What will happen to US stocks in the future?” Mr. Buffett, the “god of investment,” is wary! Summary of predictions for major Wall Street players

According to Wall Street analysts, from the latest 13F submission documents of Berkshire Hathaway led by Mr. Buffett,There is a red light on the US stock marketI'm watching it. Since January this year, Mr. Buffett has sold shares worth approximately 23.6 billion dollars,Oversold per yearIt has become. This is in contrast to 2022, when Mr. Buffett was an internet buyer of stocks. Due to rapid stock sales, the company'sCash on hand surged to a record high of 157.2 billion dollarsI did it. In response to this, Wall Street analysts said that the message from Mr. Buffett was “Be careful”, and 2024'sThe forecast is that US stocks will be hit by a difficult situationI warned you that it was showing.

Valuations that are too high may be the reason why the company does not conduct large transactions. Meyer Shields, a stock analyst at investment bank Keefe, Bruyette & Woods, stated that if valuation does not drop as interest rates rise, “it is wise not to do anything.”

Also,Global hedge funds are selling US tech stocks. According to Goldman Sachs, the positions of global hedge funds against high-tech stocks have shrunk both long and short.The weekly contraction is the biggest in the past 7 monthsIt's called. Florian Ielpo of Lombard Odier Investment Managers is a US stockvaluation bubblewithInterest in hedge funds has declinedDue toThe end of the “performance concentration” of US high-tech stocksI pointed out that it might mean.

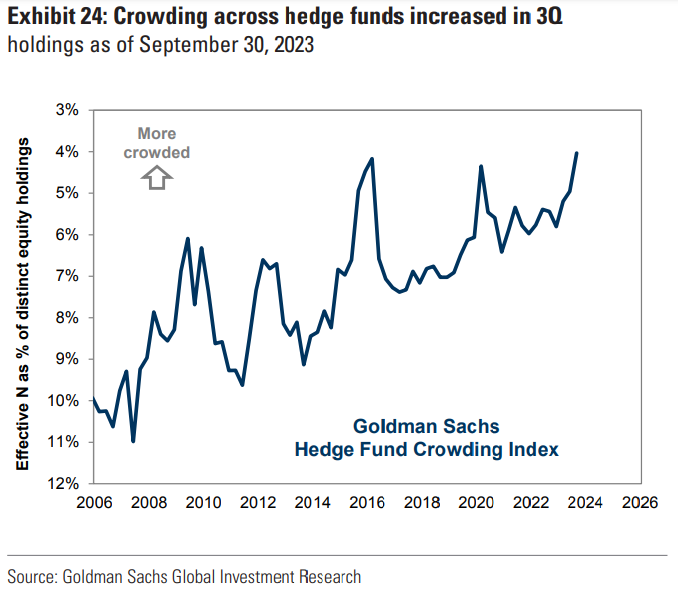

Furthermore, according to a report published by Goldman Sachs on the 20th, the “crowding index” that tracks the concentration of hedge fund investments in US stocksRecord high、The bias towards specific stocks is the biggest in the past 22 yearsI pointed it out. Investors pursuing trends and the rise in hedge fund concentration supported this year's returns, combined with the strong performance of popular stocks, but at the same time, it is said that they boosted the “crowding index” to a record high. As a result, considering the scale of these large high-tech stocks held by hedge funds and the strength of this year's rise,any reversal could be dramatic。

The US stock market remained strong until July, but the development did not even peak at the end of July. However, in November, in addition to data showing a slowdown in the economy, the S&P 500 and NASDAQ both rose due to a drastic drop in US bond yields and observations that the US Federal Reserve interest rate hike cycle would end, and they are once again close to year-to-date highs. Will this rise continue in the future? 2023 is coming to an end, and major US Wall Street banks recently announced their US stock forecasts for 2024.

This article uses automatic translation for some of its parts

Source: Bloomberg, Goldman Sachs, Morgan Stanley, JPMorgan, Citigroup, Bank of America

Moomoo News - Sherry

Source: Bloomberg, Goldman Sachs, Morgan Stanley, JPMorgan, Citigroup, Bank of America

Moomoo News - Sherry

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment