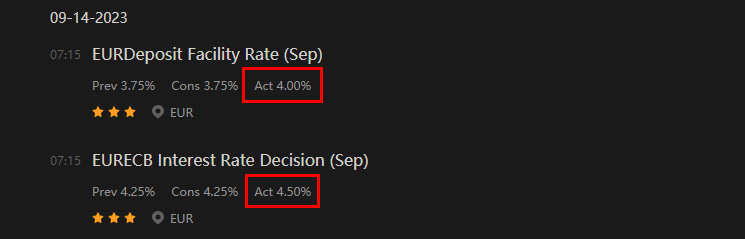

Either investors believe this is the last interest rate hike, so they are selling the Euro in anticipation of less demand in the future. Or, investors believe this very restrictive monitary policy will push the Euro zone into a recession. Personally, these are the only two justifications I can see for the Euro selloff.

terryjeanvivier : ding ding again let's see if I can refresh your memory.. I told y'all not to touch my accounts I told you it was insured. but noooo you didn't listen .. I hope that everything y'all thought I didn't know you took is our back by Monday . just saying