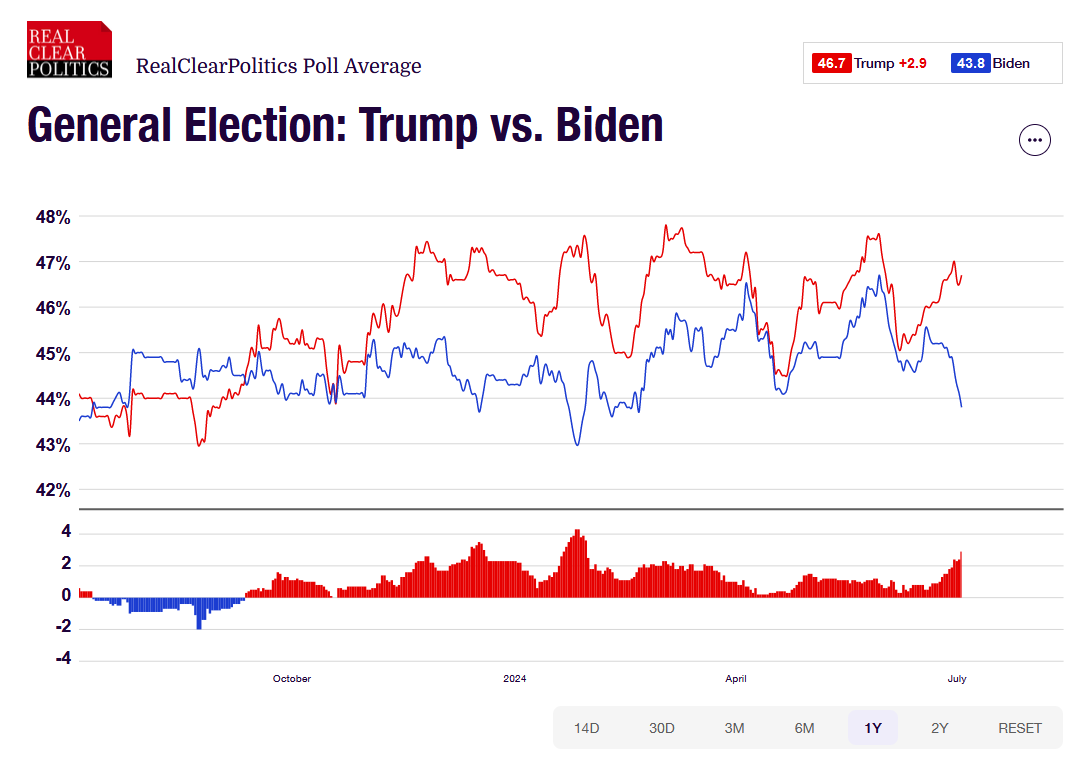

During the first U.S. presidential debate, President Joe Biden and former President Trump sparred over various issues including abortion, immigration, and the economy. Despite Biden's shaky performance, both candidates defended their economic policies ahead of the November 5 election, which is highly contested according to polls.

White_Shadow :

104749672 : Informative

Mathew Yetter White_Shadow : T hey are both pigs!

aaron1999x : Trump FtW

71780680 : why would anyone want more[Sigh]...seams to me people like the kolaid

102723010 : biden clearly cant control his brains, neither his speech... and you expect him to control a country

Steve Ng : @Casey Low

105064915 : I want to borrow 3 million.

71780680 102723010 : it's proof in the pudding....people are back to work money is flowing. we're paying stimulus money back. I'll stick with Biden and the lizard.... I just don't want anymore division between the people. with trump you can bet on mass kaos

Tricky Rick 71780680 : um. what? not a single thing you said was right. personal credit card debt is at an all time high. no one can afford anything, let alone pay back loans. the country is united under a single fact, we can't afford 4 more years of Biden

View more comments...