What to Expect in the Week Ahead (Non Farm Payrolls and Fed Powell Speech; Earnings From Carnival and Nike)

The S&P 500 fell slightly on Friday but still had its third week of gains in a row, bringing its September increase to 1.6%. With one trading day left, it's on track for its first September gain since 2019, according to FactSet data.

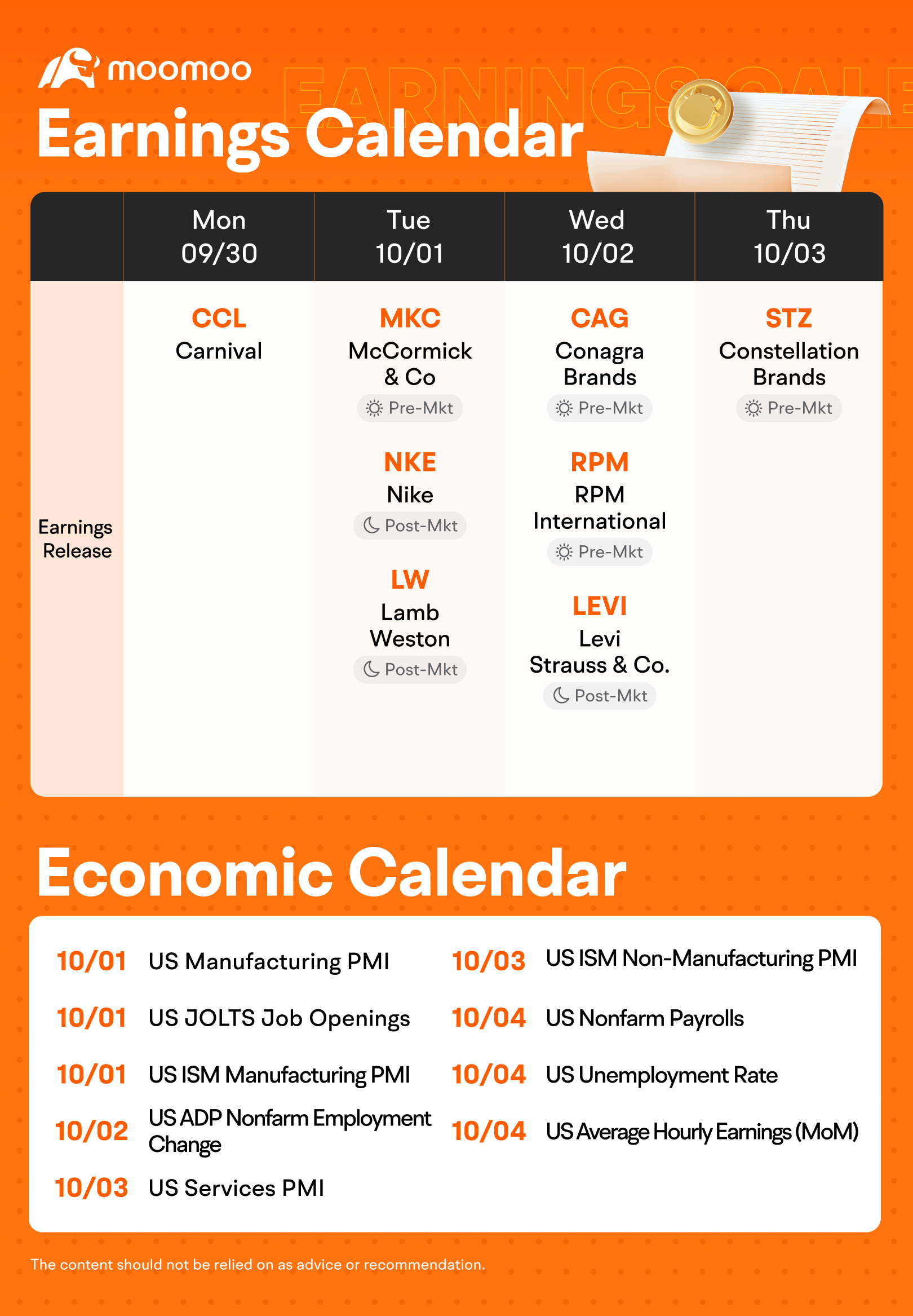

Below is an earnings calendar of the most important upcoming reports scheduled to be released next week.

$Carnival (CCL.US)$ is scheduled to release third-quarter fiscal 2024 results on September 30, 2024. Back in June, the company projected a profit of $1.15 per share for the quarter, which makes up most of the $1.18 per share it's aiming for in fiscal 2024. However, analysts expect slightly higher numbers, predicting a quarterly profit of $1.16 per share and $1.21 per share for the full year.

$Nike (NKE.US)$ will announce its earnings for the first quarter of fiscal 2025 on Tuesday after the market closes. This comes just weeks after the company announced a CEO change, with Elliott Hill set to take over from John Donahoe next month. Analysts expect both sales and profits to be lower than last year, with total revenue expected to drop around 10%, from $12.94 billion in the first quarter last year to $11.65 billion this year.

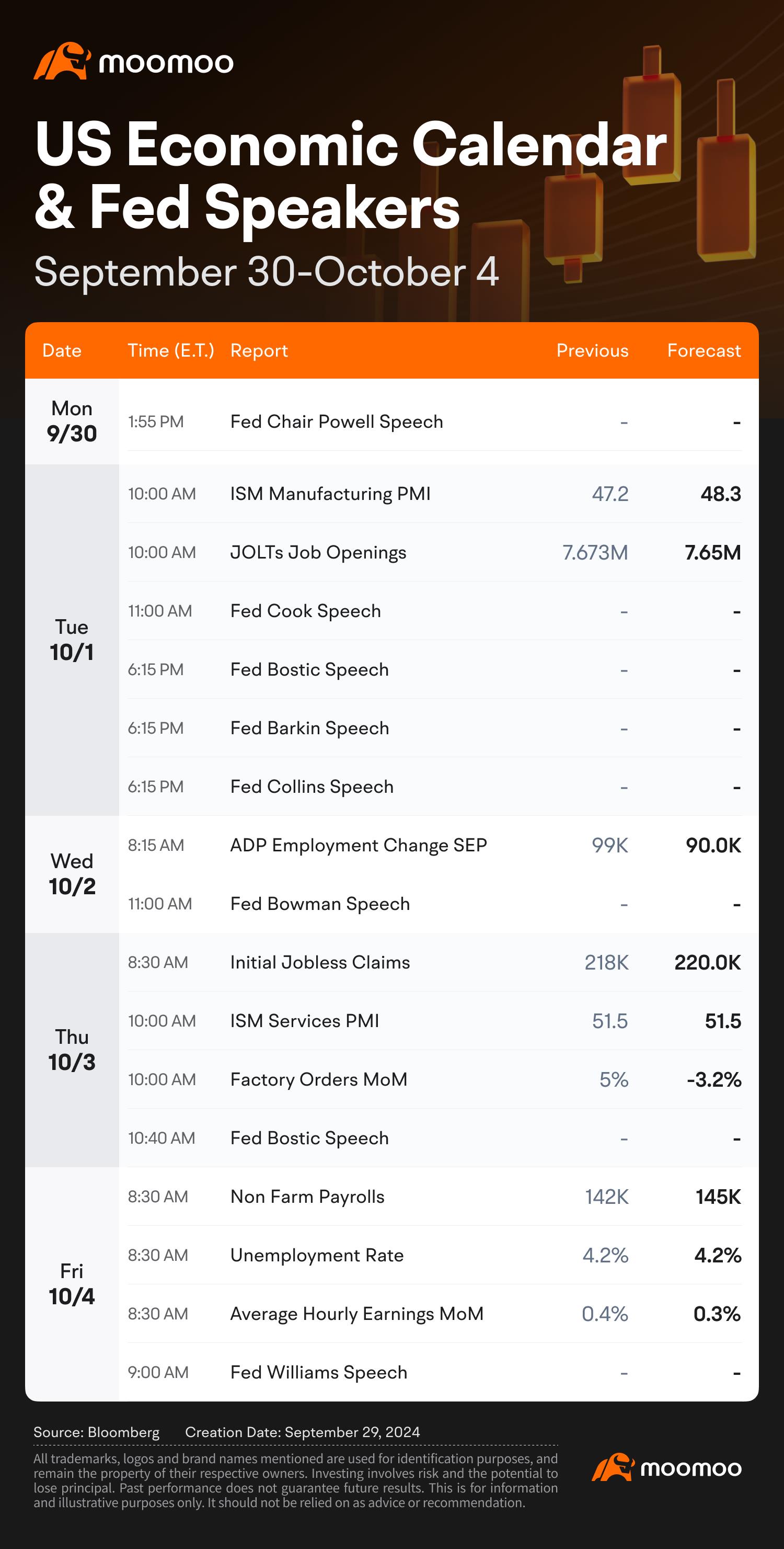

The U.S. economy will face a test next week with a series of labor market data to be released, as investors look for signs of a soft landing.

Some investors might be concerned that rate cuts might not prevent a downturn. Wall Street sees the monthly jobs report as a key economic indicator. The last two reports showed fewer job gains than expected, making the jobs reports on October 4 even more important.

For the September report due out next week, nonfarm payrolls are expected to have increased by 145,000, according to Trading Economics data.

The labor data could provide insights into what the Federal Reserve will do at its upcoming November 6-7 meeting. Futures linked to the federal funds rate show that investors are almost split on whether the Fed will lower rates by 25 or 50 basis points.

Investors will also be paying attention to Fed Chairman Jerome Powell's speech on Monday. His discussion of the economic outlook might offer clues about future monetary policy decisions.

Sectors Performance

Source: Dow Jones, Market Watch, CNBC, Finviz,

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103916021 : k

104476495 : h

101550592 :

101550592 :

101550592 :

104556909 : good

104556909 : good

103662657 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

54088 FROM RWS : 329

Alen Kok : o

View more comments...