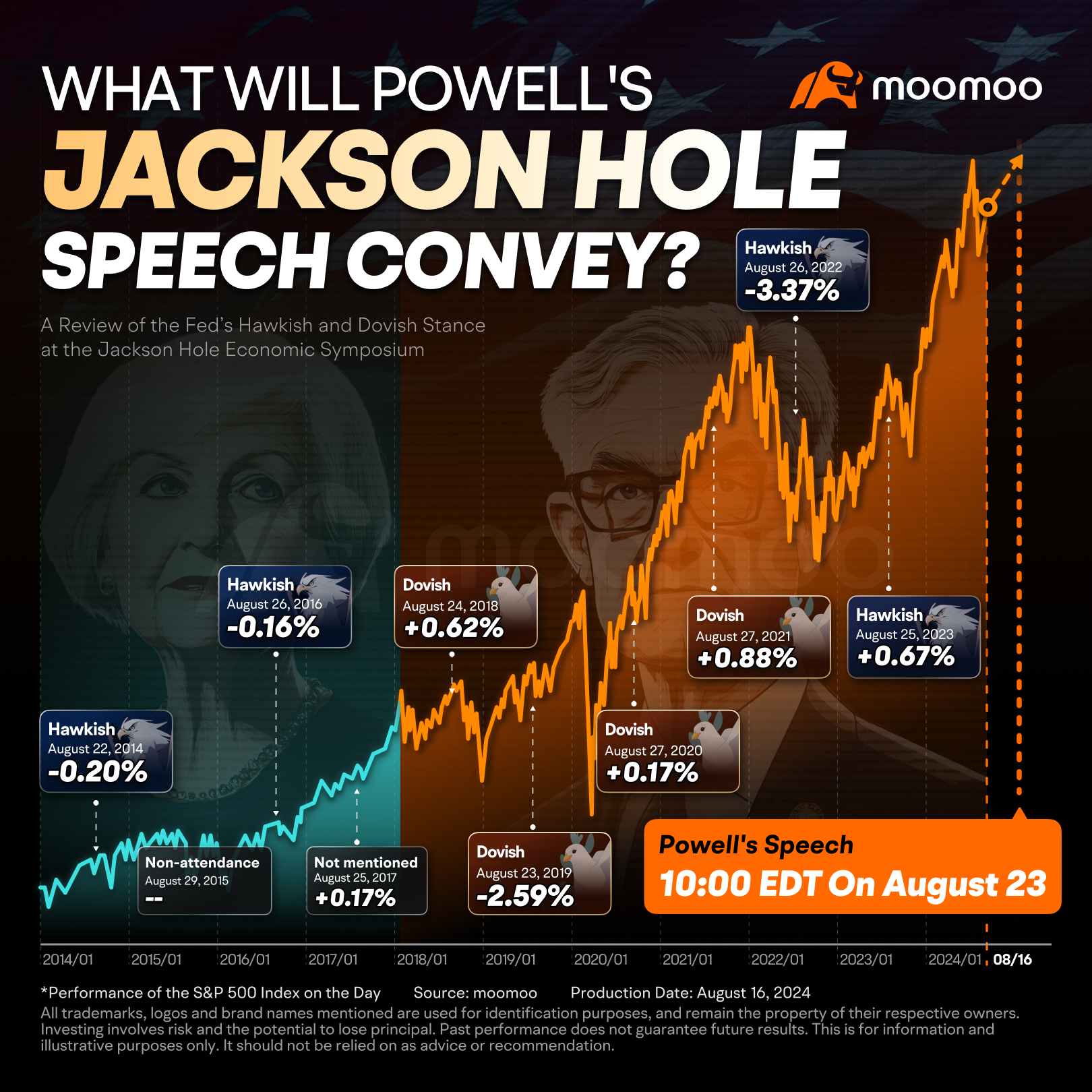

For instance, in 2022, Powell's speech sent U.S. stocks tumbling, with a "painful" narrative causing the major U.S. stock indices to plunge by 3%-4% within just nine minutes on that day. In 2023, the market saw significant waves as well, though the turbulence occurred the day before Powell's speech on Thursday, with the Dow Jones recording its biggest point drop in five months and the Nasdaq falling nearly 2%.

102429238 : can only wait

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Malik ritduan : ok

104327919 : good

XPDHugo :

igmm :

HYGWE : 25 25 25....

MelloJoe : Awesome

101775147 AL alfijai : The Malaysian Open

102643351 : Good