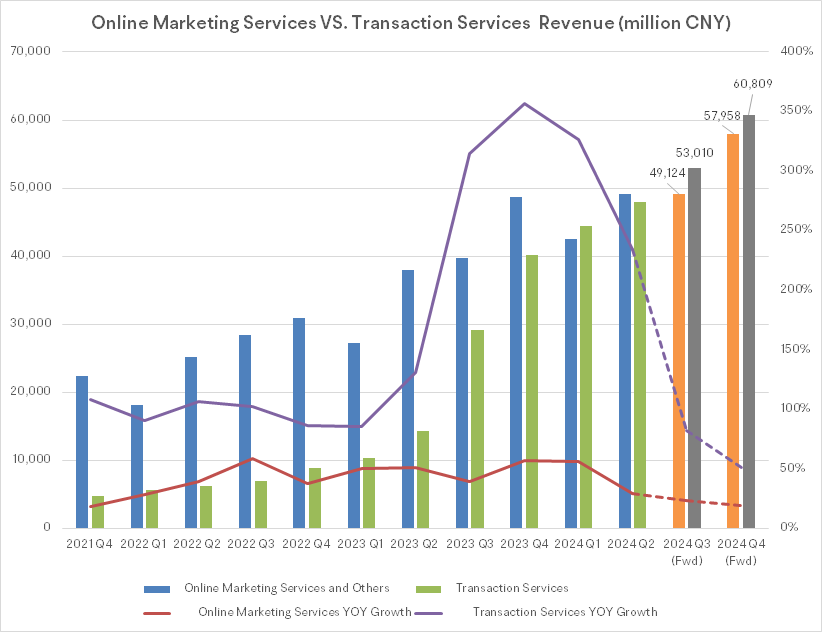

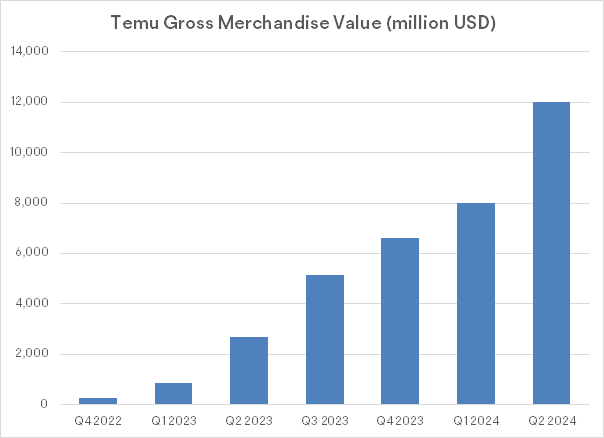

Market experts believe that PDD Holdings’ strength in its e-commerce business model appears to be a major positive, which should drive its long-term growth. Also, the analysts are optimistic about the company’s PDD platform due to its wide range of product offerings, such as agricultural produce, apparel, shoes, food and beverage, electronic appliances, and furniture, among others.