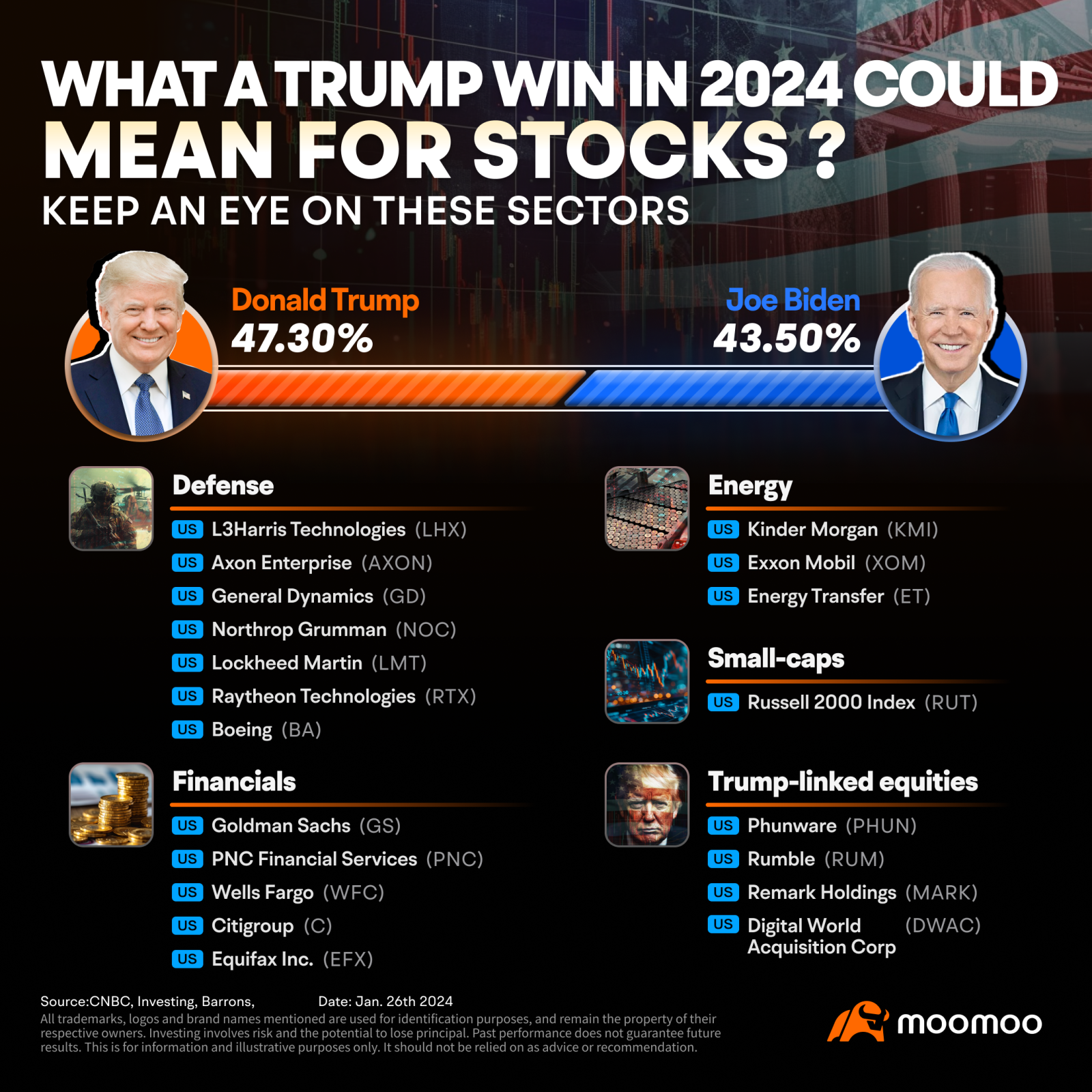

Another sector that could outperform is energy.“At 13.3mnb/d, US crude production is near an all-time high. While we believe Trump would reduce regulatory uncertainty, it could also boost production further, hitting commodity prices. For that reason, we favor midstream companies along with coal and LNG exporters,” Clifton wrote.

71379804 : We will see the crash everyone waiting for because the government will stop printing money. You heard it here first

72984602 : No thank you, I will not put greed before country.

corey lambert : Trump 2024!

57AB : who cares about stocks, you are romancing with an insurrectionist because of money? indeed money is the root of all evil. an insurrectionist who has been convicted and fined for sexual violating women in broad daylight inside a store. we are talking about the chairman of the board of "jews will not replace us" inc.

71780680 : I never in my life time though I would see so much energy, and hope to elect a person that has shown he can't tell the truth, extremely racist, has more court appearance then campaign dates. But it just showes where we are as a society.

hechunqing69 57AB : Money is not the root of all evil; the source of all evil is human nature.

hechunqing69 71780680 : The amount of time spent in court does not convict a person.

71780680 hechunqing69 : I guess thow morals out the window to,,, At one time it meant something . buy I guess everyone likes mass Kaos.

Mark Lerch hechunqing69 : The bible (1 Timothy 6:10) actually was written to say "For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows." It is not money itself, but the love of money, which could be interpreted as human nature.

Ultratech : guy admitted on tape he purposely downplayed covid. people still brainwashed by him. steals documents, shares nuclear secrets. rapes minors with epstein. ultimately this is people doomed to spend eternity in hell blind to the difference between good and evil supporting a pathological liar. Biden sucks I'm the first to admit it. who cares about Biden too many sold their souls to trump who only cares about himself. bunch of useful idiots out there. absolutely shameful

View more comments...