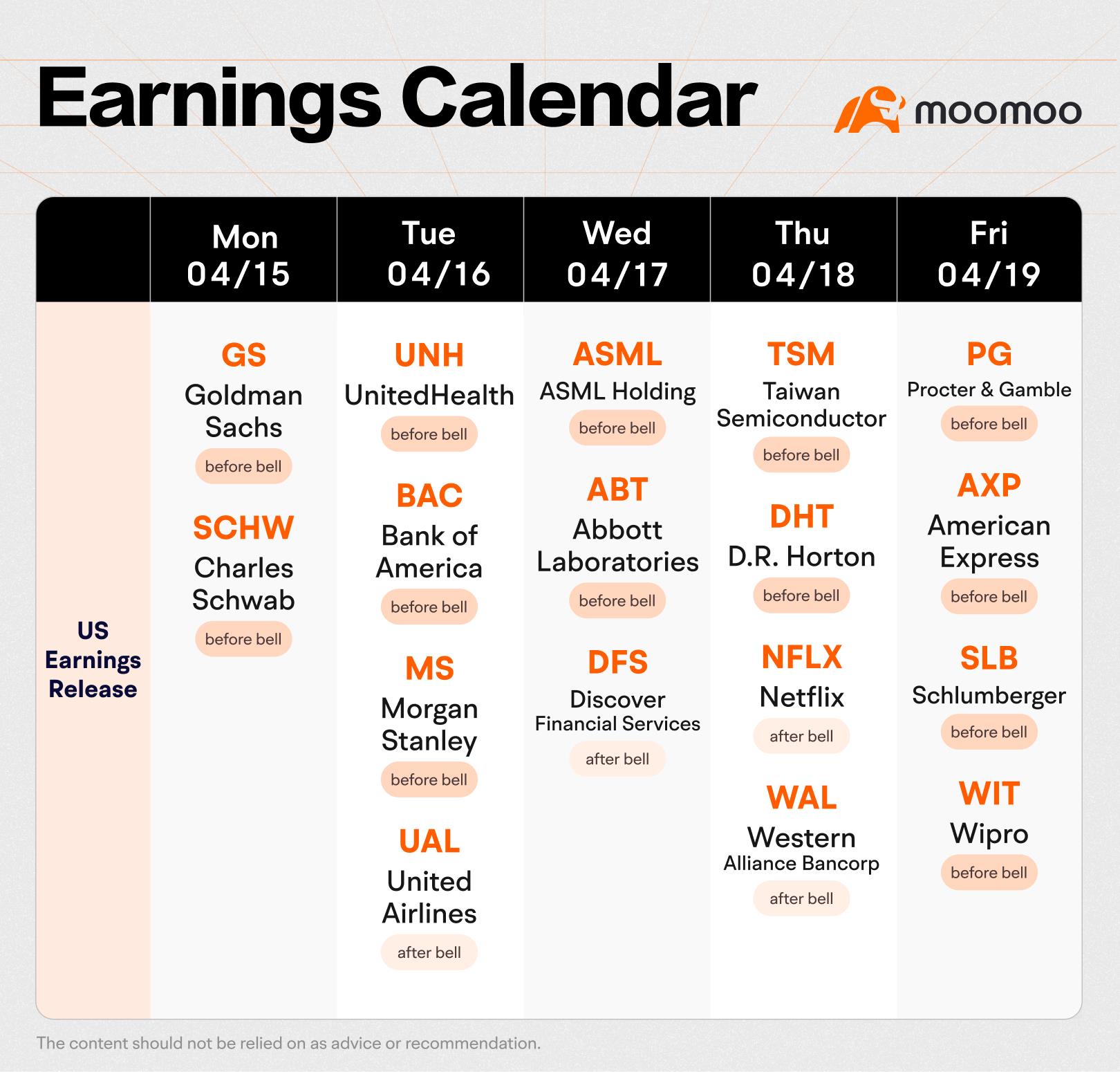

The corporate earnings season kicks into high gear in the week ahead. Investors are expecting this first-quarter earnings season will show which businesses are able to continue withstanding higher pricing pressures, as well as the upcoming refinancing cycle. Results from major banks Bank of America, Goldman Sachs, and Morgan Stanley will likely take on greater significance for investors given JPMorgan's disappointing net interest income guidance this week. Overall, analysts expect S & P 500 companies to have grown earnings by more than 3% from the year-earlier period, FactSet data shows. If that's the case, it will mark the third straight quarter of earnings growth for the benchmark.

inoyb : All this don't matter as much as the uncertainty of war. This time US and UN are sticking a foot in. All be red unless Iran says sorry mb which is impossible

inoyb : Just adding on. Iran really say, attack is over. back to business for now

BelleWeather : They did actually say it’s over.

73452559 : interesting

Paul A Meza : S&P 500 is Always ready

70631334 : I want to know how I can get into this and make money I don't want to be left out in the cold I need to support my family and the job that I have right now is not making enough for me it's ruining my life if any of you can help me get on to this so I can do this for myself or whatever please help me I downloaded your app because I wanted to invest and make money

Golden Investor 70631334 :

it takes time and diligence. Heads up too bitcoin halving hits 4/20 …

it takes time and diligence. Heads up too bitcoin halving hits 4/20 …

71864169 inoyb : Relax. No war

71864169 70631334 : First thing first, your family is part of a team. They also need to work and produce. If you are concerned and they are not, my friend, you're in the wrong family

Solorific : Be patient and don’t overthink

View more comments...