Weekly Earnings Preview: Grab rewards by guessing the market winner!

Hi mooers!

![]()

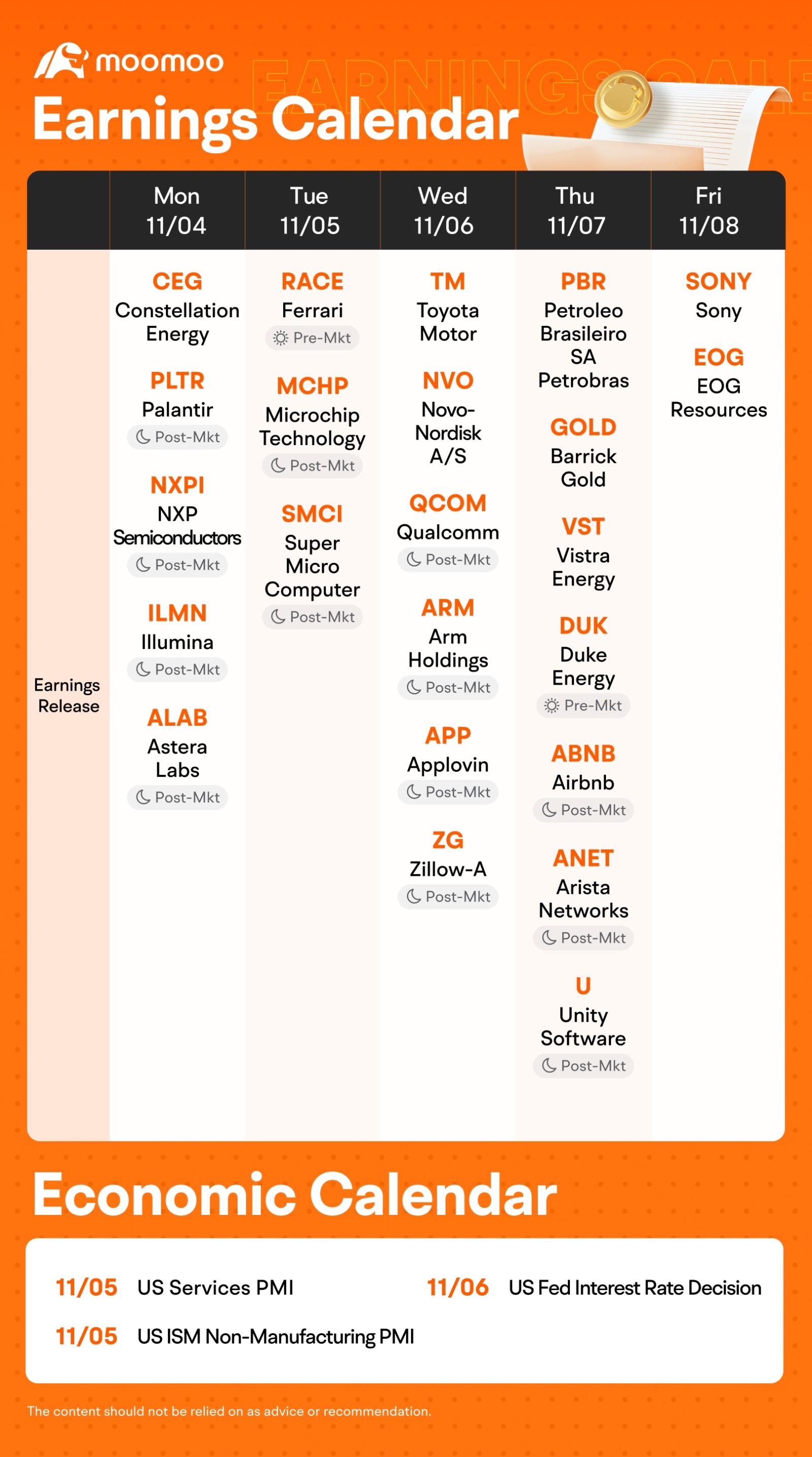

Need a quick update on this week's events? Check out moomoo's fresh

earnings & economic calendars to start this week!

![]()

![]() An equal share of 3,000 points:

An equal share of 3,000 points: For mooers who correctly guess

the stock who makes the biggest gains during the week (e.g., If 50 mooers make the correct guess, each of them will get 100 points!)

![]() Exclusive 300 points:

Exclusive 300 points: For the top comments on

companies' earnings prospects under this post.

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 17

17 1

1

104712493 : Palantir's earnings prospects have several positive aspects:

Strong Demand for Data Analytics: As organizations increasingly rely on data-driven decision-making, Palantir's software solutions are positioned well to meet this growing demand.

Diverse Client Base: The company serves a range of sectors, including government, healthcare, and finance, which can help mitigate risks associated with reliance on a single industry.

Long-Term Contracts: Palantir often secures long-term contracts with government agencies and large enterprises, providing stable and recurring revenue.

Innovative Technology: Their advanced analytics platforms, like Foundry and Gotham, are continually evolving, allowing them to stay competitive and attract new clients.

Expansion into Commercial Markets: Palantir has been making strides to expand its commercial business, which could lead to significant revenue growth outside of government contracts.

Positive Cash Flow: The company has demonstrated the ability to generate positive cash flow, which is a good indicator of financial health and sustainability.

Strategic Partnerships: Collaborations with major companies and organizations can enhance their product offerings and expand their market reach.

These factors contribute to a generally optimistic outlook for Palantir’s earnings potential in the coming years.

102362254 : I'm trying to decide if Arm or Palantir will have the biggest % gain this week. Both companies are expected to report strong earnings because of their strengths in AI and tech. Arm makes money from licensing and royalties, which gives them steady income. Palantir offers AI solutions to many clients, including government agencies. I will continue to watch their revenue growth, profitability, and any new strategic moves to understand their long-term potential

Kind Pumpkin : but alot taking profits too not to forget

ur wifes boyfriend : amc is due for massive gains but amc hasn't brought in huge gains after earnings for a long time.Any news even if it's good or bad news AMC shorts always attack it downward.This stock is heavily shorted and share holders been diluted and at the lowest price amc sold shares at the worse time. When shorts start to cover the market always halts trading immediately and will not let it run like other stocks do. They definitely, have special treatment for AMC .The media use to write hit pieces on Amc several times a week for years and now it seems like that media is not writing anything about AMC at compared to other companies that are in the movie industry and are completely positive about the box office. Amc has brought in new revenue with popcorn sales in grocery stores and movie merchandise and popcorn buckets and making their own candy for movie goers. But that's never written about. The same information is put out about the movie writers strike,covid 19, the debt, and attendance pre covid levels that only affects Amc share price and only Amc but not other companies in the same industry.Yet Amc price is left for decreased share price and the others have nicely positive gains for the year. Amc dark pool volume is always usually over 50 percent every day and ftds use to comically higher than the other stocks but is still experiencing ftds in the thousands. There has been evidence of bad actors in the market for years have been reporting bad, incomplete,or completely wrong trades and only pay a small fine without the admission of guilt. By any means necessary Amc is getting screwed and no one is trying to stop them. Amc was gonna squeeze many times but it's always halted. It's not like people don't know it's just not looked into with any urgency and regulators look the other way. Most share holders nowadays are just holding and buying for someday that the market will let Amc fly.

Lucas Cheah : $Palantir (PLTR.US)$ earnings outlook is promising, driven by strong demand for its data analytics platforms, particularly in government contracts. Its expansion into the commercial sector and investments in AI position it well for growth, though high R&D costs and profitability challenges remain. If commercial adoption scales up, earnings could strengthen, but competition in data analytics is a risk.

$Super Micro Computer (SMCI.US)$ benefits from high demand in data centers, AI, and edge computing, which supports revenue growth. Its focus on high-performance server and storage solutions aligns well with growth sectors like AI and 5G. However, competition and supply chain constraints could impact margins, making cost management critical for sustained earnings.

$Arm Holdings (ARM.US)$ position in semiconductor IP, especially in mobile devices, provides stable licensing revenue. Expansion into AI, automotive, and IoT markets presents strong growth potential. However, dependency on key customers and competition from alternative architectures like RISC-V could affect earnings stability in the long term.

$AMC Entertainment (AMC.US)$ prospects rely on a recovery in theater attendance and diversification into alternative revenue streams, like live events and theater rentals. High debt levels and competition from streaming services remain significant challenges. Sustained profitability will depend on effectively managing these financial and industry pressures.

Palantir and Super Micro have strong growth potential due to their positioning in AI and data solutions, while Arm benefits from high licensing demand but faces competition risks. AMC’s recovery is less certain due to its debt burden and streaming competition.

CNNT : $Palantir (PLTR.US)$ is the obvious winner since its part the, but less talked about, Trump backer.

Also, it does not have poor financials like AMC, pending lawsuit like ARM and fresh scandals like SCMI.