Weekly earnings preview: Grab rewards by guessing the market winner!

Hi, mooers!

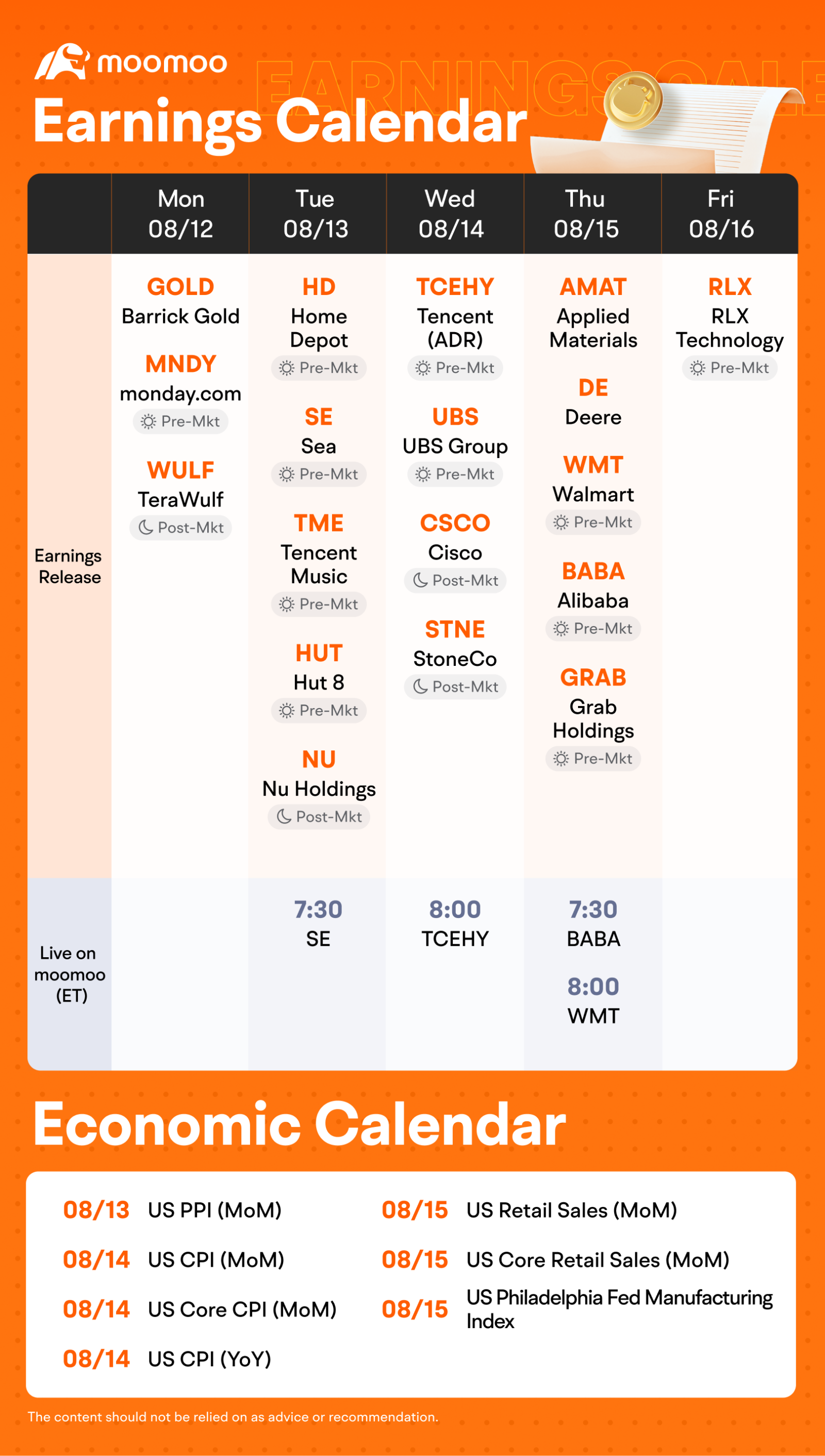

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week! ![]()

This week, various companies including $Home Depot (HD.US)$, $Sea (SE.US)$, $Tencent (TCEHY.US)$, $Alibaba (BABA.US)$ and $Walmart (WMT.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

Rewards

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : Walmart's upcoming earnings report is highly anticipated as it's expected to be positive despite slower consumer spending. Smart investments and new products like Bettergoods are helping Walmart stay strong. Their growing online advertising and store renovations with faster deliveries should increase sales and customer satisfaction. Walmart has consistently exceeded financial expectations recently. Analysts are optimistic about Walmart's stock, suggesting it's a good buy with improving earnings. $Walmart (WMT.US)$ has already risen about 29% this year, indicating investor confidence in Walmart's strategies.

I guess Walmart may end this week with the biggest percentage gain.

mr_cashcow : My vote goes to $Sea (SE.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Potential bullish signals:

▲Gaming segment growth: Sea's gaming arm, Garena, continues to drive revenue growth, with popular titles such as League of Legends

▲E-commerce expansion: Shopee, Sea's e-commerce platform, is expanding rapidly globally

▲Digital payments growth: Sea's digital payments business is gaining traction, with increasing adoption and expanding services

▲Strong management team: Sea's leadership has a proven track record of execution and strategic decision-making

Potential challenges:

▼Competition: Sea faces intense competition in gaming, e-commerce, and digital payments from regional and global players.

▼Regulatory risks: Sea operates in multiple jurisdictions, exposing it to varying regulatory requirements and potential risks.

▼High operating expenses: Sea's expansion efforts and investments in new businesses drive high operating expenses

Earnings prospects:

①Sea is expected to maintain strong revenue growth, driven by its gaming, e-commerce, and digital payments segments

②Improving profitability with initiatives aimed at increasing efficiency and reducing costs

③Expansion into new markets

Disclaimer: All the above are purely for educational purposes & are NOT financial advises! Plz DYOR/DD!