What should investors do after the stock price rises following an earnings report?

Updated on October 24, 2024

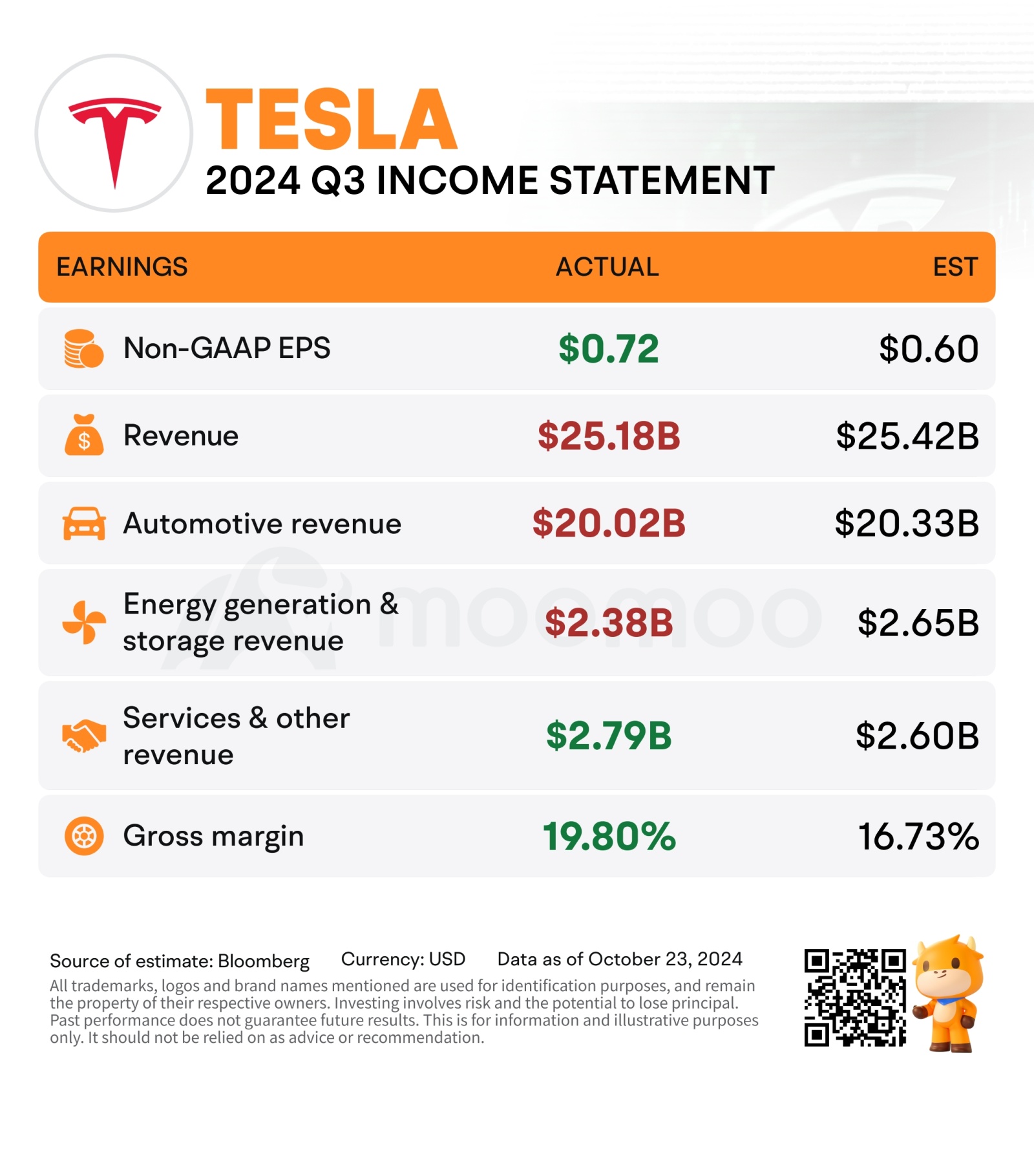

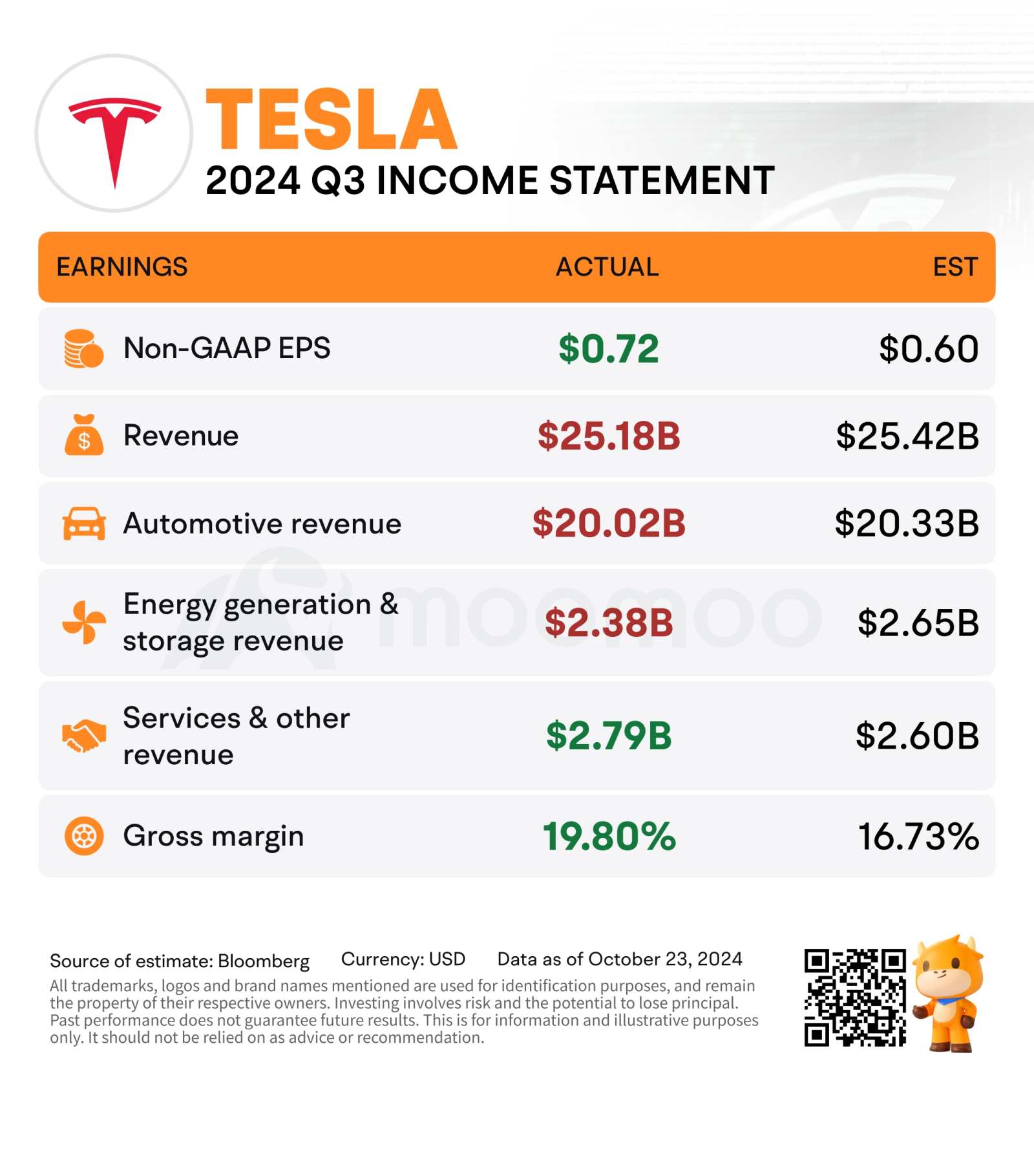

$Tesla (TSLA.US)$ released its earnings report after the market closed on Wednesday, October 23, showing a significant beat on profits. The company's EPS turned positive in Q3, with a year-over-year increase of over 9%. The overall profit margin rose to 19.8% year-over-year. The automotive segment's gross margin climbed to 17.1% excluding carbon credit sales.

Following the report, Tesla's stock surged in after-hours trading, with an increase of as much as 12%.

The stock price appears to be finding support at its current level. Since early October, Tesla has dropped nearly 20%, and as of October 23, the price has retreated 61.8% from its August high, according to the technical chart illustrated by the Fibonacci retracement tool. This might indicate a significant correction and a potential oversold condition, with the RSI approaching the critical threshold of 30.

In after-hours trading, the stock rose above $240, surpassing the 20-day moving average, which could signal a potential bullish reversal in market sentiment.

Proactive traders may see early signs of a price rebound in the near term, while more conservative traders might prefer to wait for clearer signals.

Regardless of your trading strategy, it’s important to thoroughly analyze the reasons behind stock price movements and consider how to manage your position, especially following earnings beats.

After the release of the earnings report, there are generally three reasons that can cause a company's stock to rise:

– Better-than-expected performance: The company's performance exceeds market expectations, demonstrating strong profitability and growth potential.

– Market sentiment: Positive earnings results boost market confidence in the company's future development, driving the stock price higher.

– Industry trends: The overall positive outlook of the industry leads to increased optimism about the prospects of companies within the sector.

If a company's earnings report exceeds expectations and the stock price surges, what would you do?

1. If the company reported an earnings beat, you might follow the price up.

2. If the good earnings result has already been priced in the stock price, you might go bearish on the stock.

3. Worried about buying at the stock high, you might wait for a potential pullback in the price before making any decisions.

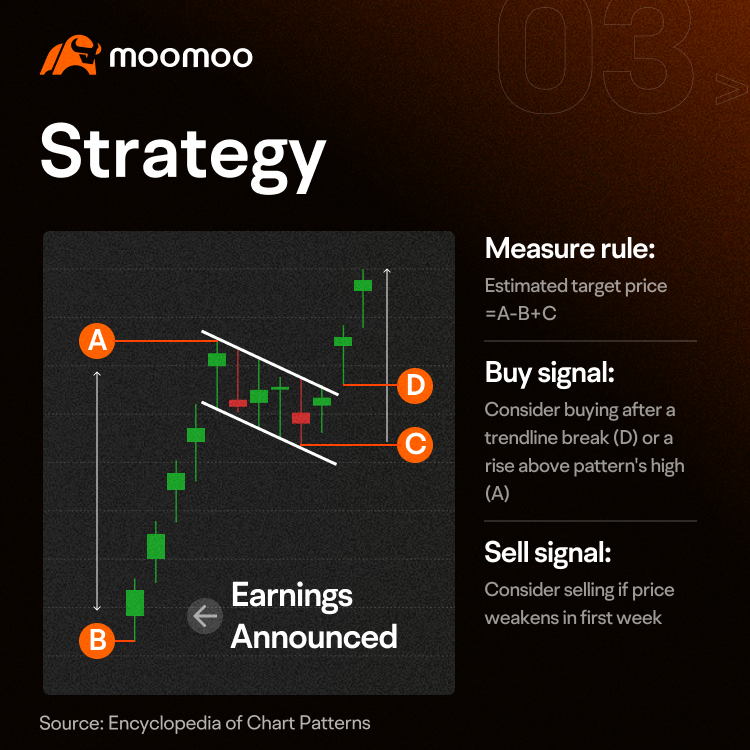

No matter what you choose, it is based on your judgment of future price trends. An event pattern known as the earnings flag can help investors better assess post-earnings moves.

An earnings flag appears after a company releases its earnings report, where the stock price experiences a significant rise, consolidates, and then continues to rise further. Thomas Bulkowski considers the earnings flag to be one of the most reliable chart patterns.

As investors, how should we use this pattern to identify potential buying and selling opportunities?

Buy signal: The pattern is confirmed when the price breaks out above the highest high or pierces through a trend line. There are two potential buy signals associated with this pattern. The first potential buy signal occurs when the price closes above the trend line of the flag (D). The second potential buy signal occurs when the price closes above the highest height of the pattern (A).

Sell signal: Trading this pattern can be difficult because the price can rise quickly and then drop significantly. If the price shows weakness in the first week, you may consider exiting your position. It can be important to consider taking potential profits relatively quickly when trading this pattern. If the price continues to rise after a brief pullback, you may consider buying again and riding the uptrend.

Note: The earnings flag is just one of the methods to help investors find suitable entry and exit points. When making a buy decision, it is important to also consider the company's fundamentals and use other technical indicators for a comprehensive assessment.

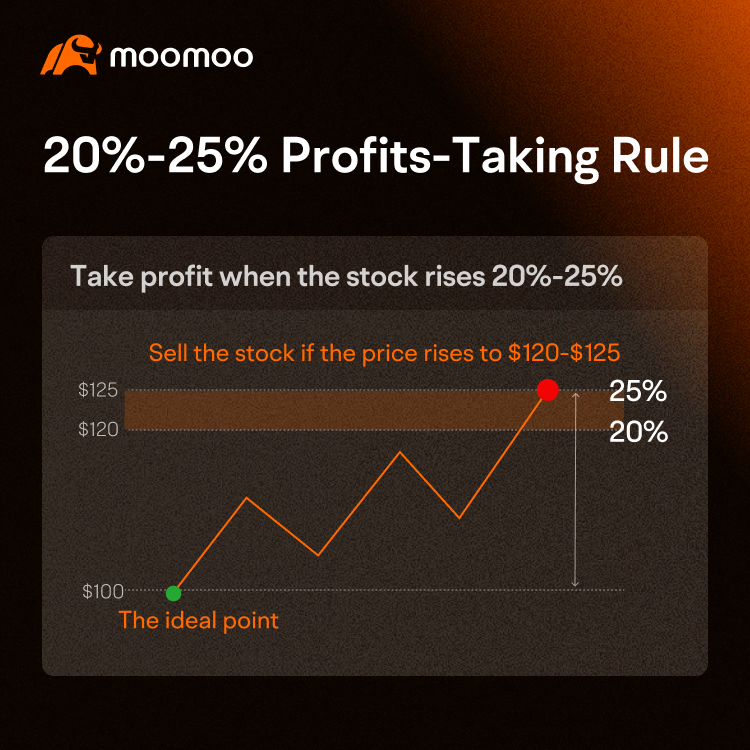

After a stock price increases, it is important to learn how to take profits. Profit-taking means selling when the price reaches a predetermined level in order to lock in gains and secure profits, thereby avoiding the risk of losing those gains if the stock price subsequently declines. So how should one set the profit-taking point?

According to William O'Neil, you may consider selling the stock when its price has gone up by 20%-25% from the ideal buy point.

Some investors might feel that earning 20%-25% is not much, but the advantage of this approach is that it allows investors to reinvest their cash into new opportunities, thereby growing their capital over time.

Many investors may wonder what to do if the stock continues to rise after they have taken profits. In such cases, investors can use position sizing strategies to manage the potential upside risk.

– If you expect a bullish market, you can sell half or one-third of your position when you reach your profit target, which locks in some profits while retaining the potential to gain further profits.

– If you expect a bearish market, consider selling the entire position when you reach your profit target to ensure that you lock in the profits you've made.

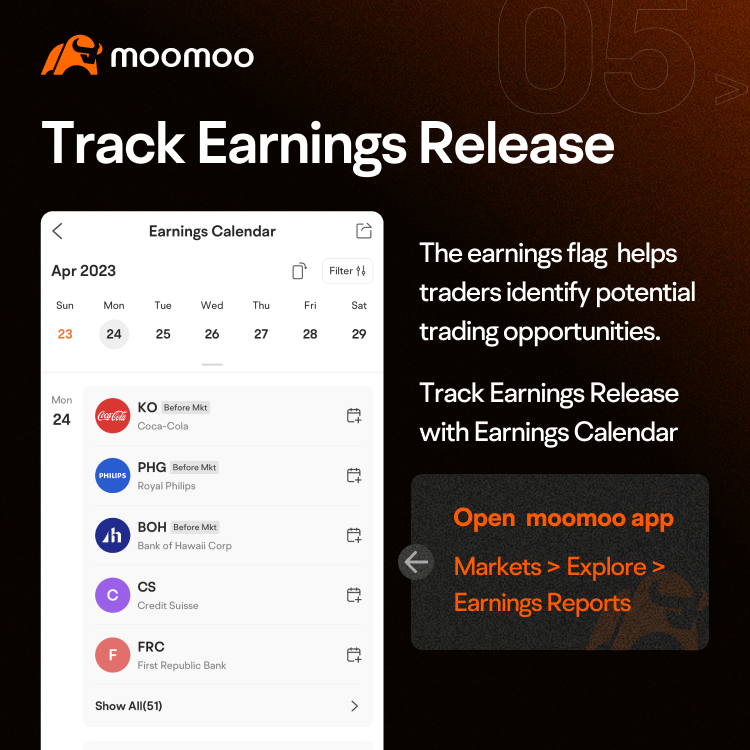

Making buy or sell decisions based on earnings report data requires knowing when a company will release its financial reports. The timing of earnings reports varies for each company, so we can use an earnings calendar to find out which companies are releasing reports each week.

moomoo:Markets> US> Earnings

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Seanpee : Very insightful.. thanks

Manshor : very useful thanks

Chak : This article is loaded. Makes sense in paper, but in reality the only thing which stands out in this article take profits if you’re up

103536321 : Excellent

Jenny 104841536 : Great information. Thanks

Mark Hinton : Thanks for the lesson

74469759 : Lots of info for this new trader. I’m picking up the crumbs until I get to the table.

102615938 : would say that it is helpful

safri_moomoor : ok

webguybob : I'll certainly ponder this strategy!

View more comments...