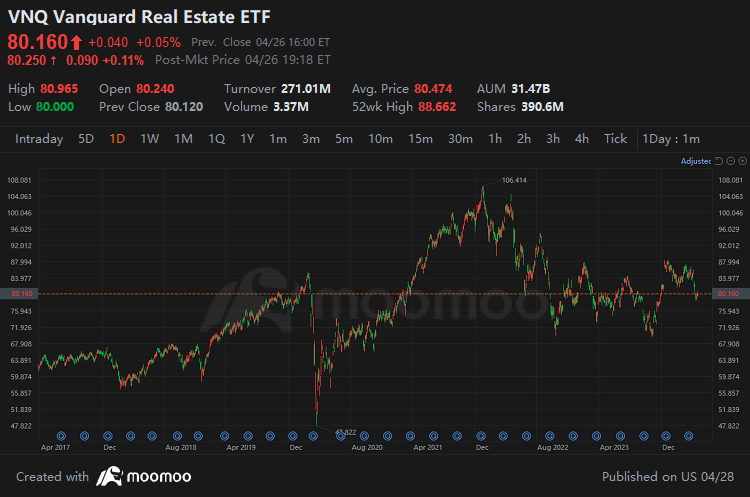

VNQ tracks the MSCI US Investable Market Real Estate Index, which includes U.S. investable market real estate stocks, covering all types of REITs except mortgage REITs, such as office buildings, shopping centers, hotels, and apartments. VNQ is one of the largest REIT-related ETFs in the market, offering broad exposure to the real estate industry, with low fees and good liquidity.

PokaiTrader : excellent article outlining the investible real estate landscape that's got recurring incomes other than capital appreciation

102429238 : If you take the US dividend, you still have to deduct 30%, and the dividend you get is less than the one in Malaysia. I personally think it is more economical to invest in Malaysia.

Eve Forever Gain 102429238 : Simply based on dividend payout rates, basically local REITs definitely have better results. As long as you are willing to do your homework and slowly accumulate and manage, the results you can achieve will be superior to these professional ETFs. Let's work together.

Moomoo Research OP PokaiTrader :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Paul Glaser : Really helpful on understanding real estate ETFs so I can better understand which real estate ETFs are going to be stable and profitable