What Investors Need to Know Ahead of Nvidia Q3 Earnings?

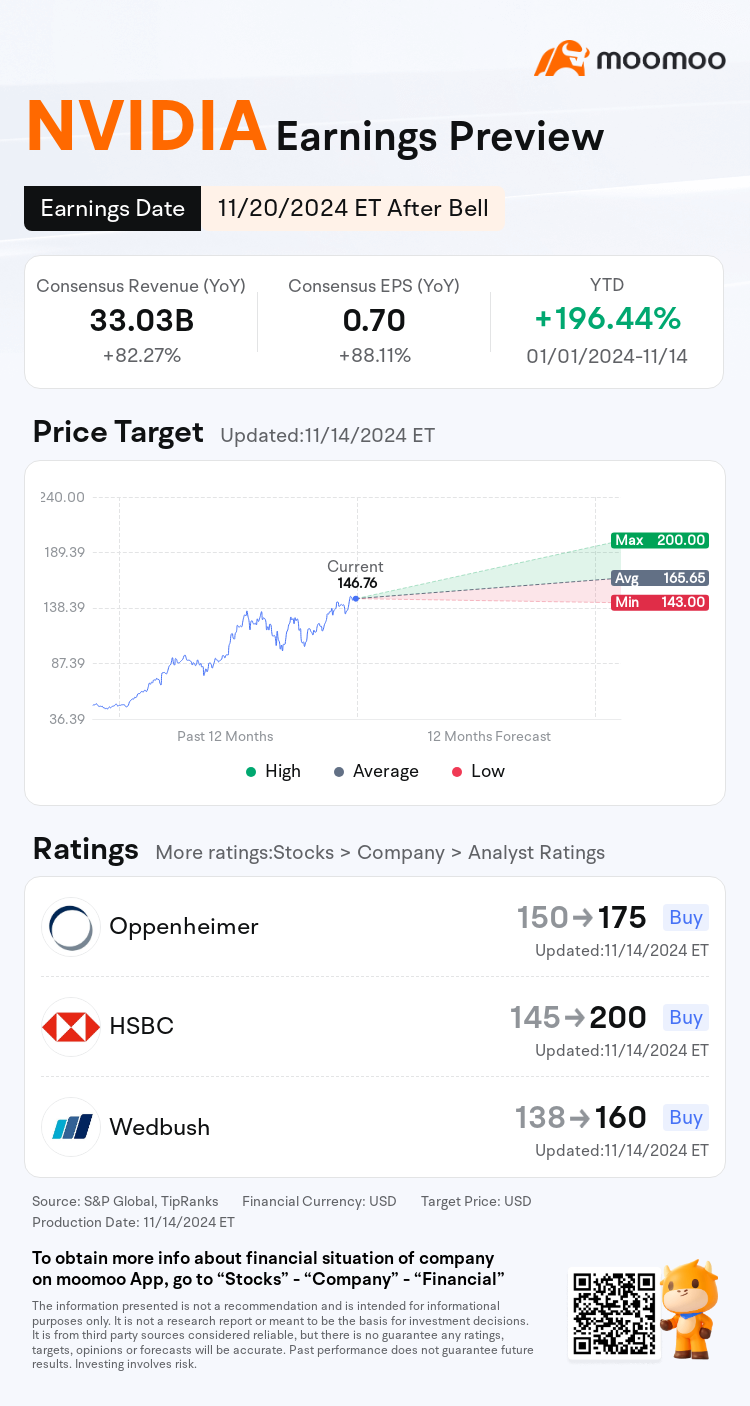

$NVIDIA (NVDA.US)$ is set to announce its Q3 2024 earnings on November 20 after market close. Investors will look at the company's full-year forecast alongside positive sentiments surrounding the next-generation Blackwell chips.

Consensus Estimates

● The analyst consensus has Nvidia reporting revenue of $33.03 billion, up 82% year-over-year. The world's most valuable company's stock has nearly tripled in 2024 driven by demand for the company's family of AI chips—including its next generation Blackwell graphics processing units.

● Earnings are expected to be $0.70 per share in the third quarter, up 88.11% from the year-ago quarter.

Nvidia's data center business is still the only segment that matters

Nvidia's performance has been dominated by its Data Center segment, which accounts for nearly 90% of total revenue (as of Q2 2025). This segment has been showing remarkable growth, which is expected to continue for the next few years.

According to Bloomberg consensus forecasts, Nvidia's Data Center Q3 revenue is expected to reach $29.098 billion, representing a year-over-year increase of 100.48%. "We see Nvidia remaining the leader in the AI training and inference chips for data center applications," analysts at Mizuho wrote, estimating that the company holds a dominant market share of nearly 95% in the space. Based on Nvidia's strong forecast for fiscal 2025, Morningstar analysts predict that Data Center revenue will rise by 133% to $111 billion in fiscal 2025. They also forecast a 23% compound annual growth rate for the three years thereafter, as strong growth in capital expenditures in data centers at leading enterprise and cloud computing customers.

Nvidia's other segments have shown modest but stable growth

The Gaming segment reported 16% year-over-year (YoY) growth in Q2 2025, while the Professional Visualization segment grew by 20%. Both segments are expected to maintain similar growth rates in Q3, though they remain overshadowed by the dominant Data Center segment's performance. According to Bloomberg consensus forecasts, the Gaming segment is expected to achieve revenue of $3.07 billion in Q3, up 7.5% from the year-ago quarter.

How's the $50 billion buyback progressing?

Nvidia announced in August that its board of directors approved $50 billion of buybacks. On the surface, Nvidia increasing its share buyback program could be viewed as a bullish sign for investors. Generally speaking, companies buy back stock when management believes shares are undervalued. Based on the past two years, Nvidia stock trades below its average price-to-earnings (P/E) and price-to-free cash flow (P/FCF) multiples.

Since the company's new Blackwell GPU is shaping up to be a massively successful product launch, there's reason to believe Nvidia stock is poised to break out. Such a move would come with valuation expansion and, therefore, a more pricey stock.

For these reasons, investors are closely watching to see if the company repurchased any stock during the fiscal third quarter at more reasonable valuations, prior to any Blackwell-driven tailwinds.

Analysts are bullish on Nvidia stock ahead of earnings next week

Analysts are growing increasingly confident in the artificial intelligence chip behemoth's prospects. At least five research firms raised their price targets on Nvidia ahead of earnings.

Susquehanna Financial Group analyst Christopher Rolland reiterated his positive rating on Nvidia stock and raised his price target to 180 from 160.

Rolland said his industry checks indicated sustained demand for Nvidia's current-generation Hopper series products, H100 and H200, ahead of the Blackwell series launch.

Robust capital equipment spending plans by hyperscale cloud service providers such as $亚马逊(AMZN.US)$and $Meta Platforms(META.US)$ are driving AI data center processor demand, Rolland said.

"We expect another strong quarter driven by healthy Hopper demand and early Blackwell ramps," Raymond James analyst Srini Pajjuri said in a client note. "Supply remains a wild card, which could limit near-term upside."

Pajjuri kept his strong buy rating on Nvidia stock and increased his price target to 170 from 140.Additionally, Morgan Stanley's Joseph Moore raised his target from $150 to $160, citing the impact of the upcoming Blackwell chips, which CEO Jensen Huang noted are experiencing intense demand.

However, Moore warned that the company might be impacted by supply chain constraints,“we are back to fully supply constrained on new products, which could limit upside on current quarter and outlook,” said Moore.

Navigate the Market: Leverage NVIDIA with These ETFOptions!

If you are bullish on Nvidia, here are the ETFs for you:

NVDL (GraniteShares 2x Long NVDA Daily ETF): NVDL was issued by Graniteshares, with a management fee of 0.99%. The Fund seeks daily investment results, before fees and expenses, of 2 times (200%) the daily percentage change of NVDA. The fund will enter into one or more swap agreements with major financial institutions for a specified period ranging from a day to more than one year whereby the fund and the financial institution will agree to exchange the return (or differentials in rates of return) earned or realized on the Underlying Stock. It is non-diversified.

NVDX (T-REX 2X Long NVIDIA Daily Target ETF): NVDX was issued by Tuttle Capital Management, with a management fee of 1.05%. The investment seeks daily investment results, before fees and expenses, of 200% of the daily performance of NVDA. The fund, under normal circumstances, invests in swap agreements that provide 200% daily exposure to NVDA equal to at least 80% of its net assets. The fund will enter into one or more swap agreements with major global financial institutions whereby the fund and the global financial institution will agree to exchange the return earned on an investment by the fund in NVDA that is equal, on a daily basis, to 200% of the value of the fund's net assets. The fund is non-diversified.

NVDU (Direxion Daily NVDABull2X Shares):NVDU was issued by Direxion Funds, with a management fee of 0.75%. The investment seeks daily investment results, before fees and expenses, of 200% of the daily performance of NVDA. The fund, under normal circumstances, invests at least 80% of its net assets (plus any borrowings for investment purposes) in the securities of NVDA and financial instruments, such as swap agreements and options, that, in combination, provide 2X daily "leveraged exposure to NVDA," consistent with the fund's investment objective. The fund is non-diversified.

If you are bearish on Nvidia, here are the ETFs for you:

If you are bearish on Nvidia, here are the ETFs for you:

NVDQ (T-REX 2X Inverse NVIDIA Daily Target ETF): NVDQ was issued by Tuttle Capital Management, with a management fee of 1.05%. The investment seeks daily investment results, before fees and expenses, of 200% of the inverse (or opposite) of the daily performance of NVDA. The fund, under normal circumstances, invests in swap agreements that provide 200% inverse (opposite) daily exposure to NVDA equal to at least 80% of the fund's net assets. The fund will enter into one or more swap agreements with major global financial institutions whereby the fund and the global financial institution will agree to exchange the return earned on an investment by the fund in NVDA that is equal, on a daily basis, to -200% of the value of the fund's net assets. The fund is non-diversified.

NVD (GraniteShares 2x Short NVDA DailyETF): NVD was issued by Graniteshares, with a management fee of 1.30%. The investment seeks daily investment results, before fees and expenses, of -2 times (-200%) the daily percentage change of NVDA. The fund is an actively managed exchange traded fund that attempts to replicate 2x the inverse (-200%) daily percentage change of the underlying stock by entering into a swap agreement on the underlying stock. The fund advisor aims to generate the inverse daily performance of the underlying stock for a single day. It is non-diversified.

Beyond NVIDIA earnings report: Upcoming U.S. stock market highlights in the rest of 2024?

Black Friday: Opportunity for U.S. consumer stocks?

The Thanksgiving to Christmas period is a traditional shopping peak, with the Friday following Thanksgiving, known as "Black Friday," often triggering a significant retail uptick. This annual event is crucial for retail companies, as it may boost their business performance and stock prices due to the substantial consumer spending it generates. However, investor confidence could be at risk if retail sales on Black Friday do not meet market expectations and this may lead to a drop in stock prices.As the holiday season draws near, U.S. consumer stocks could be in the spotlight. According to the National Retail Federation, holiday spending reached a record of over $964 billion in 2023, which was up 3.8% from 2022. This growth trend is expected to continue, with Morgan Stanley forecasting that holiday spending will rise from last year's record high. Additionally, retail sales data for October revealed a stronger-than-anticipated 0.4% month-over-month increase, with September's figure revised to a substantial 0.8%. This trend could signal a robust foundation for the upcoming holiday shopping season.

Santa Claus Rally

Wall Street typically refers to the market performance during the last five trading days of the year and the first two trading days of January as the "Santa Claus rally." During this period, the stock market often exhibits unusually strong performance. Since 1990, the S&P 500 has achieved a win rate of 71% in November, with an average monthly gain of 1.95%. In December, the win rate is even higher at 76%, with an average monthly gain of 1.23%.

According to statistics from the Almanac Trader, the U.S. stock market experienced a "Santa Claus rally" in each of the past seven years. From 2016 to 2022, the S&P 500 index rose by 0.4%, 1.1%, 1.3%, 0.3%, 1.0%, 1.4%, and 0.8% during the Santa Claus rally period. However, the S&P 500 index declined 0.88% in the past year. Therefore, despite historical data showing the Santa Claus Rally has occurred often in the past, its recurrence is unpredictable for investors, as it is influenced by a multitude of factors that can vary from year to year.

Source: IBD, Investopedia, Market Chameleon, Business Insider

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment