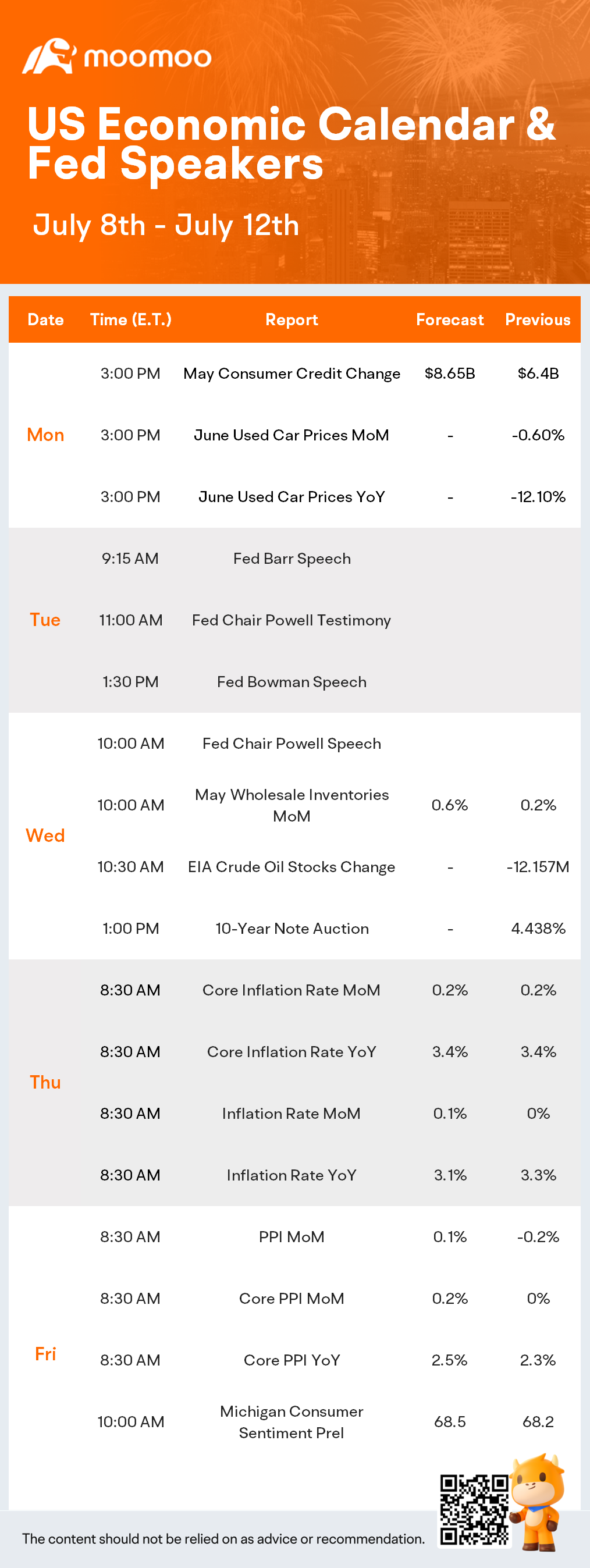

The June headline CPI, due on July 11, is expected to rise by 0.1%, primarily due to a significant seasonally adjusted decline in gasoline prices. Monthly core CPI is projected to grow by 0.2%, driven by disinflation in used cars and recreation. Year-over-year, the headline CPI should decrease to 3.0% from May's 3.3%, with core CPI remaining at 3.4%. This core CPI forecast corresponds to a 0.1%-0.2% increase in the June core PCE deflator, the Fed’s preferred inflation gauge, due later this month. This would mark the second consecutive month with a core PCE reading aligning with the Fed’s 2% target. If two more similar inflation reports follow before the September FOMC meeting, the market anticipates officials will be prepared to cut rates then.

YZRolling : The busy gambling weeks start from now!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

William L Davis Jr : Let the rally begin

105171860 : hi

1000proof : Getting closer to August / load the season

season

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Triston Chua :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103819410 : Good

103819410 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104476495 : hi

Laine Ford : I don't know what iam looking at

View more comments...