The stock price appears to be finding support at its current level. Since early October, Tesla has dropped nearly 20%, and as of October 23, the price has retreated 61.8% from its August high, according to the technical chart illustrated by the Fibonacci retracement tool. This might indicate a significant correction and a potential oversold condition, with the RSI approaching the critical threshold of 30.

Seanpee : Very insightful.. thanks

Manshor : very useful thanks

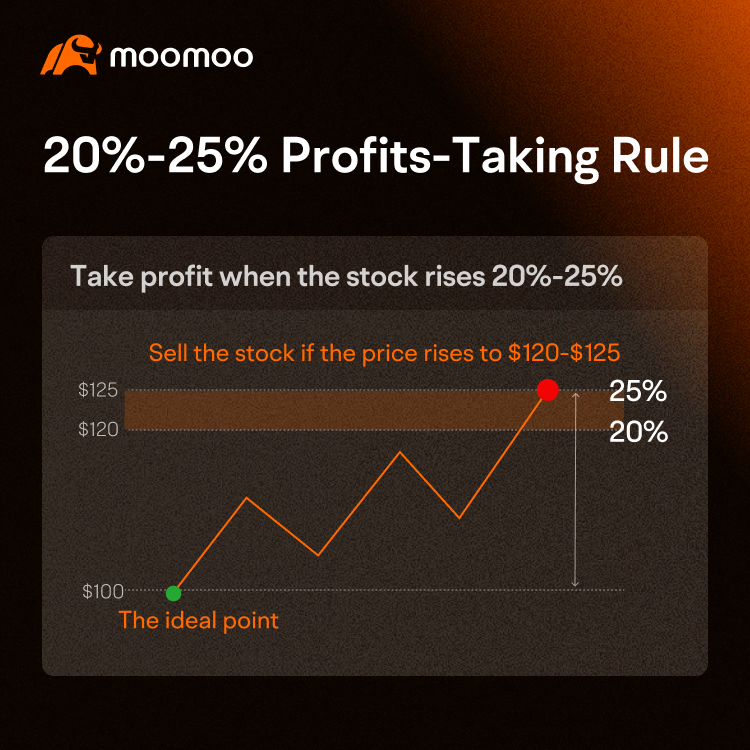

Chak : This article is loaded. Makes sense in paper, but in reality the only thing which stands out in this article take profits if you’re up

103536321 : Excellent

Jenny 104841536 : Great information. Thanks

Mark Hinton : Thanks for the lesson

74469759 : Lots of info for this new trader. I’m picking up the crumbs until I get to the table.

102615938 : would say that it is helpful

safri_moomoor : ok

webguybob : I'll certainly ponder this strategy!

View more comments...