What Are the Implications of Supermicro's Significant Retreat as the Server Giant Becomes Mired in a Quagmire of Price Wars?

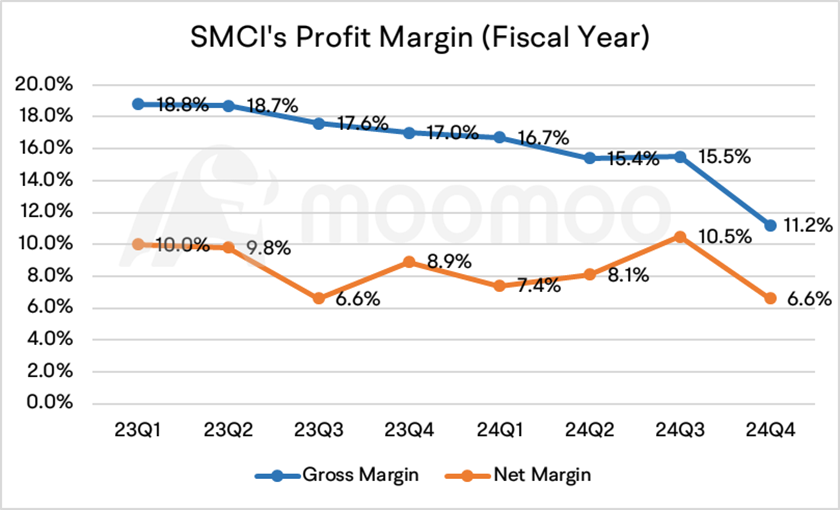

$Super Micro Computer (SMCI.US)$ 's recent financial report shows that its earnings in the latest quarter were significantly lower than expected. Non-GAAP EPS was $6.25, well below the consensus expectation of $8.30. The company's gross profit margin was 11.2%, also lower than 15.5% in FY24Q3 and 17.0% in FY 23Q4. The company expects profit margins to continue to be under pressure in the short term.

Revenue guidance is also lower than expected. In the fiscal year of 2025, the company guided net sales between $26.0B and $30.0B, compared with estimates for $33.54B.

■ Why? The competition landscape has deteriorated significantly

A good industry does not necessarily mean a good company. Although the server market has benefited from the AI wave of large-scale shipments, the competition in the AI server market is fierce. Server manufacturers have lowered prices to seize market share, and the industry's profit margin has declined.

According to Dell's 24Q1 financial report, the company's overall gross profit margin has declined due to the impact of AI server's business. Although the company added about $1.7 billion in AI server revenue, its operating profit was flat from the same period last year. In other words, the company's AI initiatives have yet to translate into profits. Before the release of SMCI's financial report, the vast majority of analysts did not price in the fierce competition.

The deterioration of the server industry pattern means that the stock frenzy caused by AI is showing obvious differentiation. Investors need to identify which field in the AI industry chain can obtain more added value.

■ What are the implications?

1) If a technology company does not own core technology, its business can easily be replaced and replicated. Warren Buffett once pointed out at a shareholder meeting that finding companies that will be able to survive and prosper for the next ten to 20 years is incredibly hard. Even though Supermicro had a deep cooperation relationship with NVIDIA for 20 years and has undertaken certain sales responsibilities in the early years, as the latter's strength has increased, Supermicro's bargaining power with NVIDIA is declining. The company lacks the voice of the industry chain, and its story of liquid cooling and modularization failed to convince investors. In addition to Dell and HP, Taiwanese manufacturers Hon Hai and Quanta are also involved in this track. In addition, Nvidia can even bypass server integrators and connect directly with large customers with assembly capabilities, such as Google and Microsoft.

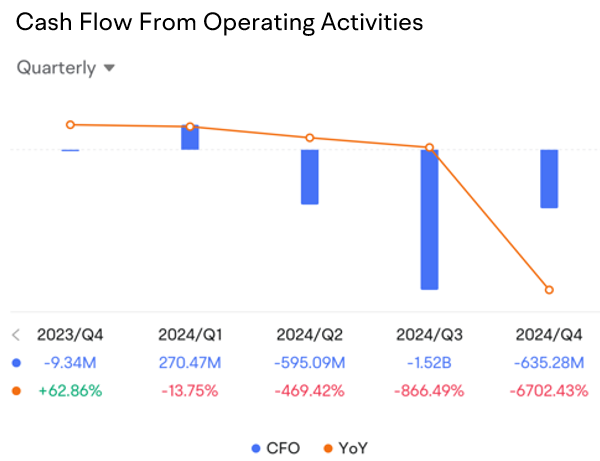

2) Investors also need to pay attention to the cash flow statement. The cash flow statement has long revealed the secrets. Last year, Supermicro experienced a substantial outflow of operating cash flow last year, reflecting significant remittance pressures. The cash outflow also led to a lack of dividend-paying capacity. SMCI continuously raises funds but does not reward investors, with financing cash flow only coming in and not going out.

■ Is there still a turnaround opportunity for the company?

Super Micro Computer will provide server racks for the supercomputer that Elon Musk's artificial intelligence startup xAI is building, Musk said on social media platform X on Jun 19. The company confirmed the partnership with xAI later, and implied a strong ramp in the second half of the year. This means that SMCI remains attractive to companies lacking assembly capabilities. Yet, Dell is also involved in supplying xAI.

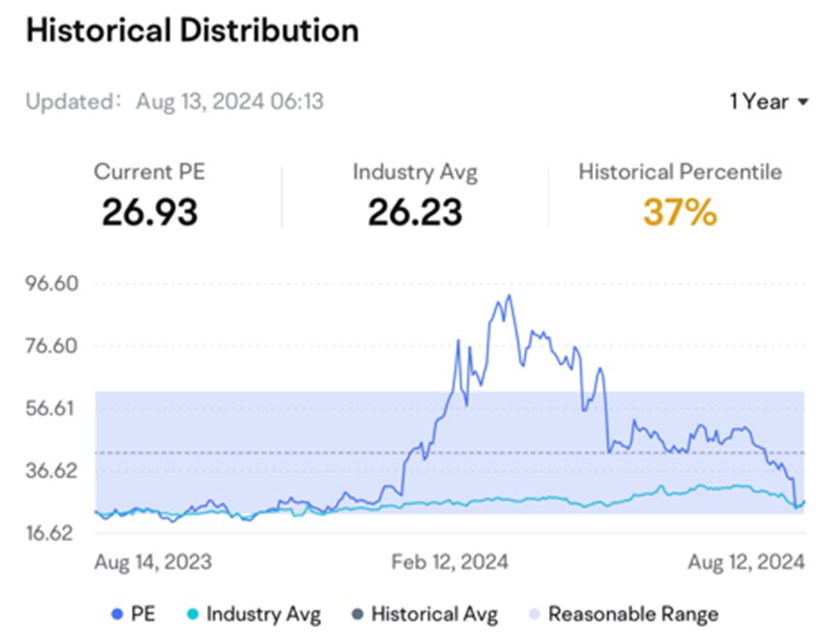

Although SMCI's gross profit margin has declined, due to the overall rapid development of the AIindustry, the company's profit still increased by 82.2%. After continuous stock declines and earnings increases, SMCI's PE valuation has fallen back to 26.9 times, which has dropped a lot compared with its peak level.

Still, following the earnings report, analysts at KeyBanc Capital Markets maintained a Sector Weight rating on the stock. They pointed out that its PE valuation is higher than the average of companies with gross margins in the low double digits and earnings growth in the mid-teens.

Similarly, analysts at Bank of America downgraded the stock from Buy to Neutral. They cited concerns over expected margin pressures in the near future. The analysts acknowledged that the long-term benefits from advancements in artificial intelligence technology are still intact. However, they downgraded their rating due to anticipated challenges over the next several quarters, including navigating a competitive pricing landscape, delays in shipping Blackwell GPU systems that require higher-margin liquid-cooling racks, and ongoing issues with the availability of components.

Consequently, Bank of America also reduced its price target for SMCI shares to $700 from the previous target of $1,090.

Source: SMCI, BofA

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

70908489 : SMCI is an organization that needs to be investigated by SEC

Aliencreation 70908489 : No. Lina Khan needs to be locked up or executed. Socialism and communism have always failed and bankrupt Europe. The USA is the most powerful and prosperous country in the world largely because of capitalism and free enterprise. Even the SEC is trying to remove Khan and her idiotic war on business. There's a reason Eli Lilly, Microsoft, Apple, Google, NVIDIA and nearly all the most powerful countries are AMERICAN.