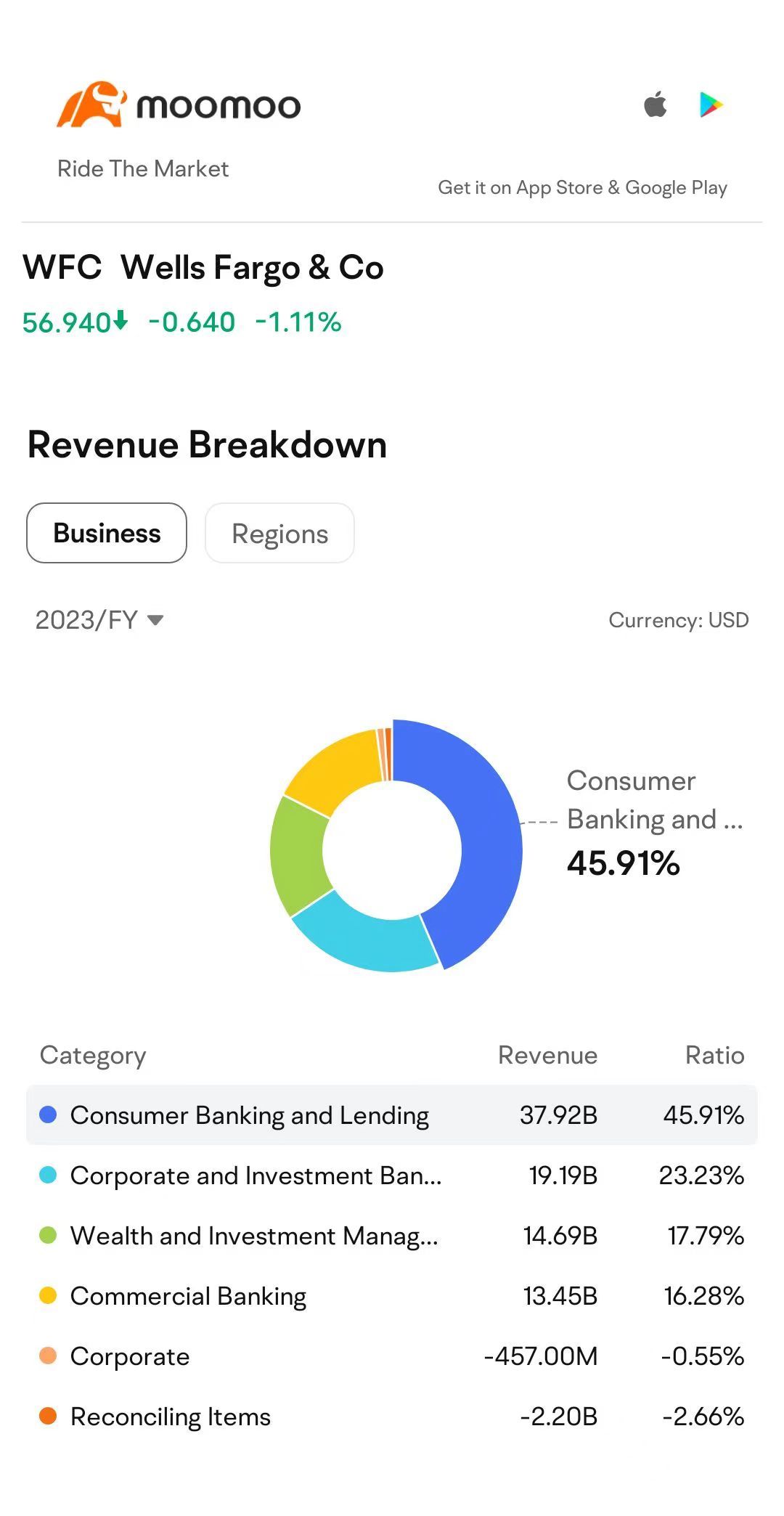

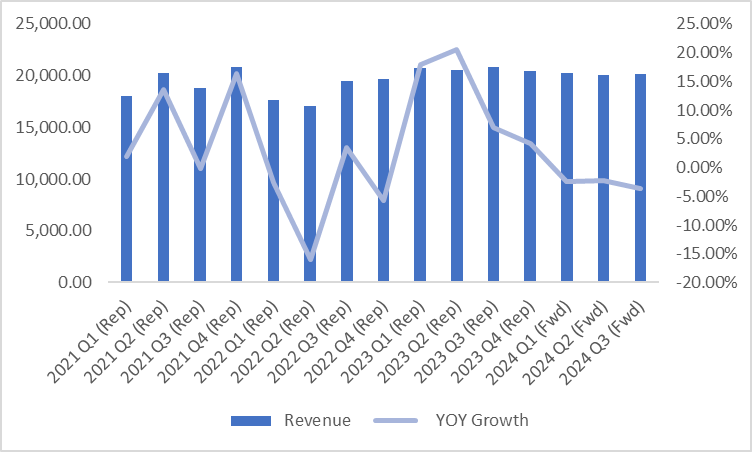

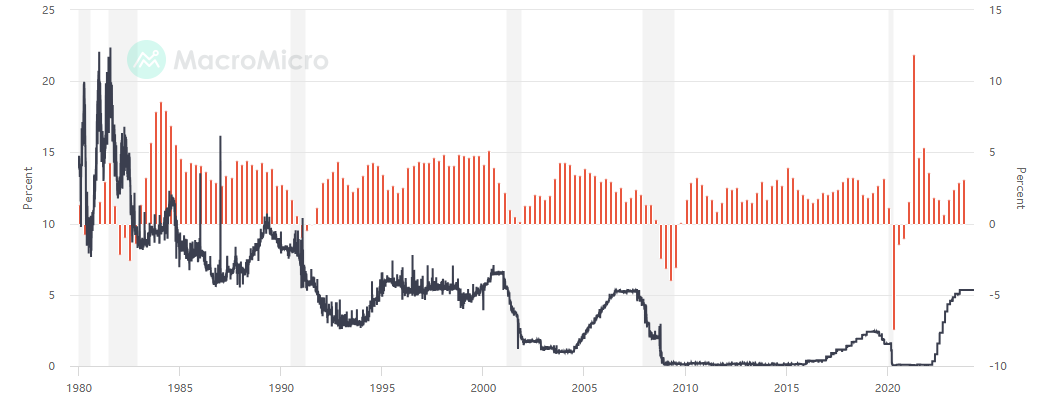

Interest Income: Looking at specific businesses, Wells Fargo's interest income business includes loan services, investment securities, deposit services, money market operations, among others; non-interest income comprises fees and commission income (such as investment banking, asset and wealth management, transaction services, credit card services, etc.), and trading income. In terms of profits, Q4 2023 net interest income accounted for 62.36% of the total, already becoming a major component of revenue.

Cwanaziz : Sha$NVDL 240419 35.00P$