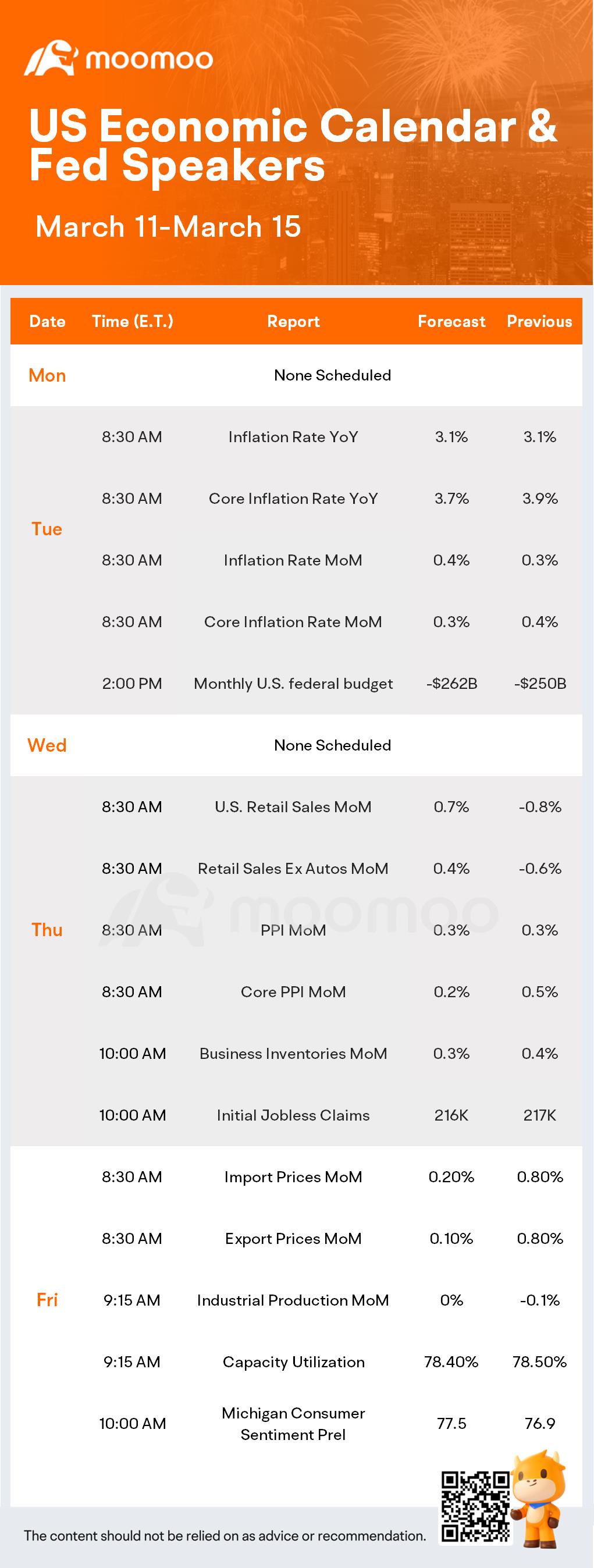

As the market anticipates the announcement of Adobe's financial results for the quarter ending in February, which is scheduled for Thursday after the closing bell, analysts have set their expectations. They predict a profit of $4.38 per share, marking a 15% rise from the same period the previous year. Furthermore, Adobe's revenue is anticipated to show a 10% increase, reaching an estimated $5.13 billion.