Weekly earnings preview: Grab rewards by guessing the market winner!

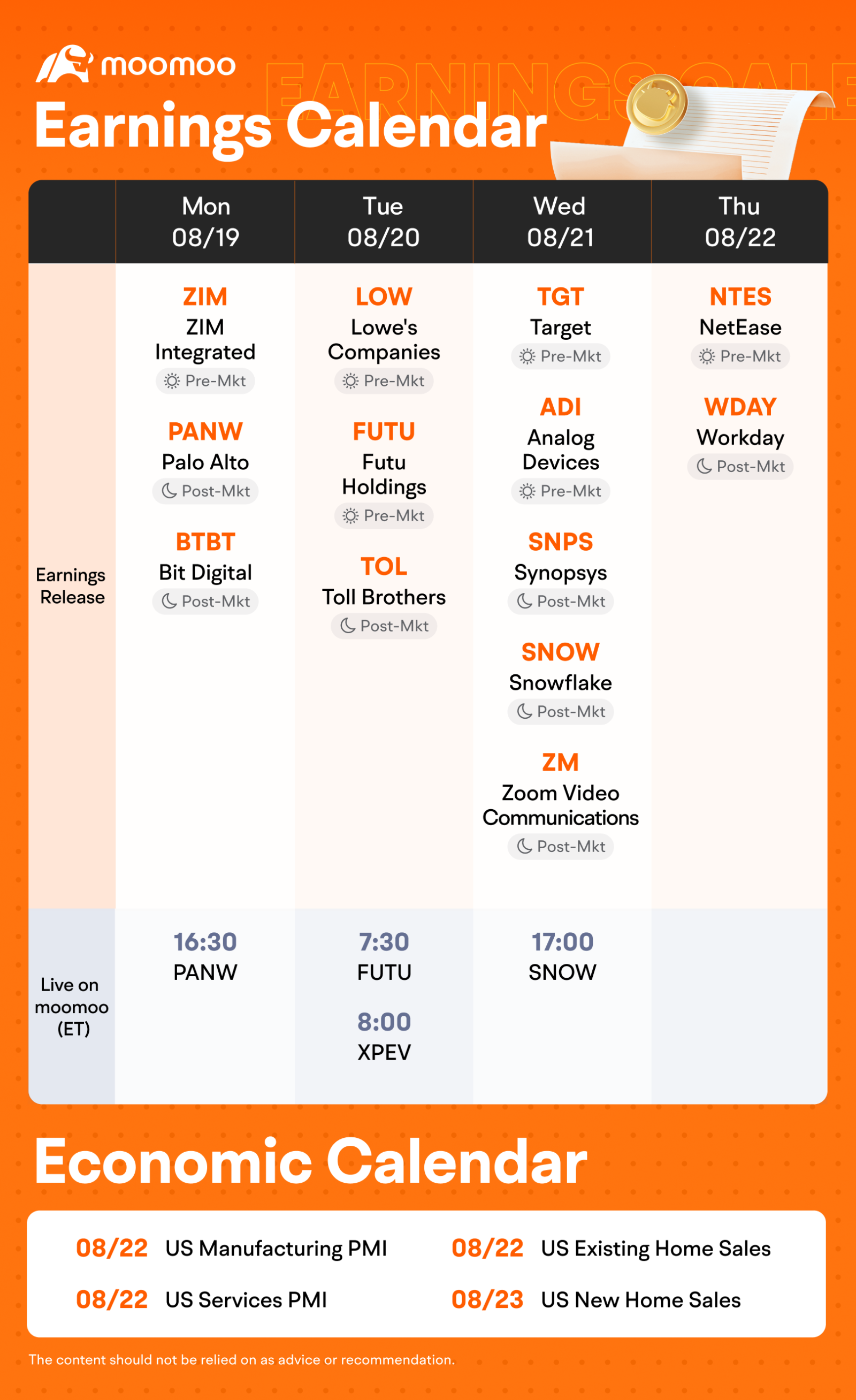

Need a quick update on this week's events? Check out moomoo's fresh

earnings & economic calendars to start this week!

![]()

![]() An equal share of 5,000 points:

An equal share of 5,000 points: For mooers who correctly guess

the stock who makes the biggest gains during the week (e.g., If 50 mooers make the correct guess, each of them will get 100 points!)

![]() Exclusive 300 points:

Exclusive 300 points: For the top comments on

companies' earnings prospects under this post.

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

102362254 : My guess is $Snowflake (SNOW.US)$ will end this week with the biggest percentage gain.

Snowflake's revenue grew impressively by 32.89% YOY in the last quarter. This growth is supported by its high Earnings Quality Ranking, indicating reliable earnings, and strong demand for its data warehousing solutions driven by increased use of cloud computing and data analytics. Looking ahead, although Snowflake's EPS forecast is negative, its consistent revenue growth and dependable earnings quality suggest a strong underlying business. Analysts are optimistic about its future, especially with its focus on AI and data analytics. Despite a potential negative EPS, Snowflake's solid market position may make it a good option for long-term investors.

mr_cashcow : My vote goes to $Target (TGT.US)$

Let's dive into an analysis of Target's earnings prospects:

Potential bullish signals:

▲Omnichannel growth: Target's investments in e-commerce, curbside pickup, and in-store experiences are expected to continue driving sales growth

▲Private label expansion: Target's private label brands, such as Cat & Jack and Art Class, have been successful and are expected to contribute to growth

▲Store remodels and expansions: Target's efforts to remodel and expand stores should improve customer experience and drive sales

Potential roadblocks & challenges ahead:

▼Competition: Intense competition from Amazon, Walmart, and other retailers may pressure margins and sales growth

▼Inflation and consumer spending: Economic uncertainty and inflation may impact consumer spending habits and Target's sales

▼Supply chain and inventory management: Target must navigate potential supply chain disruptions and manage inventory levels effectively

Predictions:

①Analysts expect Target's revenue to grow around 4-5% in 2024, driven by omnichannel growth and private label expansion

②Target is expected to maintain or slightly improve its operating margins, thanks to cost-saving initiatives and supply chain optimizations

③Target will likely continue investing in e-commerce, digital marketing, and store experiences to drive long-term growth

Disclaimer: All the above are purely for educational purposes and are NOT financial advices, plz DYOR/DD!

DouGiee : panw - not much movement

xpev - drop

snow - drop

tgt - may rise

zm - stagnate or drop

Kingyuu :

Kingyuu :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) $Palo Alto Networks (PANW.US)$: With the increasing demand for cybersecurity solutions, Palo Alto Networks is likely to show strong earnings growth. Their innovation and expansion into new markets like cloud security, AI and 5G could drive positive results. But their competitors are doing the same.

$Palo Alto Networks (PANW.US)$: With the increasing demand for cybersecurity solutions, Palo Alto Networks is likely to show strong earnings growth. Their innovation and expansion into new markets like cloud security, AI and 5G could drive positive results. But their competitors are doing the same.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) $XPeng (XPEV.US)$: As a leading player in the electric vehicle market, XPeng's earnings might benefit from the growing adoption of EVs. Their cars have more bells and whistles than a Tesla. However, competition and regulatory changes could impact their performance in the US.

$XPeng (XPEV.US)$: As a leading player in the electric vehicle market, XPeng's earnings might benefit from the growing adoption of EVs. Their cars have more bells and whistles than a Tesla. However, competition and regulatory changes could impact their performance in the US.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) $Snowflake (SNOW.US)$: Snowflake's focus on data cloud services is positioned well for growth and scalability. Their ability to attract new customers and expand existing relationships will be key to their earnings prospects. Tho I personally use their competitor, $Alphabet-C (GOOG.US)$'s Big Query

$Snowflake (SNOW.US)$: Snowflake's focus on data cloud services is positioned well for growth and scalability. Their ability to attract new customers and expand existing relationships will be key to their earnings prospects. Tho I personally use their competitor, $Alphabet-C (GOOG.US)$'s Big Query ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) $Target (TGT.US)$: Target's earnings could be influenced by consumer spending trends. Their strong e-commerce presence and strategic initiatives might help them navigate economic uncertainties. US consumer spending has been on a downtrend so far this year.

$Target (TGT.US)$: Target's earnings could be influenced by consumer spending trends. Their strong e-commerce presence and strategic initiatives might help them navigate economic uncertainties. US consumer spending has been on a downtrend so far this year.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) $Zoom Communications (ZM.US)$: With the shift towards hybrid work models, Zoom's earnings could remain robust. However, competition and market saturation might pose challenges. Zoom's UI has been the same since the pandemic. Are they innovating fast enough?

$Zoom Communications (ZM.US)$: With the shift towards hybrid work models, Zoom's earnings could remain robust. However, competition and market saturation might pose challenges. Zoom's UI has been the same since the pandemic. Are they innovating fast enough?

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

What are your thoughts on these companies?

neat Kiwi_1685 : Hello