Weekly Earnings Preview: Grab rewards by guessing the market winner!

Hi, mooers! The banks are kicking off a fresh earnings season!

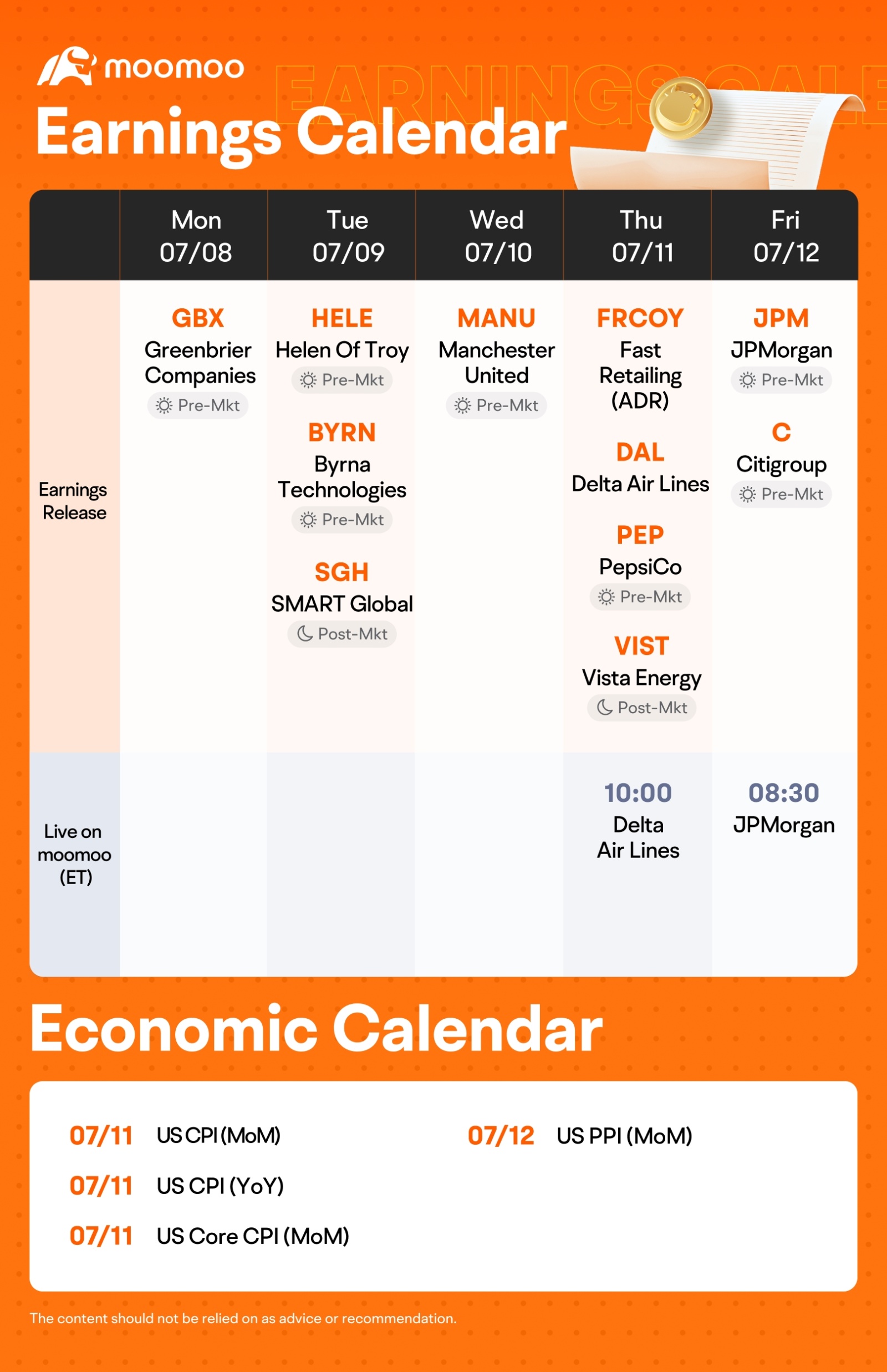

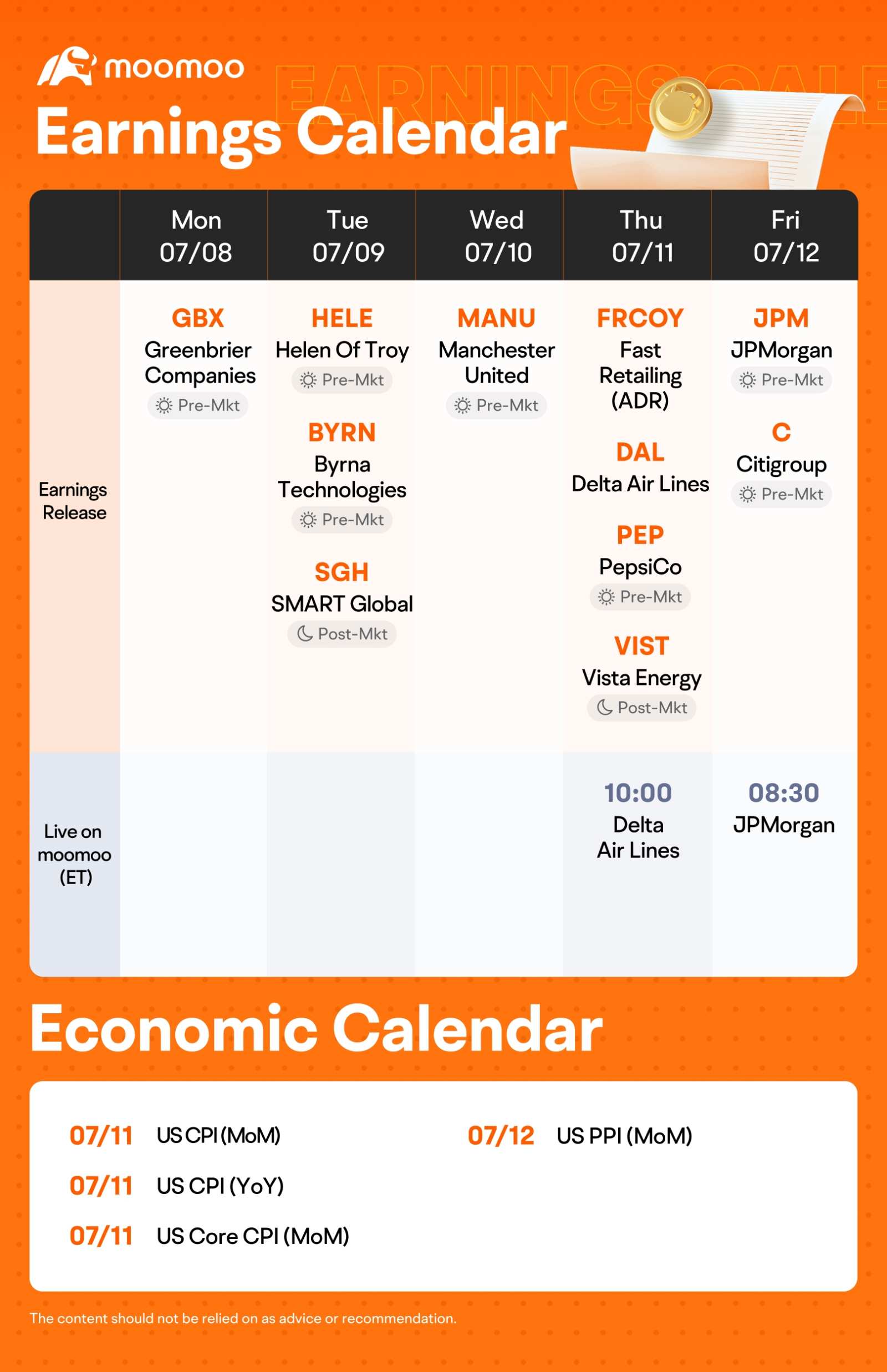

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week! ![]()

This week, various companies including $Delta Air Lines (DAL.US)$, $JPMorgan (JPM.US)$, $Citigroup (C.US)$ and $PepsiCo (PEP.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

Rewards

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

mr_cashcow : An analysis of $PepsiCo (PEP.US)$:

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Relatively stable in recent years, with a slight upward trend

Relatively stable in recent years, with a slight upward trend

Price has fluctuated between $150 and $180 per share over the past 12 months

Price has fluctuated between $150 and $180 per share over the past 12 months

Consistently paid dividends and has a current dividend yield of around 2.7%

Consistently paid dividends and has a current dividend yield of around 2.7%

Consensus rating of "Hold"

Consensus rating of "Hold"

Average target price is around $175 per share

Average target price is around $175 per share

Diversified portfolio of brands

Diversified portfolio of brands

Strong global presence

Strong global presence

Consistent dividend payments

Consistent dividend payments

Solid financial performance

Solid financial performance

Dependence on sugary drinks, which are facing declining demand

Dependence on sugary drinks, which are facing declining demand

Intense competition

Intense competition

Regulatory pressures and changing consumer preferences

Regulatory pressures and changing consumer preferences

They are focusing on expanding its presence in emerging markets and growing its e-commerce business

They are focusing on expanding its presence in emerging markets and growing its e-commerce business

They are also investing in new products and technologies, such as plant-based beverages and sustainable packaging

They are also investing in new products and technologies, such as plant-based beverages and sustainable packaging

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

PepsiCo is a multinational food and beverage corporation with a diverse portfolio of brands, including Pepsi, Frito-Lay, Gatorade, and Quaker Oats.

The company operates in over 200 countries and has a market capitalization of over $250 billion

①Recent Performance:

②Analyst Ratings:

③Strengths:

④Weaknesses:

⑤Growth Prospects:

Overall, PepsiCo's stock appears to be a relatively stable investment with a decent dividend yield

Disclaimer: All the above are purely for educational purposes and are NOT financial advise, plz DYOR/DD

ZnWC : I guess $JPMorgan (JPM.US)$ with the biggest gains ending this week.

1. Analyst's expectations

For earnings Q2 2024

EPS: adjusted $4.19 -4.1% YoY

For fiscal 2024:

EPS: $16.44, -2.1% YoY

2. The bank previously cautioned about an "uncertain" outlook due to geopolitical issues and inflation.

3. JPMorgan stock has outperformed both the S&P 500 and the Financial Sector SPDR year-to-date, rising 18.9%.

4. Shares dropped 4% on May 20 after Chief Executive Officer (CEO) Jamie Dimon announced limited stock repurchases at current prices.

5. Stock fell 6% following the Q1 results, despite beating revenue and EPS estimates, due to lower-than-expected net interest income and full-year forecasts

6. Analysts maintain a "Strong Buy" rating on JPM, with 17 out of 24 analysts recommending a "Strong Buy." The average price target of $205.25 suggests modest upside potential.

7. Based on TA, the daily chart showed a bullish continuous triangle with a 86% uptrending and break up at resistance price 211.

Retail investors may have already priced in the weaker than expected Q2 earnings. Not financial advice and DYODD if you want to invest in this stock.

102362254 : I’m guessing $JPMorgan (JPM.US)$ is likely to gain the most this week. A Bullish Continuous Triangle is seen on its chart. Over the past 5 years, the bank consistently made profits, with a ROA of 1.19% and ROE of 14.41%, outperforming many competitors. Its debt-to-equity ratio of 2.16 shows solid financial health, backed by efficient operations and cost control. JPM has shown great EPS growth, up by 21.14% last year and averaging 13.68% over recent years. I'll keep an eye on JPM's upcoming net income and revenue figures. So far, JPM’s stock has performed well. Over the past 12 months, it has even outperformed the S&P 500 index.

toomanyscammers : didn't analyse each of the stock pages...but chose citigroup cos it's the next best financial product, too many pple voting for JPMorgan alrdy , haha. also I rmb that citi had some merger or something recently I thought...in any case, it won some award for best bank or somethinggg in 2023 so hoping this will boost its performance. JP also caught in alot of scandals like 1mdb

so hoping this will boost its performance. JP also caught in alot of scandals like 1mdb

010Leo : took a quick look at the stocks. $Citigroup (C.US)$ and $JPMorgan (JPM.US)$ are on the uptrend as with the general financial stocks. morningstar rated citi 3star vs JPM 2star. analyst expects +ve growth for citi, mix for JPM. with interest rate expected to drop the financial sector will be stronger as compared to dividend stable $PepsiCo (PEP.US)$. never fancy us airlines.

toomanyscammers 010Leo : hope our 12% wins! lol

Wonder : $JPMorgan(JPM.US)$ has outperformed the S&P 500 index over the past months and its daily chart is showing a possible pullback before making a possible climb upwards as seen from the bullish continuous triangle.

JPM has a history of prudent capital management and it was reported that faced with rising costs, it warned of plans to pass on the cost of stringent regulation to its customers such that free services (checking accounts, wealth management tools, credit score trackers and financial planning tools) will no longer be free.

The bank is on an expansion mode and plans to open more than 500 new branches by 2027 in new regions (reported in Feb24). This will solidify its branch network and presence in deposit franchise and strengthen loan portfolio size.

The prospects of an economy slowdown and tough regulatory climate may derail the earnings of the bank, but over a longer horizon, the largest U.S. bank is likely to gain favourably from its strong foothold and strategic initiatives.

yoongmy : $JPMorgan (JPM.US)$ has higher potential higher performance from the list, strong economy with high interest will beneficial for banking sector.

AnnYeo God of Money : $Citigroup (C.US)$ 's earnings outlook for 2024 appears cautiously optimistic. Analysts forecast a continued growth trend, with earnings per share (EPS) expected to range between $4.61 and $6.56 for the year, averaging around $5.66. The firm has already shown resilience by surpassing estimates in the first quarter of 2024, reporting an EPS of $1.58 against an expected $1.29.

With the next earnings report due on July 12, 2024, the market will be watching closely to see if Citigroup can maintain its positive momentum. The company's performance will likely be influenced by factors such as interest rate movements, economic conditions, and regulatory changes. Given its solid first-quarter results and positive earnings estimates, Citigroup appears positioned for a strong performance, though it will need to navigate potential headwinds in the broader financial landscape.

SneakyBear : Hey mooers!

This week is packed with earnings reports from big players from various industry. The market is buzzing with anticipation, and I'm placing my bet on $PepsiCo (PEP.US)$ for the biggest percentage gains this week. Here’s why:

This week is packed with earnings reports from big players from various industry. The market is buzzing with anticipation, and I'm placing my bet on $PepsiCo (PEP.US)$ for the biggest percentage gains this week. Here’s why:

Pepsi has been consistently strong and reliable, and their diversified portfolio often helps them weather any market storms. With consumer staples being a steady bet, especially in uncertain times, PepsiCo might just surprise us with solid numbers that could boost their stock.

Now, let’s break it down and have some fun with predictions:

> Delta Air Lines (DAL): Travel demand is up, but rising fuel costs could dampen the outlook.

> JPMorgan (JPM): Strong loan growth and trading revenues might give it the edge.

> Citigroup (C): Another banking giant with potential, but JPM has been outperforming.

> PepsiCo (PEP): Consistent performer with a diversified portfolio—could be a sleeper hit this week.

Furthermore, based on technical analysis, Pepsi is lying on the huge weekly 200EMA support long term uptrend!! It tends to bounce back strongly after hitting!

View more comments...