TSLA

Tesla

-- 421.060 PLTR

Palantir

-- 80.550 NVDA

NVIDIA

-- 134.700 OXY

Occidental Petroleum

-- 47.130 AMD

Advanced Micro Devices

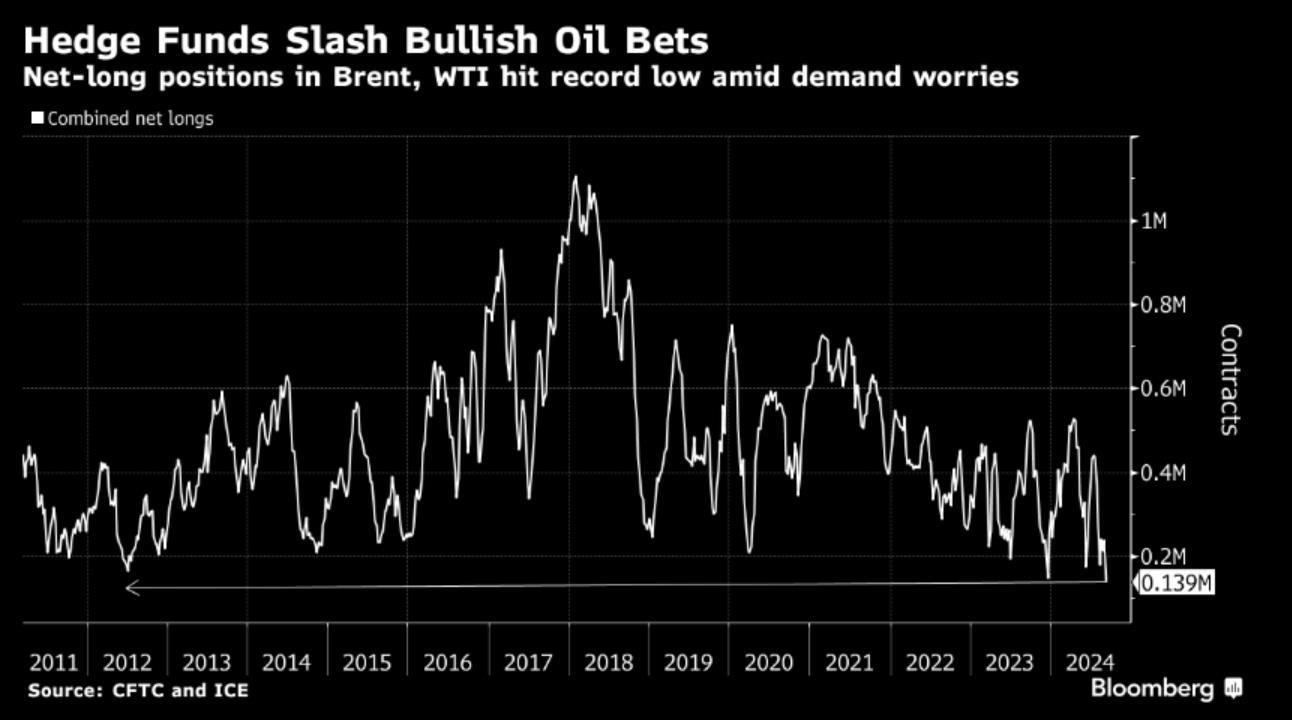

-- 119.210 This week's market focus includes two key US inflation reports ahead of the FOMC meeting, the Trump-Harris debate, and a potential oil rebound after recent lows. Australia's Treasurer plans to visit China to discuss critical minerals and trade, while the US hosts a major clean energy conference, putting clean energy metals in the spotlight. The S&P/ASX 200 rebalance sees gold stocks rising and oil names removed, reflecting shifting market trends.

151453268 witso : Seems like a lot of pricing in of potential future developments, Westgold as you mentioned its ascent to the SP Asx200 is a canary in the coal mine for west Aussie gold investors, it doesn’t get more real than these guys plugging away in the Murchison region will watch and up the ante if need be.