Weekly Earnings Preview: Grab rewards by guessing the market winner!

Hi, mooers!

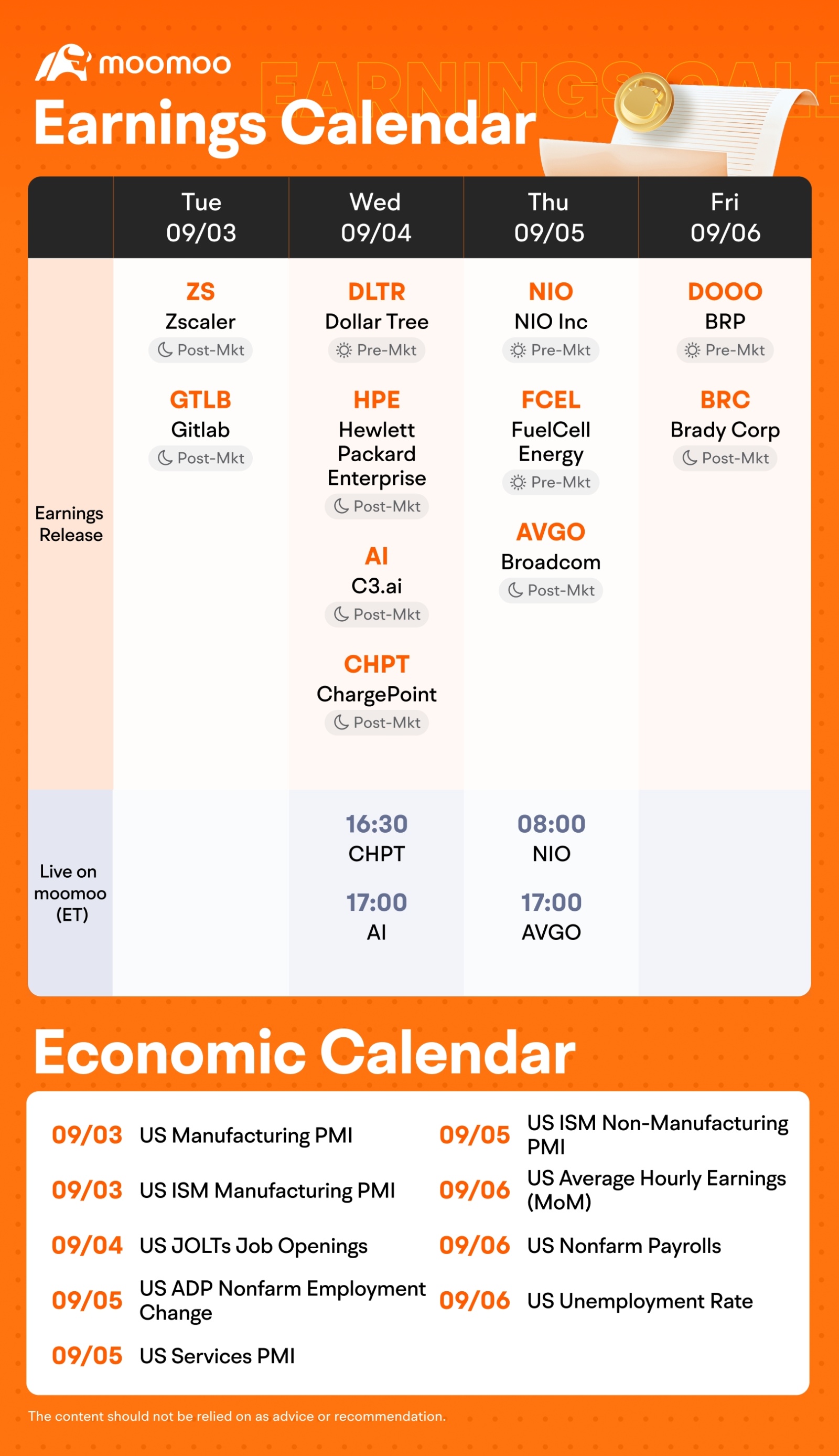

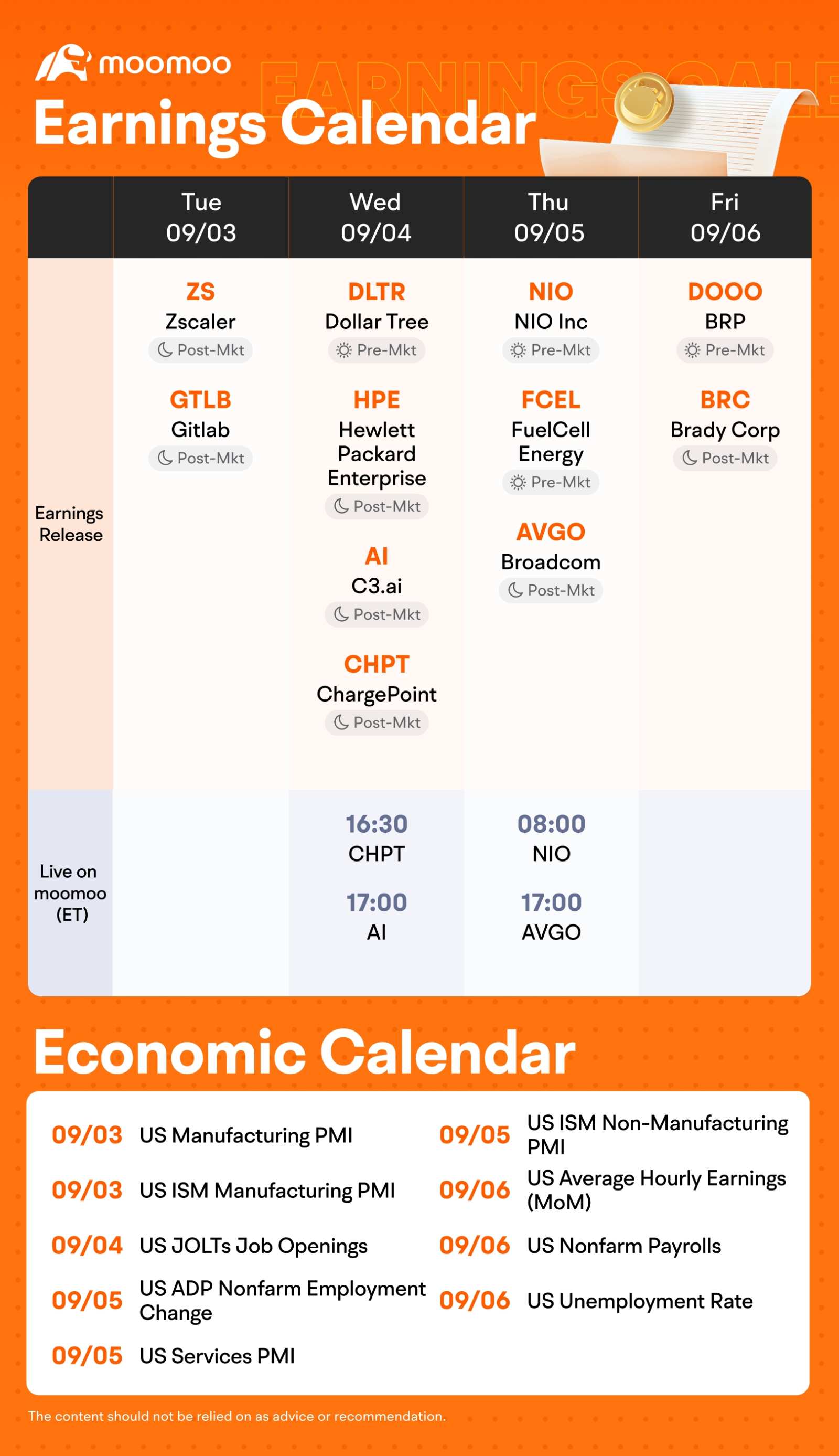

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week! ![]()

This week, various companies including $FuelCell Energy (FCEL.US)$ , $ChargePoint (CHPT.US)$ , $NIO Inc (NIO.US)$ , $C3.ai (AI.US)$ and $Broadcom (AVGO.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

Rewards

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

WH the rooster : $Broadcom (AVGO.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

mr_cashcow : My vote goes to $Broadcom (AVGO.US)$ as it seems to be doing well![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Let's us dive into a deeper analysis of Broadcom (AVGO):

Potential bullish signals:

▲Diversified product portfolio: AVGO's broad range of semiconductor and infrastructure software products reduces dependence on a single market

▲Growing demand for cloud and data center solutions: AVGO's data center and cloud-related businesses are expected to benefit from the ever increasing demand

▲Strong track record of acquisitions and integration: A long history of successful acquisitions, expanding its product offerings and customer base

Potential challenges & speed bumps ahead:

▼Cyclical nature of semiconductor industry: AVGO's semiconductor business may be impacted by industry cycles and fluctuations

▼Strong competition: Increasing competition in the semiconductor and software markets may pressure pricing and market share

▼Global economic uncertainty: Economic downturns or recessions may affect demand for AVGO's products

Some key areas to keep an eye out for:

①Semiconductor segment growth

②Software segment performance

③Gross margin expansion

④Free cash flow generation

Disclaimer: All the above are purely for educational purposes & are NOT financial advice, plz DYOR/DD!

102362254 : $C3.ai (AI.US)$ fell 14% last month, underperforming the S&P 500's 2.6% gain, amid profitability concerns. Despite these challenges, analysts predict 18% annual revenue growth over the next 3 years, outpacing the software industry. However, risks like shrinking margins, ongoing losses, and market competition could affect short-term performance, though long-term prospects are strong. I’m guessing $C3.ai (AI.US)$ may end this week with the biggest percentage gain.

CNNT : If this was a bull month, my answer would be very different.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

But since it's Sept (historically a bear month for US stock market), and US recession is looming, my guess is $Broadcom (AVGO.US)$ .

Albeit over-priced and facing profit margins erosion in the past few years, it's still a Goliath in semicon sector and a safer bet than the other 4 in this cautionary investment climate. Plus, it pays a consistent dividend.

Fun fact: Did you know that Broadcom's CEO is from Malaysia and grew up in Penang?