping an eye on patterns and indicators that may signal price movements, market news/events and strike at the right time. Portfolio diversification is also highly recommended in low-volume environment to spread risk across different assets and sectors.

HuatLady : I tend to be conservative and adhere to my aged old but diamond studded theory of stocks diversification when the market shows low volume. It will help me to decrease the risks by rebalancing my portfolio. Therefore, regardless of market volatility, it is important to accumulate very cautiously. They are small steps towards Big Impacts.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ZnWC : Low volume is expected in November and December due to holiday season. We may even see profit taking as investors decided to take a break or celebrate. If you're taking long position, there's nothing to worry about as long as the company fundamental is still healthy.

If we are looking at the entire year, tech stocks especially magnificent seven stock value increase. There may be some stock price drop due to various reasons (like Nvdia, Microsoft and Tesla) or simply price correction.

Current situation is much better than a year ago. Fed has paused rate hike, most countries has resumed travel and promote trade and US dollars are dropping. Previously I predicted 3 sectors may see strong growth - ArtificiaI Intelligence, Supercomputing and Ultra-fast internet (6G and beyond). We are looking at the rise of AGI (General Intelligence).

How to invest will depend the holding power you have. Will the stock market crash further or waiting for a reason to rally? I prefer to believe the latter and hold.

小trader : As a fundamental analysis-driven investor, my primary focus is on assessing the underlying strength and value of a company. While I rely heavily on fundamentals and intrinsic value to shape my investment thesis, I also acknowledge the significance of market volume.

Volume serves as a crucial indicator of market activity and can provide valuable insights into the level of interest and participation from investors. Low volume may suggest reduced liquidity, potentially leading to increased price volatility. This scenario can make it challenging to execute trades at desired prices, emphasizing the importance of strategic decision-making.

In times of low volume, I maintain a dual perspective. Firstly, I adhere to my fundamental analysis, ensuring that the company's core strengths align with my investment criteria. Simultaneously, I remain vigilant to the market dynamics influenced by volume, considering it as a factor that could impact short-term price movements.

In essence, while fundamentals guide my long-term investment strategy, I recognize the significance of market volume in navigating the current landscape. Balancing both perspectives allows for a more comprehensive approach to decision-making in varying market conditions.

HuatEver : Surviving the low market volume doesn’t always require precision talents or huge commitments. These simple yet impactful ways will do the trick:-

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) To keep cool as long as I know my Risks Tolerances. Panic selling can be my downfall.

To keep cool as long as I know my Risks Tolerances. Panic selling can be my downfall.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) To identify good value stocks and to accumulate them at attainable prices. I will focus on Defensive stocks such as consumers stables, utilities and pharmaceuticals because they generally do well on earnings and dividends payments regardless whether it is a bear or bull market.

To identify good value stocks and to accumulate them at attainable prices. I will focus on Defensive stocks such as consumers stables, utilities and pharmaceuticals because they generally do well on earnings and dividends payments regardless whether it is a bear or bull market.

Rizwan Khan : $FITTERS (9318.MY)$

cola1010 : Low-volume market situations should be viewed with caution, as they frequently indicate increased price volatility and less liquidity. I will hold onto my investments, utilising a dollar-cost averaging technique to steadily grow assets, focusing on high-quality equities or alternative investments, and remaining knowledgeable about market trends and economic indicators are all strategies. DYODD to align investment approach with the long-term financial goals and risk tolerance.