Weekly Earnings Preview: Grab rewards by guessing the market winner!

Hi, mooers!

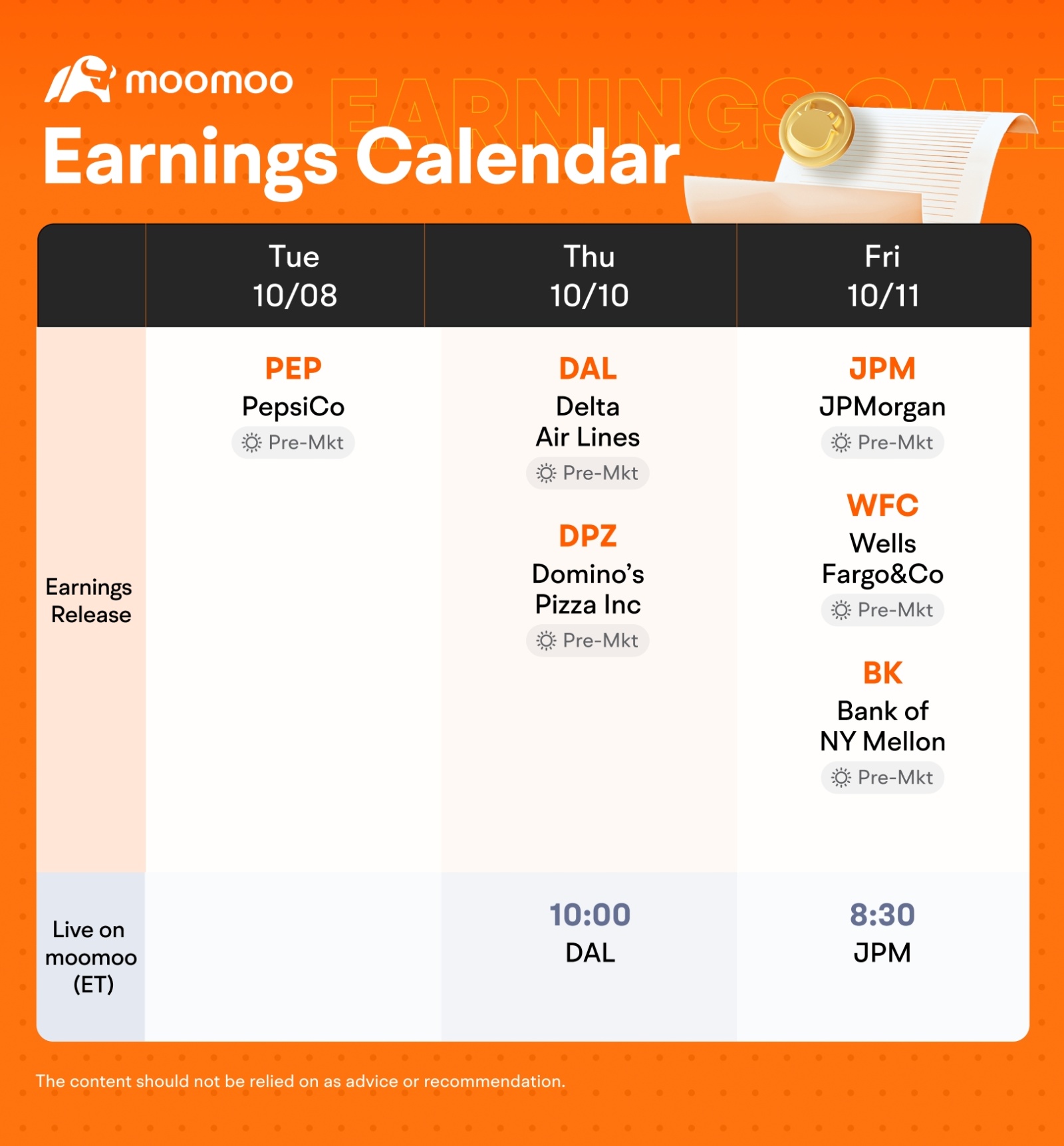

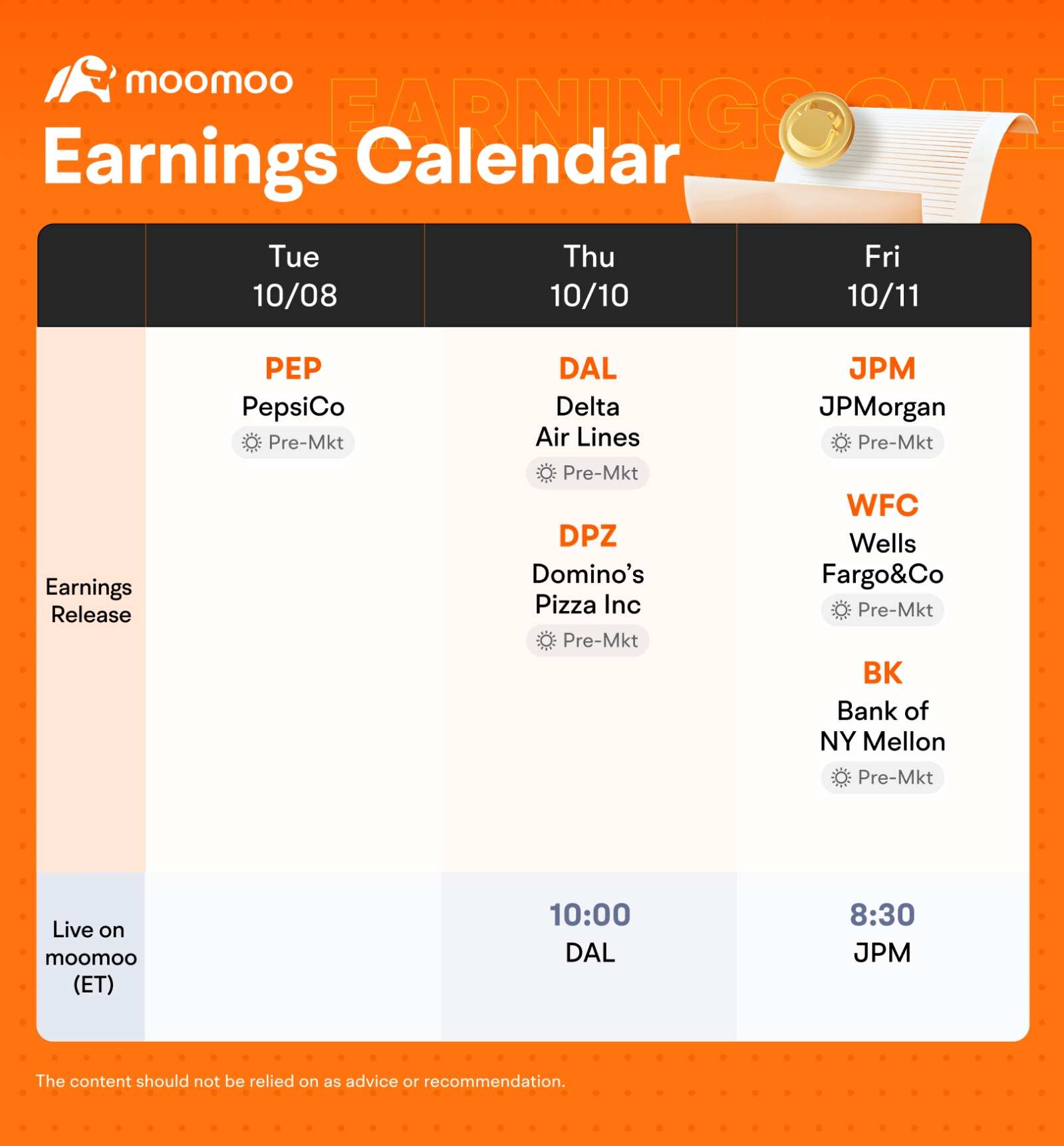

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week! ![]()

This week, various companies including $Delta Air Lines (DAL.US)$ , $JPMorgan (JPM.US)$ and $Wells Fargo & Co (WFC.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings releases, check out Moo earnings hub!

Rewards

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

kheldarX : 1st posting .lol..picking JP Morgan. Although now most capital flight out of US market and into China

102362254 : I guess $JPMorgan (JPM.US)$ may end this week with the biggest % gain. JPMorgan is in a strong position to take advantage of the current economic climate, with higher interest rates boosting its net interest income (NII) and strong results in trading and investment banking. And, its solid fundamentals and diverse revenue streams suggest it may continue to report strong earnings, potentially exceeding market expectations, as it did in the previous quarter.

mr_cashcow : My vote goes to $Delta Air Lines (DAL.US)$

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Let's do key summary of DAL's earnings prospect!

DAL is expected to report impressive Q3 2024 earnings, with revenue projected to rise 55% year-over-year to $12.87 billion. EPS also jumped. This growth is attributed to strong demand for travel, operational excellence, and the airline's diversified revenue streams

Key factors:

△Strong Demand for Travel: Delta has seen an increase in corporate travel demand, with managed corporate sales growing 14% year-over-year

△Operational Excellence: The airline's focus on reliability and on-time performance has led to industry-leading completion factors and operational margins

△Diversified Revenue Streams: Delta's premium revenue, loyalty program, and cargo business have contributed to its revenue growth

Overall, Delta's Q3 2024 earnings prospect looks promising, driven by strong demand, operational excellence, and diversified revenue streams

Disclaimer: All the above are purely for educational purposes and are NOT financial advice! Please DYOR/DD!

Lucas Cheah : $Delta Air Lines (DAL.US)$ is benefiting from strong demand for travel as the airline industry recovers from the pandemic. The company has regained pricing power, especially in premium travel and international routes, which is boosting revenue. However, rising fuel costs and inflationary pressures remain challenges. While business travel continues to recover, any potential economic slowdown could dampen demand. Overall, Delta's earnings prospects remain positive, but heavily influenced by fuel prices and macroeconomic conditions.

$JPMorgan (JPM.US)$ , as the largest U.S. bank, is well-positioned for growth due to rising interest rates, which increase net interest income (NII). Strong performances in the corporate and investment banking segments are driving earnings growth, while its large consumer banking franchise continues to benefit from economic resilience. However, the bank faces potential headwinds from regulatory changes, higher credit losses if the economy slows, and market volatility. Despite these risks, JPMorgan's diversified business model and strong capital base make its earnings outlook favorable.

$Wells Fargo & Co (WFC.US)$ is benefiting from higher interest rates, which are boosting net interest margins. The bank has been focusing on cost-cutting and restructuring efforts to improve profitability following its regulatory issues. However, it still faces challenges from regulatory constraints and possible loan losses in a slowing economy. Despite these concerns, Wells Fargo’s strong deposit base and improved efficiency efforts provide a solid foundation for future earnings growth.

CNNT : This one is quite clear from the trendline that it will be:

$Delta Air Lines (DAL.US)$

ĴPM is also on an uptrend by not as strong, while WFC is moving sideways.

Furthermore, DAL's ex date is coming up, so that is a boost factor too.

Skyrye7 : Comparing the earnings prospects of Delta Air Lines, JPMorgan Chase, and Wells Fargo involves analyzing different sectors and various factors:

Delta Air Lines

Pros: Strong recovery in travel demand post-pandemic, potential for higher revenues as leisure and business travel increases.

Cons: Vulnerability to fuel price volatility and economic downturns that can reduce discretionary travel spending.

JPMorgan Chase

Pros: Diversified business model with investment banking, asset management, and consumer banking; benefits from rising interest rates improving net interest margins.

Cons: Exposure to market volatility and regulatory risks, as well as economic cycles impacting lending.

Wells Fargo

Pros: Focus on traditional banking and cost-cutting measures can improve profitability; potential recovery in lending growth.

Cons: Historical regulatory issues and slower recovery compared to its peers in certain markets.

Overall Assessment

Banking Sector: JPMorgan generally has a stronger diversified earnings base and is often seen as having better prospects in a rising rate environment.

Airline Sector: Delta has significant potential with increased travel demand but faces greater external risks.

Conclusion: If interest rates remain favorable and economic conditions support lending, JPMorgan Chase might have the best earnings prospects among the three. However, Delta's recovery in travel can also lead to strong earnings, especially in a booming travel environment. Wells Fargo may have more stable prospects but faces challenges from its past.

Cashcowww : how do I add the economic and earnings calendar into my favourite list? or how do I navigate and locate the economic calendar ?