Western Bank Surges 60% After 100% Premium Acquisition: Who Could Be the Next Buying Target?

National Bank has agreed to purchase $Canadian Western Bank (CWB.CA)$ for $5 billion, a move that sees the bank paying a 118% premium over CWB's June 11 close price of C$24.89. This acquisition follows the $Royal Bank of Canada (RY.CA)$'s significant purchase of HSBC Canada, valued at $13.5 billion, signaling a consolidation trend in the Canadian banking industry.

Since the announcement, Canadian Western Bank's stock has soared over 60%, a reaction typically seen in the shares of a company being acquired at a premium. National Bank's shares have witnessed a 10% dip as the market factors in the potential short-term financial strain and cash outflows associated with paying a premium on the acquisition.

Why the Market Reacts with Caution to National Bank's Purchase

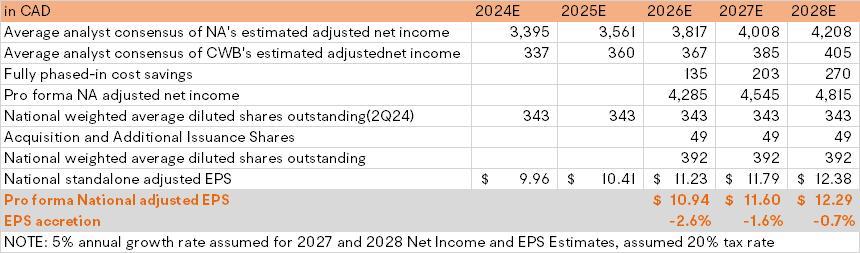

The acquisition appears expensive at 14 times CWB's projected 2025 EPS, though it is in line with the multiple paid by RBC for HSBC Canada. National Bank has indicated that it will take at least three years post-acquisition to become accretive to earnings per share (EPS), with the deal expected to close by the end of 2025. However, with projections including a 5% annual growth rate for the following years and considerable synergies, the bank may still face hurdles in achieving this financial boost, according to Bloomberg analyst Samuel Radowitz's financial model.

After three years of integration, nearly five years from now, there is a likely possibility of a break-even," Samuel wrote in the note.

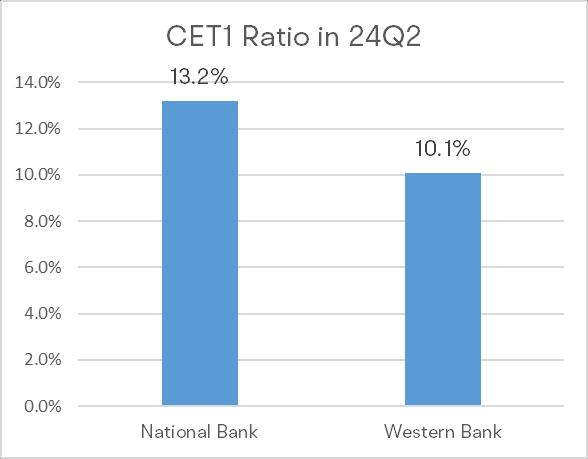

Regarding capital, the National Bank reported a common equity tier 1 (CET1) ratio of 13.2% in its latest quarterly results, beyond CWB's 10.1%. Post-acquisition, the CET1 ratio is projected to remain strong, exceeding 12.75%, comfortably above the regulatory minimum of 11.5%.

As for assets, the combined entity's assets are set to swell to C$484 billion, expanding National Bank's footprint notably west of Quebec, though it will still be half the size of its nearest peer, CIBC.

Why National Bank is Betting Big on Canadian Western Bank

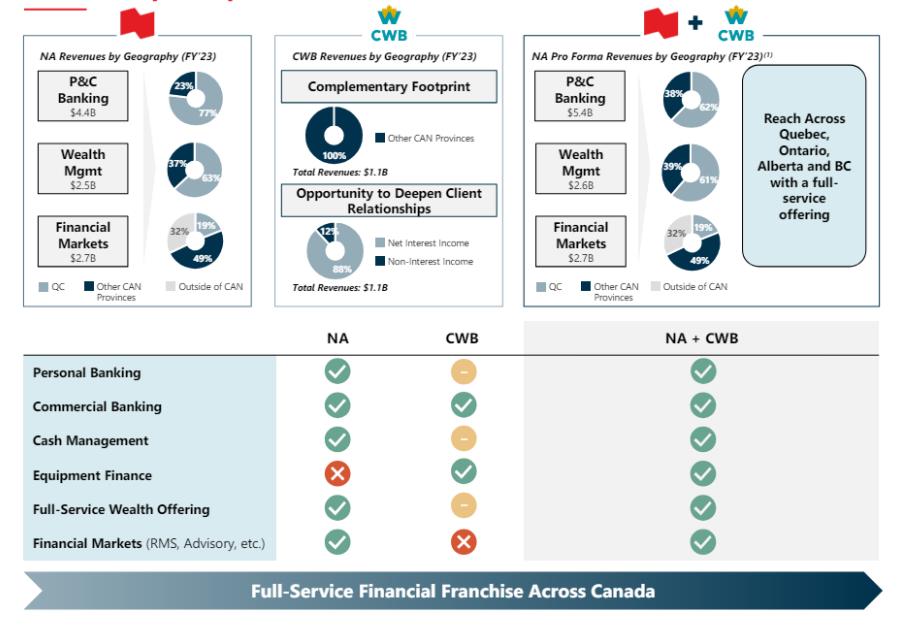

Strategically, the acquisition of CWB plays into National Bank's broader vision. As analyzed by Morningstar DBRS, the move is poised to enhance the bank's revenue diversification both geographically and by product. CWB's integration lessens National Bank's reliance on the Québec market and significantly strengthens its presence in the lucrative Western Canada region, including British Columbia and Alberta.

The acquisition aligns with National Bank's aspirations to grow its Personal and Commercial Banking and Wealth Management segments, promising to offer an expanded array of products and services to CWB's customer base. This drives the P&C segment's revenue contribution from 40% to 45%, according to Bloomberg. Moreover, with CWB's Equipment Finance business, National Bank will emerge as a more comprehensive institution, filling a service gap and presenting a broader service palette to its clients.

More Consolidation in Banking Industry?

"The acquisition of CWB also aligns with our expectations for further consolidation within the Canadian banking industry," said Veritas Investment Research Corp. senior investment analyst Nigel D'Souza in a note to clients. He said the consolidation potential comes from smaller banks' inability to match the inherent advantages enjoyed by larger banks, such as more substantial economies of scale, widespread branch networks, and the benefit of lower borrowing costs.

Big banks are increasingly absorbing smaller entities to bolster their competitive edge and expand their market dominance.Shilpa Mishra, the managing director at BDO's Capital Advisory Services practice, also observed the heightened activity in the sector, stating, "There's an unprecedented level of M&A in the Canadian banking sector.

"Following National Bank's recent expansion news, Laurentian Bank and EQ Bank stand out as the next possible acquisition targets. $Laurentian Bank of Canada (LB.CA)$ stock rose by 6.6% after National Bank's announcement, a noteworthy gain given the bank's strategic review last year—a move frequently interpreted by investors as signaling a company's openness to a sale, though it failed to find a buyer at that time.

Simultaneously, $EQB Inc (EQB.CA)$, which owns EQ Bank, experienced a 2.9% rise in its share price, hinting at potential investor interest in more consolidation.

Source: Bloomberg, Wealth Professional, Morning Star

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment