After his comeback, what points should we pay attention to regarding former President Trump's reign as USA president? Will the rise in US stocks continue until next year?

2024年米大統領選は、共和党候補のドナルド・トランプ前大統領の当選が確実、4年ぶりにホワイトハウスに返り咲くことになった。トランプ氏が勝利したことを受け、「トランプ・トレード」が急増している。米大統領選巡る不透明感が払拭され、米主要3指数はそろって大幅に上昇し、最高値を更新した。

6日の $S&P 500 Index (.SPX.US)$は5973.10ポイント。データによると、これは投票日(選挙の当日)としては過去最高のパフォーマンスになった。7日の米株市場では、S&P500種株価指数が3日続伸。終値で今年49回目の最高値更新。

2000年以降6回の米大統領選挙の後、11月末までの期間において、S&P500種株価指数は3回上昇し、3回下落したと、ドイツ銀行のマクロストラテジスト、ヘンリー・アレン氏が指摘した。

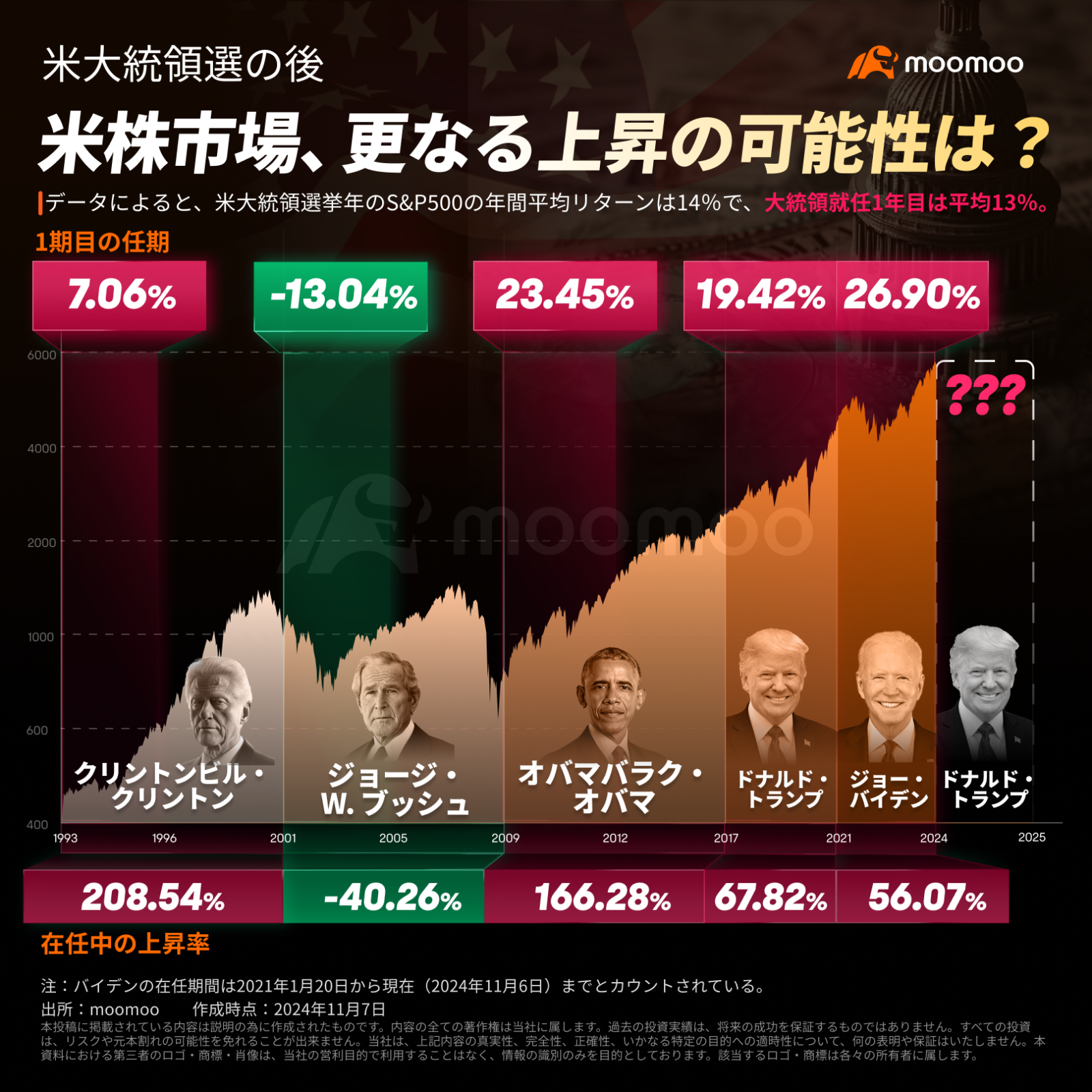

過去のデータを見ると、米国株はジョージ・W・ブッシュの任期中にマイナスのリターンを記録した以外、すべての大統領任期中に力強い上昇を達成している。また、年別にみると、In the first year of the presidency, there is a tendency to progress favorably, with most showing a double-digit upward trend.。

However, investors need to be aware that election results are not the only factor affecting post-election market fluctuations.

Regarding the possible market movements after Mr. Trump's victory in this election,Mr. Trump wins! How will the market move after the presidential election? A complete summary of interest rates, exchange rates, and related stocks in the 'Trump trade'.can be confirmed.

米大統領選が一段落し、ゴールドマン・サックスは、米株は引き続き上昇し、少なくとも年末までは上昇が続くと予想している。同行のアナリストは、その理由を3つ挙げている。

①歴史的な傾向として、米国株は選挙の年はいつも大幅高。

②投資家が株式市場に資金を再投入。

③トランプがホワイトハウスに返り咲くことで、M&A(企業の合併・買収)の活発化やIPOがさらに株価を下支えする可能性が高い。

モルガン・スタンレーの米国株チーフストラテジスト、マイク・ウィルソン氏は、米大統領選が終わり、年末のFOMO(見逃すことへの恐怖)心理が働くため、S&P500種株価指数は2024年最終盤に上昇を続ける可能性があると予想している。しかし、明らかな好材料が見当たらないことやバリュエーションが伸び切っていることなど、2025年が到来するにつれ、株価上昇への熱狂は薄れる可能性があるThere are also warnings.

In addition, there are comments that President Trump's tax reduction policy will support the medium to long-term corporate earnings in the United States and contribute to the overall profits of U.S. stocks, mainly.There is a possibility that small-cap stocks and cyclical stocks may show better performance.There is a high possibility that traditional energy sectors such as financial stocks and fossil fuel-related industries will outperform as well.

What are the key points to watch for after that?

The Federal Reserve Board (FRB) at the Federal Open Market Committee (FOMC) meeting open until the 7th.As expected by the market, a 0.25 point interest rate cut was decided.This move aims to avoid the softening of the labor market due to the substantial rate hikes implemented over the past two and a half years amidst easing inflation.

However, looking ahead to future interest rate cuts,Due to strong belief that President Trump's policies will cause inflation, the market expects interest rate cuts in November and December to be less than 50 basis pointsare predicting.

Some major banks have lowered their expectations for future rate cuts by the Federal Reserve Board (FRB) in response to Donald Trump's election as US President.

Economists such as David Sief of Nomura Securities continue to anticipate that the Federal Reserve Board (FRB) will cut interest rates twice more by 25 basis points each before the end of this year. However, their expectations for rate cuts by the FRB next year are quite pessimistic. The latest forecasts suggest that there will be only one rate cut next year, significantly lower than the previous expectation of four cuts.

In addition, there is a view that the next 1-2 months will be an important period to observe President Trump's new policies.

Under normal procedures, after the election results are confirmed, President Trump will give a victory speech, enter the transition period from November, and the process of adjusting the cabinet members will intensify. This is the scheduled plan.

The presidential inauguration will take place on January 20 next year,followed by President Trump's inaugural address and a series of presidential orders from late January to early February,there is the possibility of determining the direction of the Trump administration, a crucial period to observe.

Source: moomoo, DowJones, Bloomberg, Reuters

- moomoo News Zoe

- moomoo News Zoe

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

びふう : I've never seen the Dow rise by $1,400 in one day on election day...seems like it's still going up