Weekly Earnings Preview: Grab rewards by guessing the market winner!

Hi, mooers!

Just a heads-up:

Q2 Earnings Challenge is in full swing! With so many big earnings set to release this week, what's your or other mooers' take? Now join the challenge, leverage moomoo's handy features to support your views on these stocks and earn plenty of rewards! Don't miss the chance to win big>>

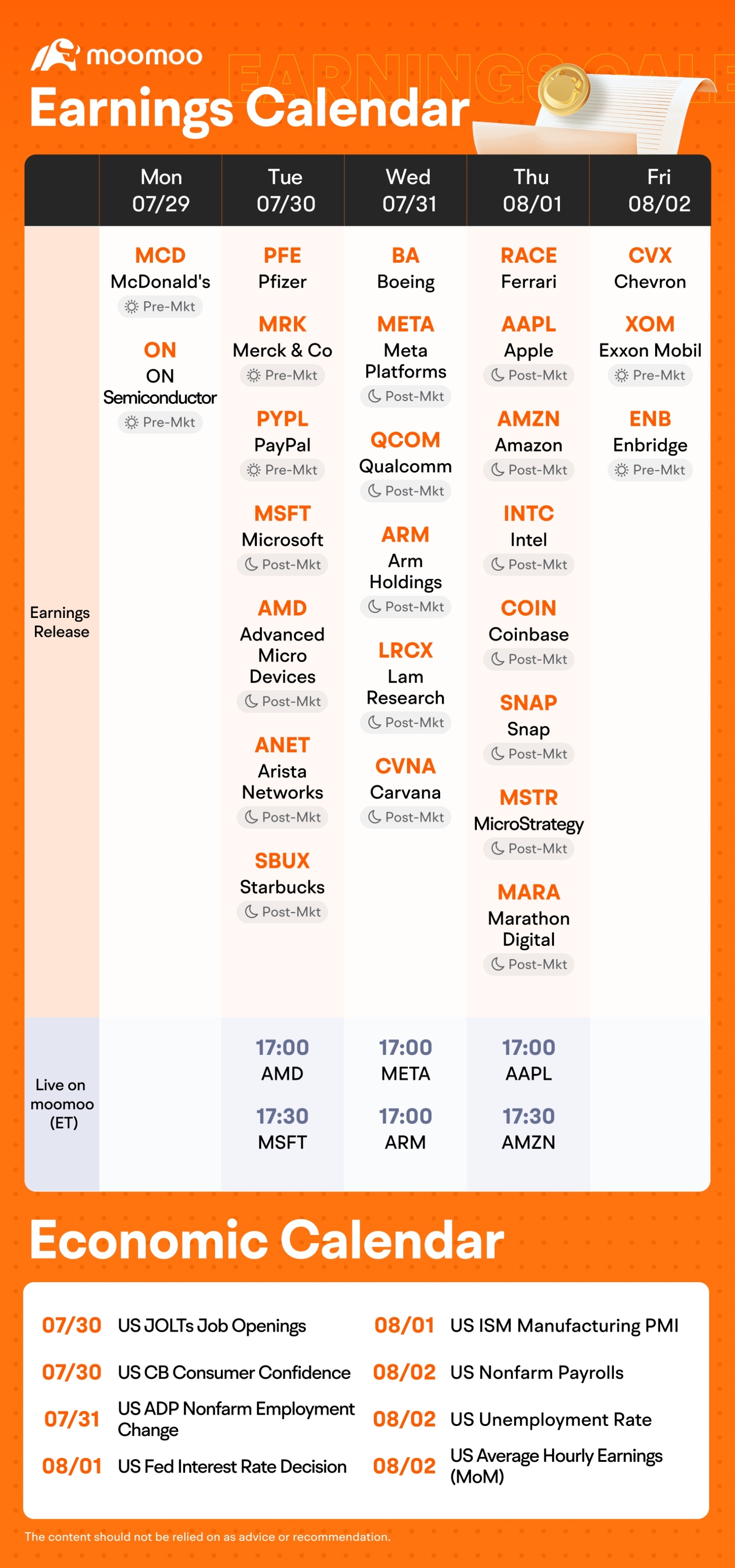

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week! ![]()

This week, various companies including $Advanced Micro Devices (AMD.US)$, $Microsoft (MSFT.US)$, $Meta Platforms (META.US)$, $Apple (AAPL.US)$ and $Amazon (AMZN.US)$ are releasing their earnings.

-AMD: AMD's short-term prospects are impacted by weaknesses in the Embedded and Gaming segments, but the company expects a double-digit percentage increase in Data Center segment revenues, primarily driven by the sequential ramp-up of data center GPUs.

-MSFT: The company has successfully transitioned from a personal computing manufacturer to a leading cloud computing provider. In its Productivity and Business Processes segment, including services like Office 365, Microsoft has moved to a subscription-based model instead of traditional software licenses.

-META: Meta's user traffic and advertising revenue have shown significant growth, driven by strong engagement and AI advancements, despite competition and economic cycles. However, the company's metaverse initiative continues to incur substantial losses, affecting overall profitability.

-AAPL: The iPhone is crucial to Apple, accounting for over half of its revenue and driving its Services and Wearables segments. Recent fluctuations in market share, impacted by competitors and seasonal trends, highlight the importance of maintaining its strong performance, which Apple aims to bolster through price cuts and AI integration.

-AMZN: Amazon's core business, the e-commerce business, has seen fluctuating revenue growth due to pandemic and macroeconomic factors, but recently rebounded with improved profit margins. AWS, Amazon's key growth driver, also experienced revenue growth recovery and margin improvement, though competitive pressures from Microsoft Azure and Google Cloud warrant close monitoring.

$Arm Holdings (ARM.US)$, $Coinbase (COIN.US)$ and $Intel (INTC.US)$ are also set to unveil their earnings this week.

How will the market react to the companies' results? Let's make a guess!

Rewards

Don't walk away! Here's a tip.

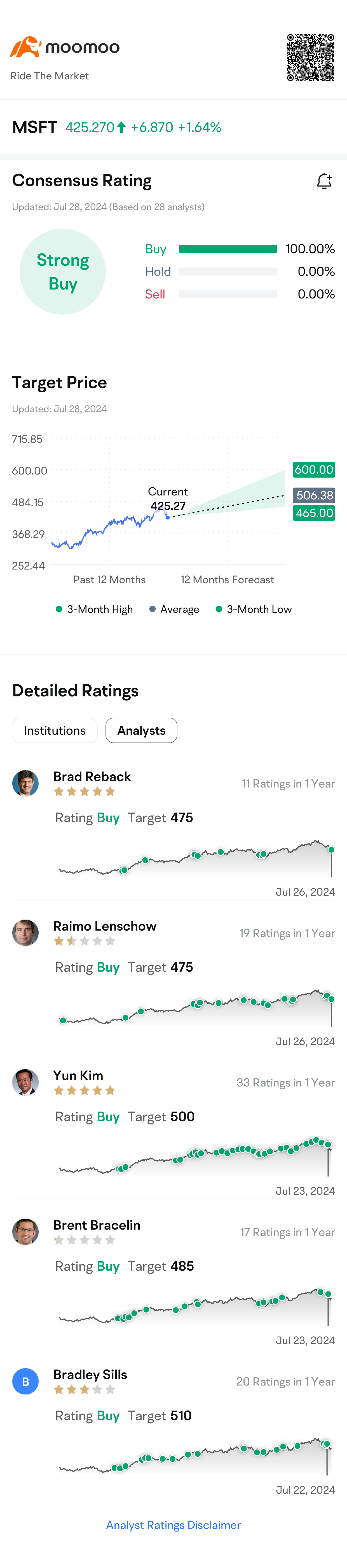

Safely navigating a highly volatile earnings season and making gains—how to achieve it? Analyst Ratings is a way that you can try on moomoo.

Around the time of a company's earnings release, analysts consistently provide ratings based on available information and their expert judgment. You can compare the ratings of different analysts to see if they are in agreement, and you can also see if the stock's movement after each analyst's rating matches his or her judgment.

What are you waiting for? Join the Q2 earnings challenge and share your findings using moomoo's features!

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

steady Pom pipi : $Apple (AAPL.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Will “Apple Smart” arrive late? Will allegedly miss the debut of iOS 18 and miss the first iPhone 16

Will “Apple Smart” arrive late? Will allegedly miss the debut of iOS 18 and miss the first iPhone 16

Meta Q2 Earnings Preview: AI Advancements and Advertising Revenue Growth in Focus

Meta Q2 Earnings Preview: AI Advancements and Advertising Revenue Growth in Focus

It's over, it makes me feel like Tesla.

Apple Intelligence's main AI features may be postponed until October, and iOS 18.0 and 18.1 beta versions will be launched at the same time.

$Meta Platforms (META.US)$

I'm guessing Meta might be this week's earnings winner.

Meta released its Llama 3.1 open source AI model this month. J.P. Morgan analysts said the launch could make Meta AI “the most used artificial intelligence assistant before the end of the year.”

mr_cashcow : Keeping my eyes on $Apple (AAPL.US)$ they recently slash their iPhone prices in India and although there is a slight delay in their AI service launch I still think it will be able to outperform the rest due to the following:

Diversified product ecosystem: iPhone, Mac, iPad, Apple Watch, and AirPods drive revenue and profitability

Diversified product ecosystem: iPhone, Mac, iPad, Apple Watch, and AirPods drive revenue and profitability

Multiple services segment growth: Apple Music, Apple TV+, Apple Arcade, and Apple Care contribute significantly to revenue, so many awesome apple TV shows that locks in subscriptions

Multiple services segment growth: Apple Music, Apple TV+, Apple Arcade, and Apple Care contribute significantly to revenue, so many awesome apple TV shows that locks in subscriptions

Innovation and R&D: AI & foldable phone, recently announced super slim iPhone model alongside their super slim ipad

Innovation and R&D: AI & foldable phone, recently announced super slim iPhone model alongside their super slim ipad

Exceedingly strong brand loyalty: Customer retention and loyalty drive repeat business

Exceedingly strong brand loyalty: Customer retention and loyalty drive repeat business

Global expansion: Despite slow down of sales in China, they have cut price in India to boost sale

Global expansion: Despite slow down of sales in China, they have cut price in India to boost sale

Efficient supply chain management that boost profit margins

Efficient supply chain management that boost profit margins

ZnWC : Thanks for the guessing games![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I put my bet on $Meta Platforms (META.US)$. Here are the reasons:

Positive:

1) Expected to report revenue of $38.35 billion, according to estimates compiled by Visible Alpha, about a 20% YoY .

2) Net income is projected to be $12.31 billion, or $4.71 per share, a 58% jump YoY.

3) Citi analysts expecting the revenue to grow citing a strengthening ad environment, adoption of Instagram Reels, and new products for advertisers.

4) Meta this month unveiled its Llama 3.1 open-source AI model. J.P. Morgan analysts said the launch could make Meta AI "the most used AI assistant by year-end, if not sooner."

Negative:

5) Macroeconomics conditions may affect the stock performance after earnings. If the Fed fails to give a clear signal of rate cut in September after Wednesday FOMC meeting, Meta stock may go south.

6) The rotation of funds into small cap stocks away from the mega cap may continue. Like Google and Tesla, this may give downtrend pressure to the stock. Meta stock is -7.7% in 1 month.

Thy GoD : I think AMD might have the biggest chance, the current outlook for them is EPS of 0.68 on 5.7 bil revenue, up from the 0.58 on 5.4 bil last year.

The projection from AMD earlier this year was 5.7 bil +- 300 mil, so it should more or less fit within analyst expectations.

AMD is also catching up to Nvidia as a close competitor, rising their market share to 19% at the end of 2023.

Prospect-wise, AMD will likely eat up some market share of Nvidia, and price-wise they recently hit the 200 SMA point, which may serve as a support level.

Source is from: tastylive.com/n... I like using their news and insights.

Wonder : I am hoping $Meta Platforms (META.US)$ will be the crown this week to turnaround the disappointment and uncertainties that investors faced for the Mag7 after the earnings results of Google and Tesla.

With Meta increased user traffic of Threads, the prospects of Llama 3.1 open-source AI model to be the most used AI assistant by year end (per J.P. Morgan analysts), the ramping up of monetisation its products, Meta may just beat the market estimates to achieve a positive revenue outlook for AI.

102362254 : My guess is Microsoft will end this week with the biggest percentage gains driven by expanding Azure adoption among businesses, boosting demand for its cloud services. Analysts predict Q4 2024 revenue growth due to investments in AI, cybersecurity, and advanced technologies. Investor optimism about Microsoft's upcoming earnings report signals positive market sentiment. Overall, Microsoft looks set for a strong Q4 2024 performance due to high cloud demand and strategic investments.

JOHN EMERSON963 : Apple can’t bet against it

seeyouu : Microsoft

红财来 : good

Feiniao : Gotta bet on the minimum bets to gain maximum

View more comments...