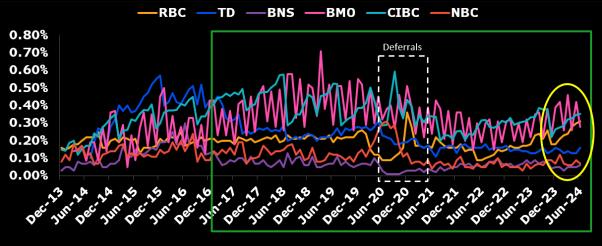

Rising debt levels and high interest rates are leading to an increase in credit card delinquency rates at Canada's major banks, and this trend may continue despite a temporary decrease noted in May. BMO reported the most significant rise, with delinquency rates reaching 75 bps, followed by RBC at 43 bps, and TD at 25 bps. Conversely, CIBC saw some relief due to the expansion of its credit pool. June experienced a 29 bps jump in late payments compared to the same month last year, with delinquencies of 90 days or more standing 14 bps higher year-over-year, indicative of significant consumer financial stress. These figures, which can vary depending on the loan types included in the trusts, are from the card-trust portfolios of Golden Credit Card Trust (RBC), Evergreen Credit Card Trust (TD), Trillium Credit Card Trust II (Scotiabank), Master Credit Card Trust (BMO), and CARDS II Trust (CIBC).