Weekly Buzz | Market thaw after the rate cut — Did you profit?

Hi mooers! ![]()

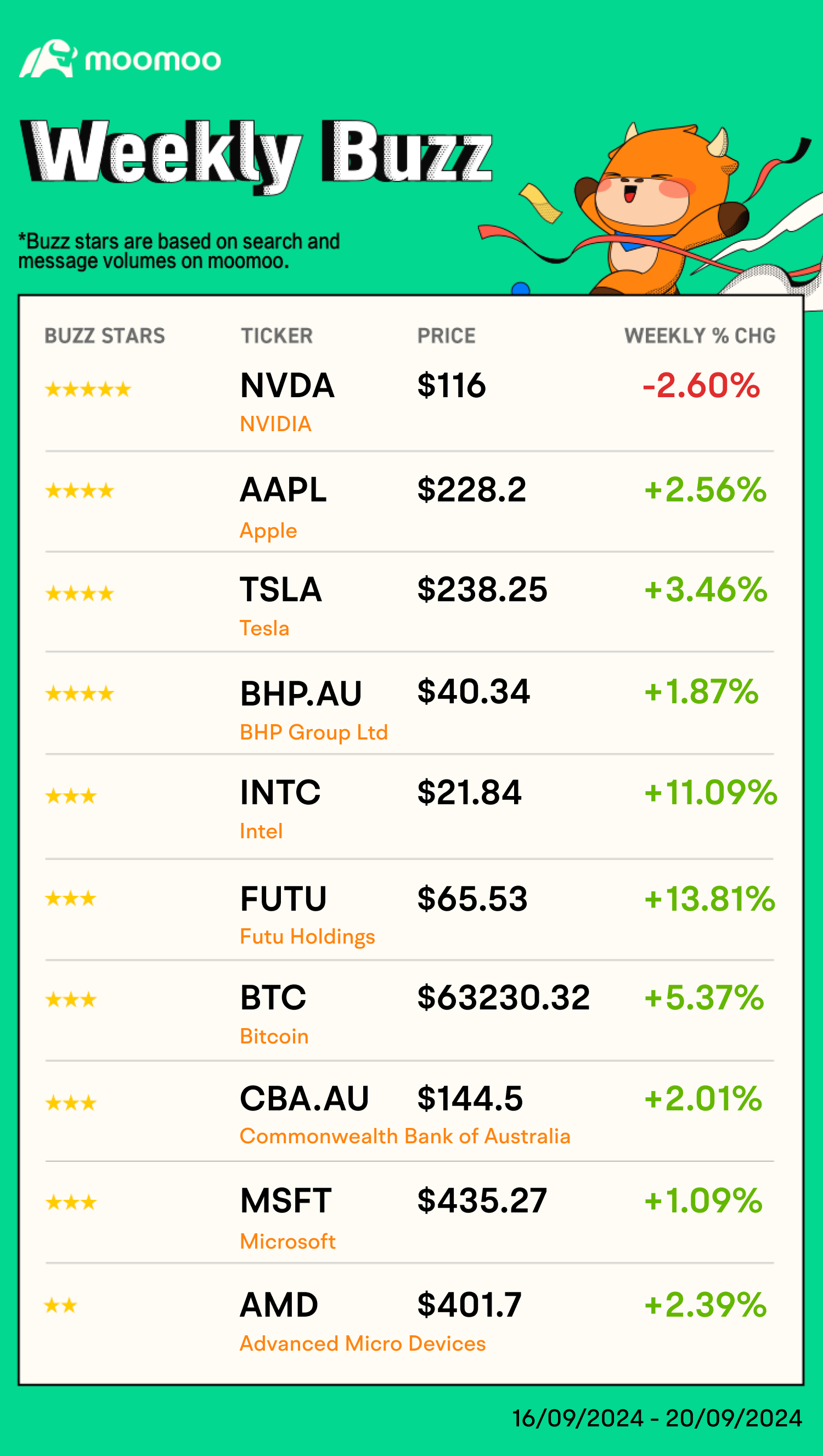

Welcome back to Australian Weekly Buzz, where we review the news, performance, and community sentiment of the top 10 buzzing stocks on moomoo based on search and message volumes last week!

Comment below to answer the Weekly Topic question for a chance to win incentives!

Let's dive into the buzzing stocks last week!

– If you're interested in the latest development of US stocks like $NVIDIA (NVDA.US)$ , $Tesla (TSLA.US)$ , $Apple (AAPL.US)$ , $Intel (INTC.US)$ and $Bitcoin (BTC.CC)$, pls refer to this article Weekly Buzz: Rate cuts bring record stock gains written by @Popular on moomoo.

Oil futures rose this week after news reports said pagers, walkie-talkies, and other devices carried by thousands of Hezbollah operatives in Lebanon exploded in an apparent coordinated sabotage attack. Combined with increased shelling from Israeli artillery, the attacks fanned fears of a broader Middle East conflict that could threaten crude flows from the region. $Crude Oil Futures(NOV4)(CLmain.US)$ climbed 2.8% to above $71/barrel for the first time since the prices dropped at the beginning of the month.

The BHP share price increased as investors reinvested in mining stocks, driven by a rebound in iron ore prices to $US92.35 per tonne in Singapore. Morgan Stanley upgraded BHP Group to overweight from equalweight, setting a new price target of AU$47.50, up from AU$44.65.

💡mooer's insights:

@Jessica Amir: The Australian share market punched to a brand-new record all-time high of 8,187, with 191 of the ASX 200 stocks trading in the black. $BHP Group Ltd (BHP.AU)$ is up the most in the heavyweights, rising 1.4% and gaining US$6 billion in two weeks in anticipation of the Fed's easing cycle supporting its company profits turnaround. While today's iron ore data showed Australia's exports are growing perhaps quicker than expected, the market has a double whammy of positive tailwinds for Australia's mining giants. It seems many suspect the commodity price lows could be behind us. But again, time will tell.

@Liam Mitchell: I'm a long time $South32 Ltd(S32.AU)$ shareholder, and usually a keen S32 buyer, but the past couple of weeks have been actively buying parcels of $BHP Group Ltd(BHP.AU)$ under $40. At two year lows it feels like an excellent place to build a position. It's too tempting for me to refuse! I can understand why people are holding or selling bank shares but goodness only knows who is buying them at current prices. I sold mine and bought more BHP last week. BHP has multiple avenues towards being highly profitable and it the world's biggest miner with a rock solid balance sheet behind it.

FUTU's share price closed last week with a nice gain of 13.81%. There's no clear information available yet for this incredible surge.

💡mooer's insights:

Commonwealth Bank of Australia launched the AI Factory in collaboration with Amazon Web Services (AWS). The AI Factory will enable employees to test and develop AI large-language models for personalized customer experiences and high-performance computing. CommBank's chief of data and analytics, Andrew McMullan, stated that leveraging AWS's cloud infrastructure will accelerate AI development by four times, enhancing personalized services and operational efficiency across the bank.

💡mooer's insights:

@ArtieZiffsCat: Currently, CBA is a major holding 41% of the ASX financial sector. In other words, only if you have fatter wallets than the Super Funds that require Aussie financial allocation, then you are just going to get burnt! Is CBA a perfect business, NO! not even close, is it expensive at the 'CURRENT time" = well yes! that is clear. This is my opinion! unlike some clowns on here getting it all wrong and telling people what to do! and making excuses for all their crap calls! if it does drop to 120's again, I will be right there with you topping up!

@Chii11: If CBA start laying off client service roles and replace them with a robot, good luck to them. Nothing better than talking to a chat bot with a monotone voice who gives you a narrow scope of options to choose from. 'AI' cant be the reason people are piling in surely?

Microsoft's stock price rose over 1% last week. The company announced that its Board of Directors has approved a quarterly dividend of $0.83 per share, up $0.08 or 10% from the previous quarter. The dividend will be paid on December 12, 2024, to shareholders of record as of November 21, 2024, with an ex-dividend date of November 21, 2024.

💡mooer's insights:

@scarlight: hmm large sell off, But pull back is quick, then that is fine.

The Federal Reserve announced a 50 basis point interest rate cut, lowering the target range for the federal funds rate from 5.25%-5.5% to 4.75%-5%. Boosted by this news, major U.S. tech stocks collectively surged, with AMD's stock price rising over 2% last week.

💡mooer's insights:

@R30R: $NVIDIA(NVDA.US)$ once the darling of wall street, this one is struggling when everything around it is popping up in double digits - $Taiwan Semiconductor(TSM.US)$ , $Advanced Micro Devices(AMD.US)$ . Bull or Bear , this one is burning everyone in phases right now.

Which stock in your portfolio has brought you the most profits following the US rate cut, whether it's in the paper trading account or the real one? ![]()

Post it with the persuasive P/L image [here]. We'll send each of the AU mooers who participate in the topic 2024 Q3 P/L Challenge: What shifts did you make in your portfolio? with an extra 200 points! ![]()

![]()

Investing wisely often means picking the right stocks. But often, the best stocks cost a pretty penny...Don't worry! Moomoo's fractional shares help you invest in the most expensive companies with only $5.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : $SPDR S&P 500 ETF (SPY.US)$ has brought me the most profits since the US rate cut. Its broad market exposure has allowed it to capture a wide range of opportunities, while its strong performance in rate-sensitive sectors has greatly boosted my returns. I’ll continue to keep an eye on how the market evolves and consider diversifying further.

SnowVested : not close to profit LV in my us market holdings...

little on my au holdings tho..

my PT-AU holdings are stronger then personal ones

Poppy2retire : NST.AX Northern Star Resources has delivered great growth over the last 12 months with a kick up in September delivering 47% for the last year.

VicTAN :

r○bsplace :