Wesfarmers: Cost Control Pressures Remain High Amidst Inflation

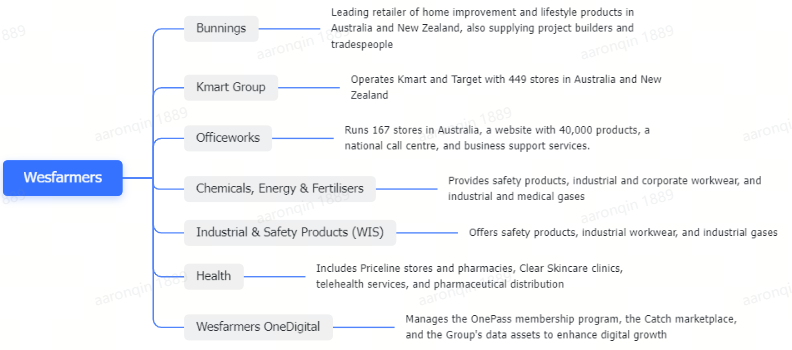

Who is Wesfarmers Ltd?

$Wesfarmers Ltd (WES.AU)$, based in Australia, is a diversified conglomerate established in 1914. Originally founded as a farmers' cooperative in Western Australia, it has grown to become one of the largest retail companies in Australia and is also listed among the Global Fortune 500 companies. Headquartered in Perth, Western Australia, Wesfarmers has extensive operations across various industries.

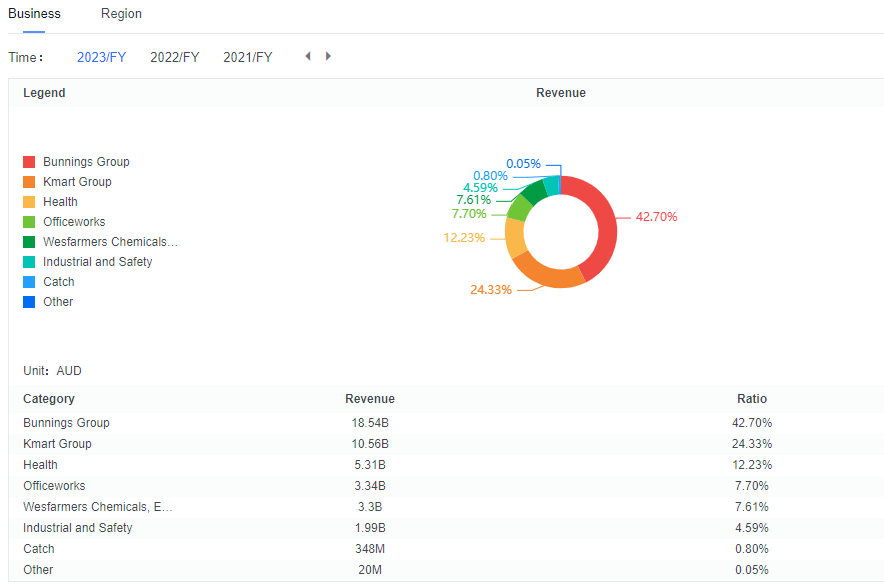

Its retail operations include Bunnings Warehouse, the leading hardware chain in the market, and discount department store Kmart, which together account for the majority of the group's revenue. Other business segments include healthcare, office supplies, chemicals, and industrial operations.

Operational Performance

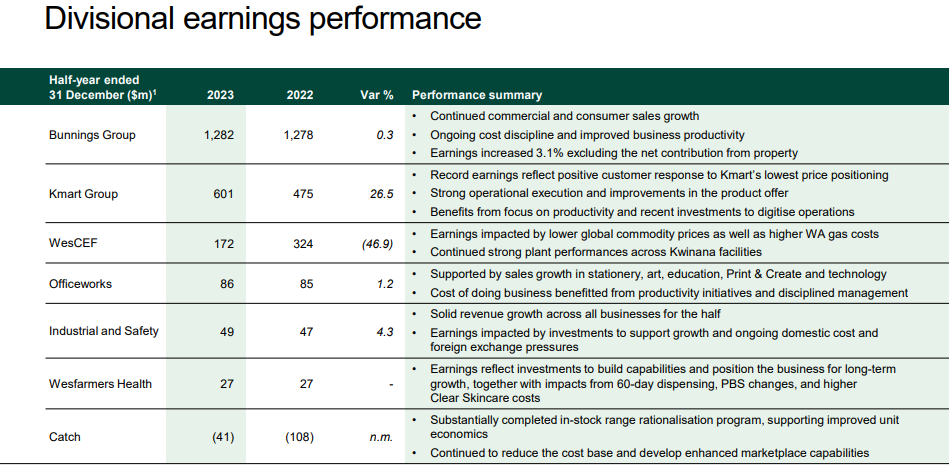

According to the latest financial report from Wesfarmers Limited, for the six months ending December 31, 2023, the company reported revenue of AUD 22.67 billion, representing a year-on-year growth of 0.5%. The net profit after tax was AUD 1.425 billion, showing a year-on-year increase of 3.0%.

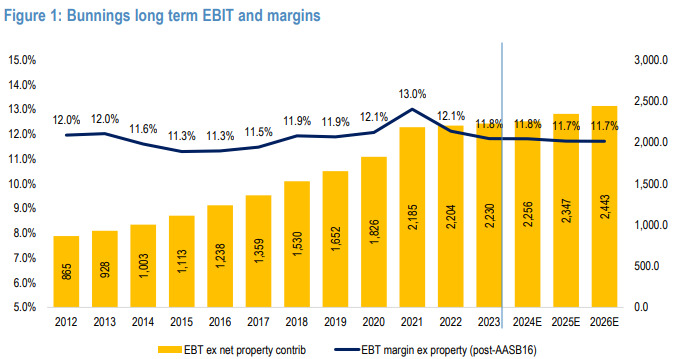

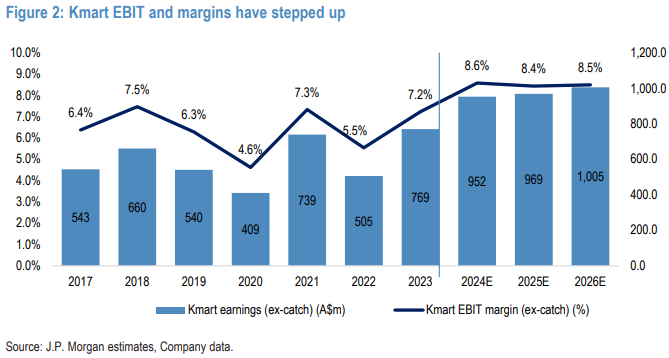

Wesfarmers' Bunnings and Kmart retail divisions are its core businesses. The Bunnings division, being the largest revenue contributor, showed relatively flat revenue performance, reflecting the current trend of sluggish retail sales in the market. Driven by strong growth in clothing sales, Kmart achieved record earnings in the first half of the year, with a year-on-year increase of 26.5%.

1.Bunnings Creates Value Through Space and Product Range Adjustments

Bunnings is striving to optimize its operating model by meticulously managing store space at both macro and micro levels, aiming to achieve higher gross margin returns within the existing footprint. This strategy has led Bunnings to not only expand its current product categories but also introduce new categories such as pet supplies and fast-moving cleaning products to attract more customers and enhance gross margins. Meanwhile, the online platform offers a broader product selection, allowing smaller stores to ensure product availability without the need to display all product types in-store.

Bunnings' diverse product offerings help mitigate the impact of real estate cycle fluctuations. The company's management is currently more focused on creating value through small-scale, efficient adjustments to store space and product range, rather than solely relying on market cycles or new store expansions.

2.Kmart's Share of Spending Among Middle- and High-Income Households Increases

Kmart's growth trajectory remains strong, and its brand design solutions company, Anko, has long-term development potential. Kmart's growth in the last quarter was driven by broader household coverage and an increased share of spending among middle- and high-income households. While the growth in real wages may slightly reduce some consumers' demand for low-priced goods, impacting some of Kmart's cheaper products, the increased share of spending among middle- and high-income households and its unassailable position in the brick-and-mortar retail sector place Kmart in a very favorable position. With the continuous optimization of its operations, we see the potential for an upward improvement in its profit margins.

In the long run, Anko's global collaboration potential is significant. For example, its partnership with Mattel in wooden toys, the initial limited rollout of products at Carrefour, and the opening of independent specialty stores all indicate more opportunities ahead.

3.Officeworks Poised to Leverage AI Opportunities

Officeworks is preparing for the new era of artificial intelligence technology. Its unique position in the SME (Small and Medium Enterprises) and consumer markets enables it to gain an early advantage in the AI-driven computer product cycle. Therefore, it will be crucial to observe whether consumers and SMEs are willing to pay a premium for experiencing more powerful AI functionalities.

Given the additional practicality brought by this change, Officeworks may need to increase its workforce and collaborate with device manufacturers to enhance service levels around this category of products. As the second-largest computer retailer in Australia, this represents a significant growth opportunity for Officeworks that could potentially exceed current performance forecasts.

Investment Thesis

1.Kmart, Bunnings, and Officeworks Are Key Growth Drivers

Wesfarmers' Investor Day event in May focused less on trading updates or performance guidance and more on the factors driving Wesfarmers' long-term success. The company's long-term investment horizon undoubtedly creates added value across its various businesses. Kmart, Bunnings, and Officeworks continue to be favored by consumers due to their price leadership and execution. However, the healthcare, CEF, Catch, and digital businesses still face challenges, with overall profit growth remaining at low levels (JP Morgan forecasts 3% for FY 2024 and 4% for FY 2025, which is about 5% lower than market consensus).

2.Core Retail Business Remains Stable Despite Inflation Impact

Australia's low unemployment rate and strong population growth support the economic environment, driving housing demand. Although inflation has eased over the past year, current inflation and interest rates remain high, leading consumers to be more price-conscious and cautious with their spending. Despite this, the group's retail businesses are well-positioned in the current environment due to their strong value reputation and broad product offerings.

WES's low-price strategy (leveraging its scale advantage and sourcing capabilities) helps it gain market share and solidify its leading position in the Australian retail market as consumers become more price-sensitive. Additionally, WES's investments in logistics and supply chain (e.g., semi-automated customer fulfillment centers) will reduce delivery times and improve operational efficiency. WES's digital initiatives (integrating various departments into the OnePass platform) can also enhance synergies between departments and provide a better customer experience.

3.Significant Cost Pressures Require Cost Management

Due to inflation, labor constraints, rising wages, and increased energy and supply chain costs, cost pressures remain high in Australia and New Zealand. The group is monitoring international supply chain pressures and has implemented contingency measures to mitigate risks. Additionally, WES's estimated net capital expenditure for FY 2024 is AUD 1 billion to AUD 1.2 billion, which may lead to higher debt levels and interest expenses.

In summary, we hold a neutral view on Wesfarmers. While the company's core retail position remains solid, it faces significant risks, including lower-than-expected consumer spending and higher-than-anticipated cost inflation. The company's stock price has risen 20% year-to-date, making the current price fairly reasonable.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment