What you need to know about Mag 7 earnings and how to play?

Q3 earnings reports for U.S. stocks are in full swing, with several tech companies and chipmakers set to release their results this week. How to assess the market situation? Let’s take a look.

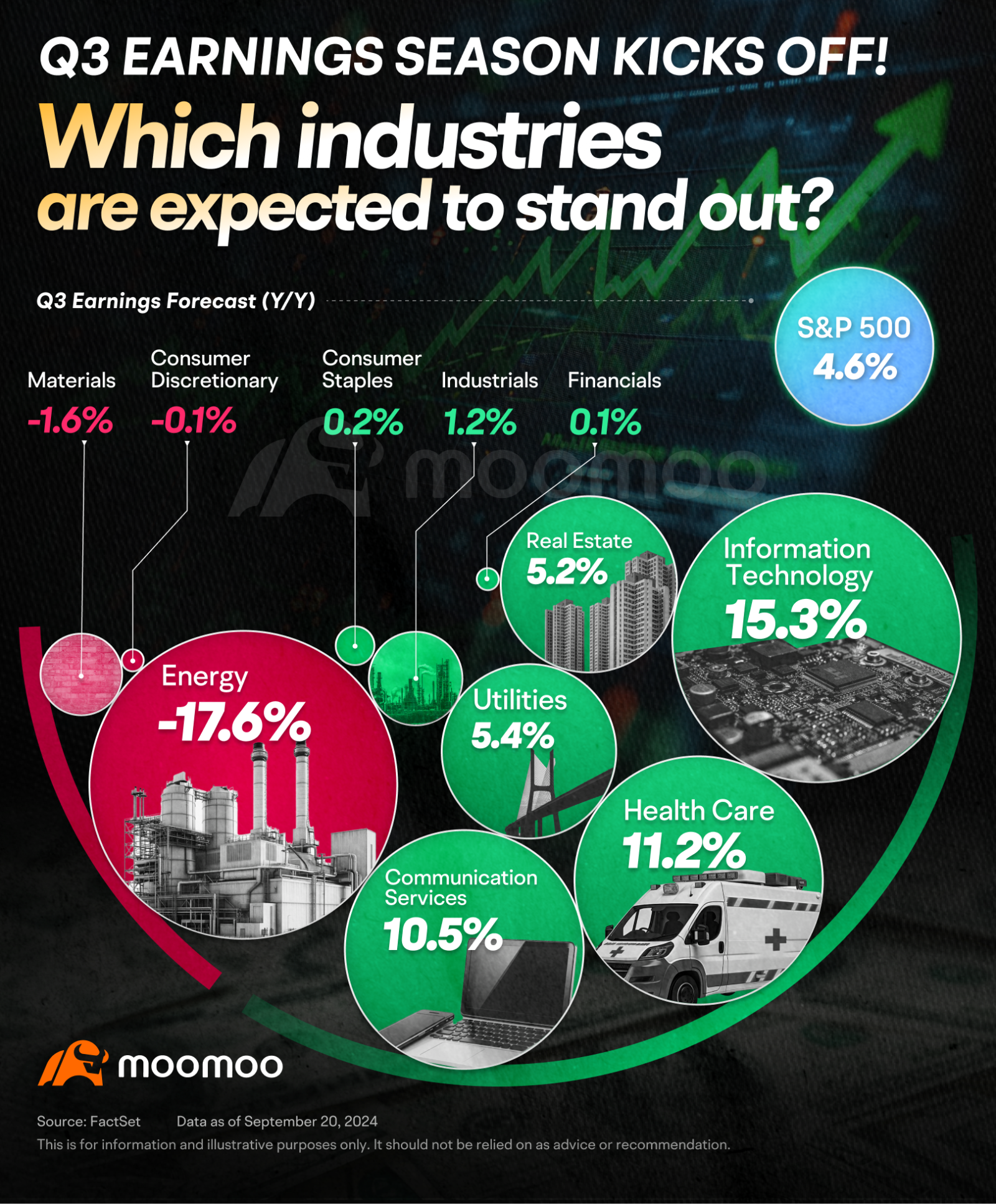

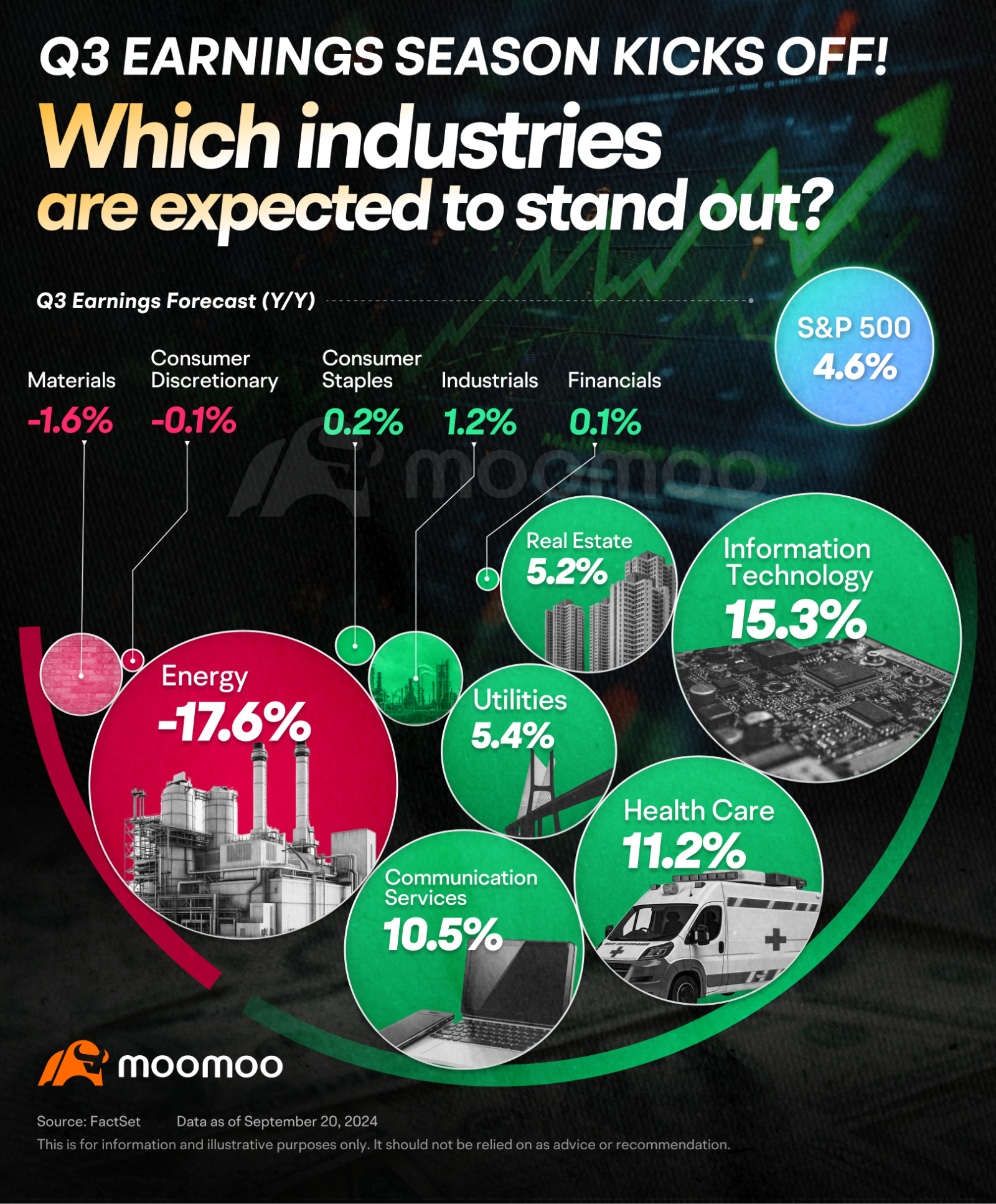

FactSet indicates that the market expects the S&P 500's earnings growth rate to be 4.6% for the third quarter.

Among the 11 sectors of the S&P 500, eight are expected to see year-over-year earnings growth in Q3. Information technology, healthcare, and communication services are anticipated to grow 15.3%, 11.2%, and 10.5%, respectively.

$NVIDIA (NVDA.US)$ from the information technology, along with $Alphabet-C (GOOG.US)$ and $Meta Platforms (META.US)$ in the communications services, are expected to drive earnings growth in their industries.

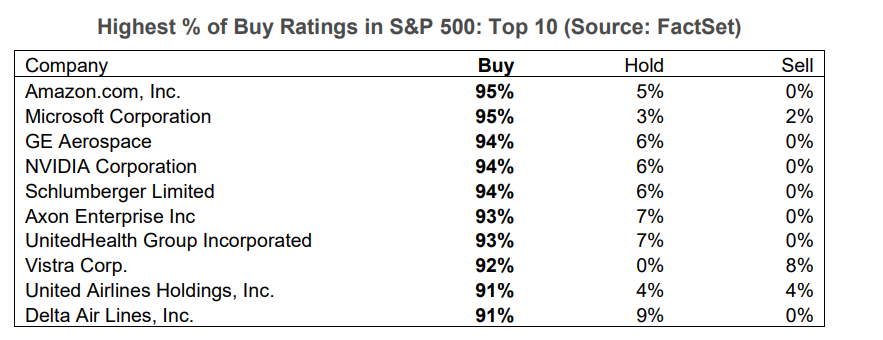

Of the ten companies with the highest buy ratings, three are from the 'Magnificent Seven': $Amazon (AMZN.US)$ , $Microsoft (MSFT.US)$ , and Nvidia.

Source: FactSet. Data as of September 20, 2024. This is for information and illustrative purposes only. It should not be relied on as advice or recommendation.

Key earnings overview

This week, five of the 'Magnificent Seven' are set to release earnings reports.

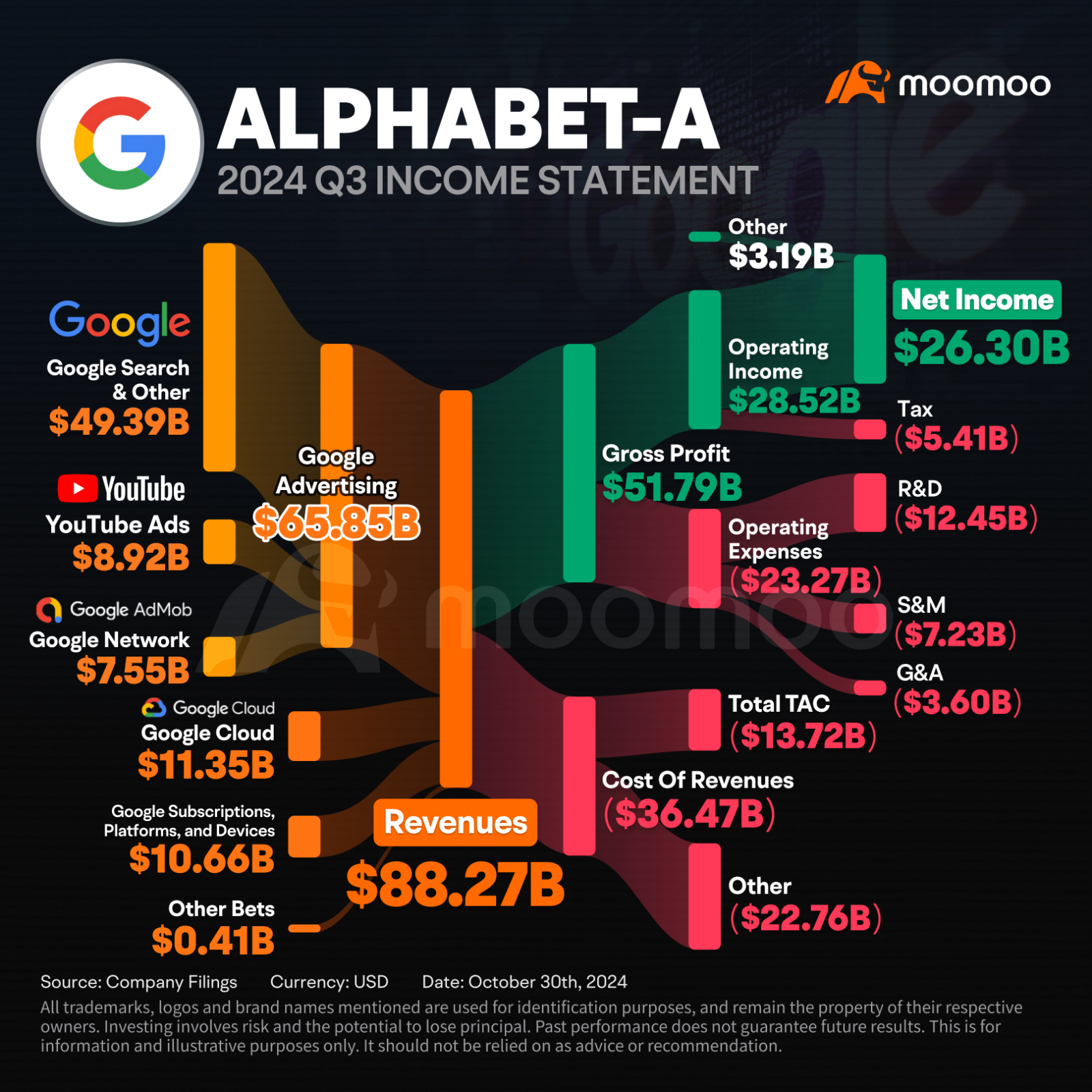

Google released earnings on October 29, after the US stock market closed. The company reported Q3 earnings of $2.12/share, vs estimates of $1.84/share, on revenue of $88.27 billion vs estimates of 86.45 billion.

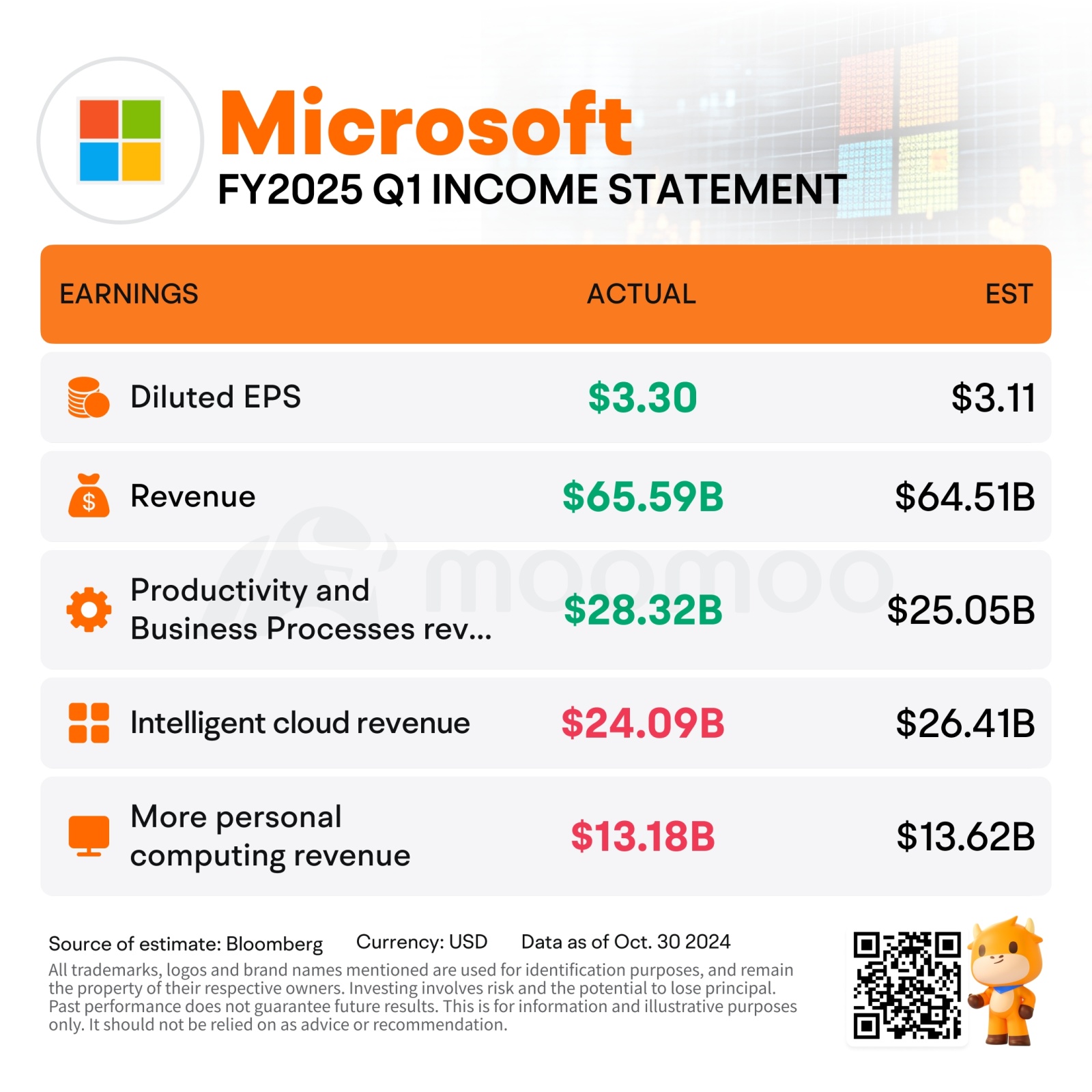

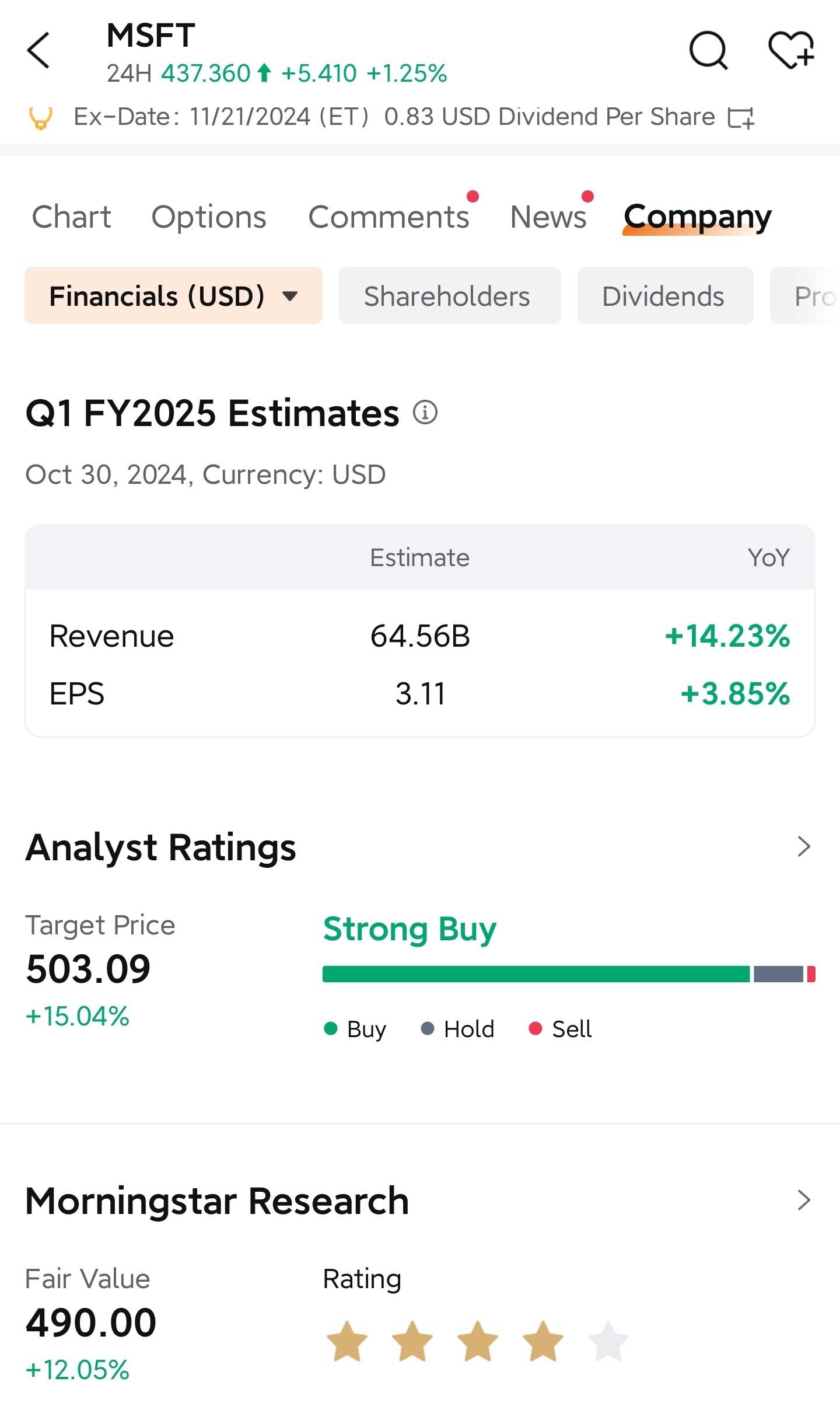

Microsoft released earnings on October 30, after the US stock market closed. The company reported Q3 earnings of $3.30/share, vs estimates of $3.10/share, on revenue of $65.59 billion vs estimates of 64.51 billion.

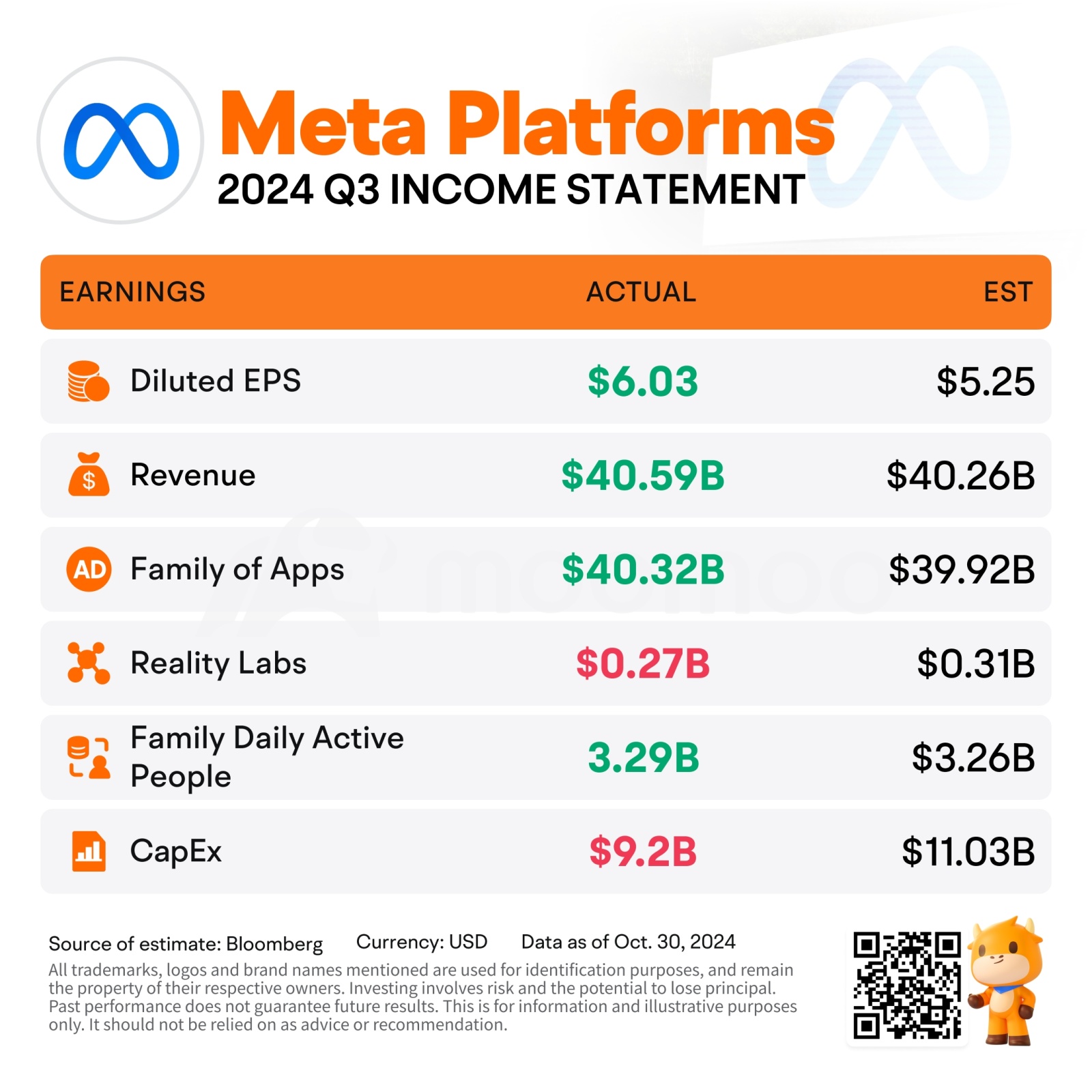

Meta released earnings on October 30, after the US stock market closed. The company reported Q3 earnings of $6.03/share, vs estimates of $5.25/share, on revenue of $40.59 billion vs estimates of 40.26 billion.

– Scheduled to release earnings on October 31, after the US stock market closes. The market expects revenue of $94.316 billion for Q3 2024, a yoy increase of 5.38%; expected EPS is $1.53, a yoy increase of 4.77%.

– Key points: Contribution of iPhone, iPad, Mac, etc. to revenue, market performance of iPhone 16; sales performance in different regions, especially in China where sales continue to decline; latest developments in Apple AI.

– Scheduled to release earnings on October 31, after the US stock market closes. The market expects revenue of $157.251 billion for Q3 2024, a yoy increase of 9.9%; expected EPS is $1.14, a yoy increase of 21.27%.

– Key points: Contributions from e-commerce, AWS cloud services, advertising services, subscription services to revenue; development of the AWS cloud services business.

The earnings calendar feature lists companies that are about to release their earnings reports soon, allowing investors to add calendar reminders for companies they are interested in. Go to moomoo: Markets> Country' sub-tab> Earnings.

The company mentioned is for illustration purposes only, and any statement involved does not constitute investment advice.

Furthermore, on the specific stock page under the "Company" section, you can view the company's earnings forecast data, institutional ratings, and more fundamental information.

Source: moomoo. Data as of October 30, 2024. This is for information and illustrative purposes only. It should not be relied on as advice or recommendation.

– Recently, the stock market has been highly volatile due to factors such as earnings reports, the upcoming elections, and changes in international political situations. If the market experiences a pullback in the future, it could present a buying opportunity.

– Moomoo continuously monitors the star companies in the market, providing you with the latest market dynamics and investment advice. Refer to our courses - Deciphering Earnings of Big Names.

– Moomoo offers courses on financial statement analysis to help you quickly grasp the key information. Refer to our courses - Advanced Financial Analysis for US Stock Investing.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

DimondHandsDsolo94 :

AL MALIK PAIZA : off simpang Pulai route is Leader by follow investigation investment unit trust are confident invest and closing price and probably

pokemon pang : tqvm, good to learn

103181906 : Can see but cannot eat.

德玛总管 : ??

102604719 :

73279472 : i

kelvin88gan : ok

NTY SG portfolio : I believe these companies have strong moats and have a good chance of being successful in the future. However to mitigate we should be diversified

View more comments...