Weekly earnings preview: Grab rewards by guessing the market winner!

Hi, mooers!

Just a heads-up:

Q2 Earnings Challenge is in full swing! With so many big earnings set to release this week, what's your or other mooers' take? Now join the challenge, leverage moomoo's handy features to support your views on these stocks and earn plenty of rewards! Don't miss the chance to win big>>

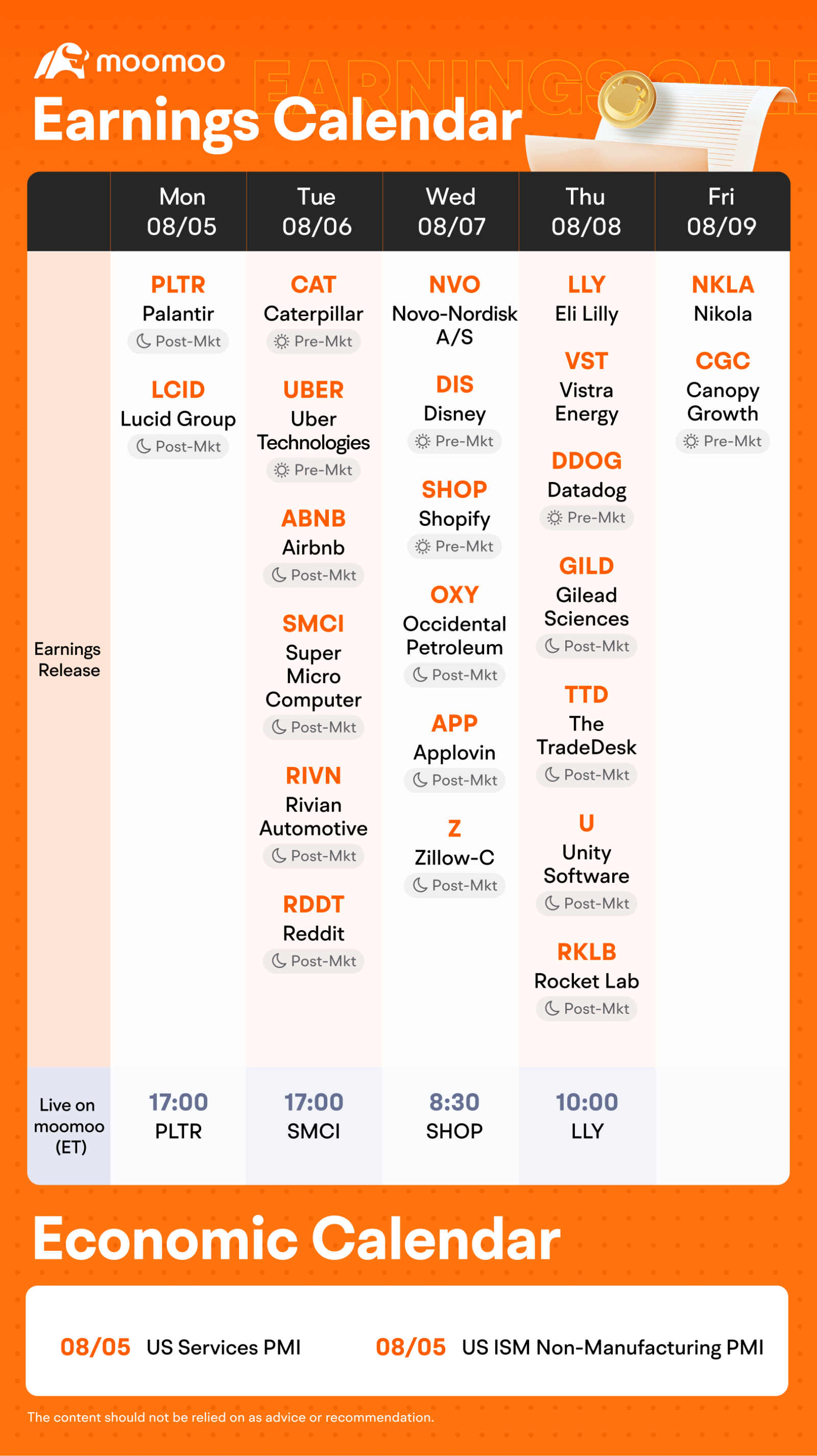

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week! ![]()

This week, various companies including $Palantir (PLTR.US)$, $Super Micro Computer (SMCI.US)$, $Shopify (SHOP.US)$, $Novo-Nordisk A/S (NVO.US)$ and $Eli Lilly and Co (LLY.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

Rewards

Don't walk away! Here's a tip.

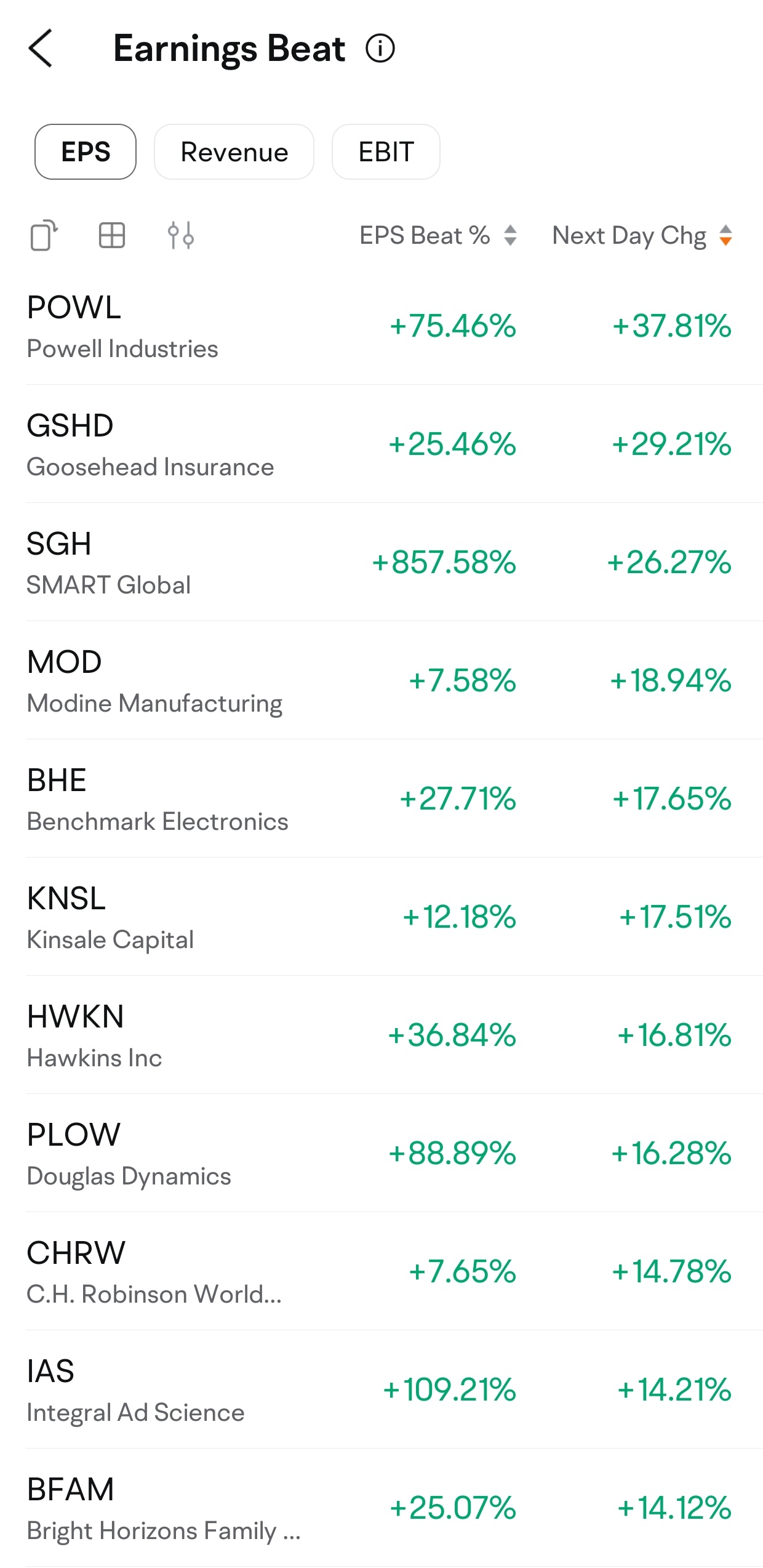

Safely navigating a highly volatile earnings season and making gains—how to achieve it? Earnings Beat is a way that you can try on moomoo. Tap here to learn more>>

Typically, if a company's earnings beat analysts' estimates, then the market's confidence in it may be as strong or stronger. How can we find such a company? Moomoo offers a one-stop tool, Earnings Beat, to help us compare actual results with analysts' estimates for companies that have released earnings reports.

What are you waiting for? Join the Q2 earnings challenge and share your findings using moomoo's features!

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : Analysts have increased Eli Lily EPS estimate by 1.43% recently, showing optimism. The pipeline of new drugs for diabetes, oncology, and immunology is driving growth. With a strong market presence and a variety of popular medicines, backed by acquisitions and partnerships, Eli Lilly has stable finances with good cash flow and manageable debt. These factors suggest it could likely meet or exceed market expectations this quarter. However, industry competition, and economic changes could impact future performance.

I guess $Eli Lilly and Co (LLY.US)$ may end this week with the biggest percentage gain.

Lucky Dog An : Change to whichever one just crashes

ZnWC : Thanks for the guessing games![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

My bet is on SMCI to be the best performing stocks of the week:

Positive

1) Expected to post earnings of $8.08 per share for the current quarter, +130.2% YoY

2) Consensus sales estimate for the current quarter of $5.3 billion indicates +142.6% YoY

3) As the AI surge has continued, demand for the company’s servers and work centers in which power AI companies have continued to see strong growth.

Negative

1) Macroeconomics is not in favour of tech stocks. There's fear of the US slipping into recession caused almost all stocks especially the tech stocks to fall

2) The AI hype may no longer generate growth as other chip makers are also trying to capture the market share.

Bottom line

We may not see any stock with the highest percentage gain this week but rather which stock fell the least.

Richard6398 : Good

OWY 7558 : SMCI

still the best bet!

still the best bet!

No risk no gain!

AI ice cream cone

Now only their products still in demand!

U sell it, I buy it!

ck beast : medical pharma industry has less selling pressure compared to IT data related industry

Zhan Qian : too hot

Daily Investors : I say SHOP the bulls are going to bring them up. Really they should be the main company in their sector. With rescent events as well with WeBull doing a conference, that will just lead to bigger gains. SMCI is already to far ahead. LLY could also be a top, they are in everywhere and in all major hedge funds including Zacks. But my final choice SHOP

104838245 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101870398 : AI

View more comments...