Nvidia's stock hit a new high after Q3 earnings!

Nvidia's stock hit a new high after Q3 earnings!

Views 3.5M

Contents 601

Weekly Earnings Preview: Grab rewards by guessing the market winner!

Hi mooers!

![]()

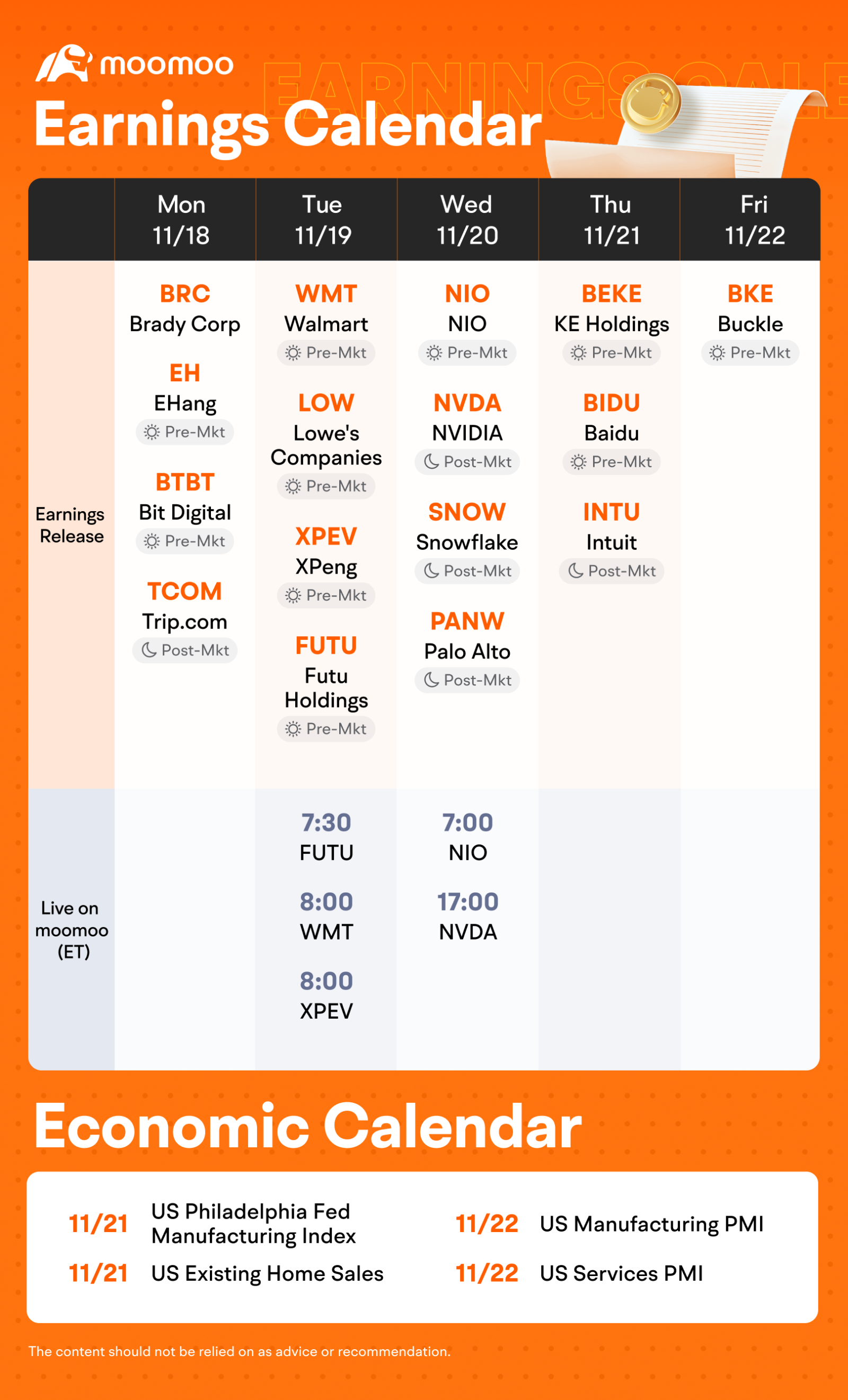

Need a quick update on this week's events? Check out moomoo's fresh

earnings & economic calendars to start this week!

![]()

![]() An equal share of 3,000 points:

An equal share of 3,000 points: For mooers who correctly guess

the stock who makes the biggest gains during the week (e.g., If 50 mooers make the correct guess, each of them will get 100 points!)

![]() Exclusive 300 points:

Exclusive 300 points: For the top comments on

companies' earnings prospects under this post.

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Dragon Fish : Wow. All pick Nio. Hope all are prospering together.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Holy bird bird ❤ : Don't pick nio, nio are kotex stock.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Blazethebeagle : Nio really hahaha

udang merah :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

musang queen :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

tekka :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

black torn :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104712493 : NIO, the Chinese electric vehicle (EV) maker, has been working towards achieving profitability by leveraging several key drivers. Here’s a summary of what could push NIO's earnings into positive territory:

1. Product Portfolio Expansion

New Models: NIO continues to release new models and refresh existing ones, such as its flagship sedans and SUVs. Increased offerings attract a broader customer base and enhance revenue streams.

Technology Integration: Advanced battery technologies (like solid-state batteries and battery-swapping services) differentiate NIO in the competitive EV market, driving premium pricing and customer loyalty.

2. Battery-as-a-Service (BaaS)

NIO's unique BaaS model reduces upfront vehicle costs, attracting more buyers while ensuring recurring revenue from subscription services. This provides a stable and predictable cash flow to support long-term growth.

3. Scaling Production

Increasing manufacturing capacity and operational efficiency through partnerships (e.g., with JAC Motors) helps reduce per-unit costs, improving gross margins as production scales up.

4. Geographical Expansion

NIO is aggressively expanding into international markets, including Europe and potentially the U.S., leveraging demand for premium EVs in these regions. Broader market access diversifies revenue sources and boosts overall sales.

Lucas Cheah : $Walmart (WMT.US)$ focus on groceries and essential goods ensures stable revenue even during economic uncertainty. Its growing e-commerce platform and international expansion, such as Flipkart in India, add new revenue streams. However, inflation and labor costs could pressure margins.

$NVIDIA (NVDA.US)$ leadership in AI and data center GPUs, such as the A100 and H100, drives strong growth prospects. Its gaming segment is recovering with new product launches, while its automotive and AI solutions offer additional revenue streams. Valuation and competition from AMD are key risks.

$XPeng (XPEV.US)$ emphasis on smart EV technology and international expansion supports growth potential. Its XPilot autonomous driving system and the G6 SUV are key differentiators. However, competitive pricing and lower-than-expected deliveries could weigh on near-term margins.

$NIO Inc (NIO.US)$ premium EV positioning and Battery-as-a-Service (BaaS) model provide recurring revenue and strong customer retention. Expansion into Europe and steady vehicle delivery growth bolster prospects. Challenges include competition from Tesla and high R&D costs.

In summary:

• $Walmart (WMT.US)$ : Stable, defensive with e-commerce growth.

• $NVIDIA (NVDA.US)$ : High growth from AI and data centers, with some valuation risks.

• $XPeng (XPEV.US)$ : Innovative but faces margin pressure from competition.

• $NIO Inc (NIO.US)$ : Premium EV player with recurring revenue potential.

Courtney J : NVIDIA![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...