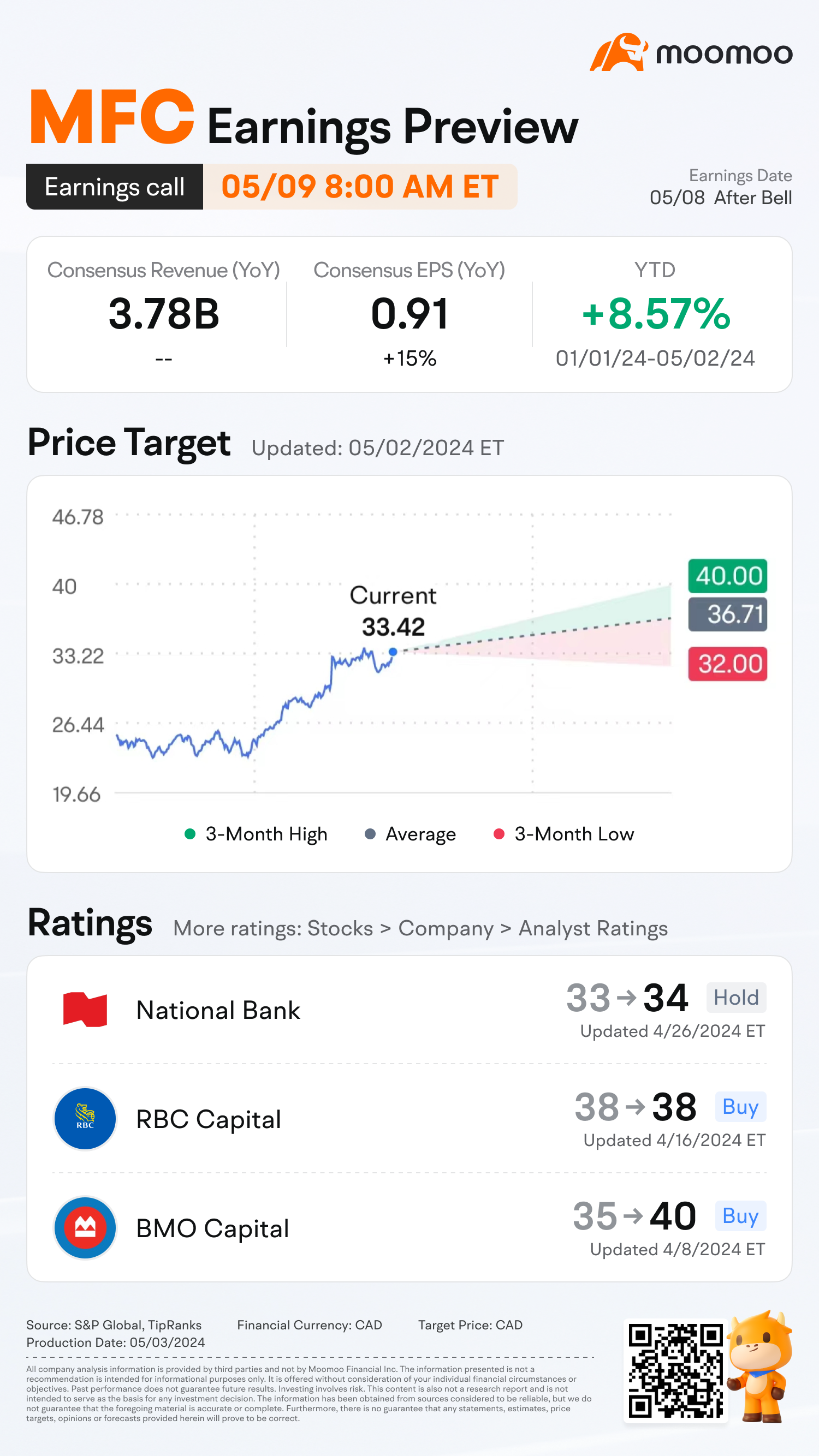

With good momentum in the asset management, as well as Canada and Hong Kong operations, along with a tailwind from higher interest rates, Manulife may post 15% year-over-year growth in 1Q 2024 core EPS, based on consensus. In 2023, net asset-management flows were resilient ($5 billion), while many peers saw outflows. This, combined with rising equity markets lifting account values, should drive strong 1Q 2024 asset-management profit growth.

让子弹飞一会儿 : Thank you for collating the information