What You Need to Know Ahead of Microsoft's Earnings

$Microsoft (MSFT.US)$ is scheduled to release its financial results post-market on October 30 ET.

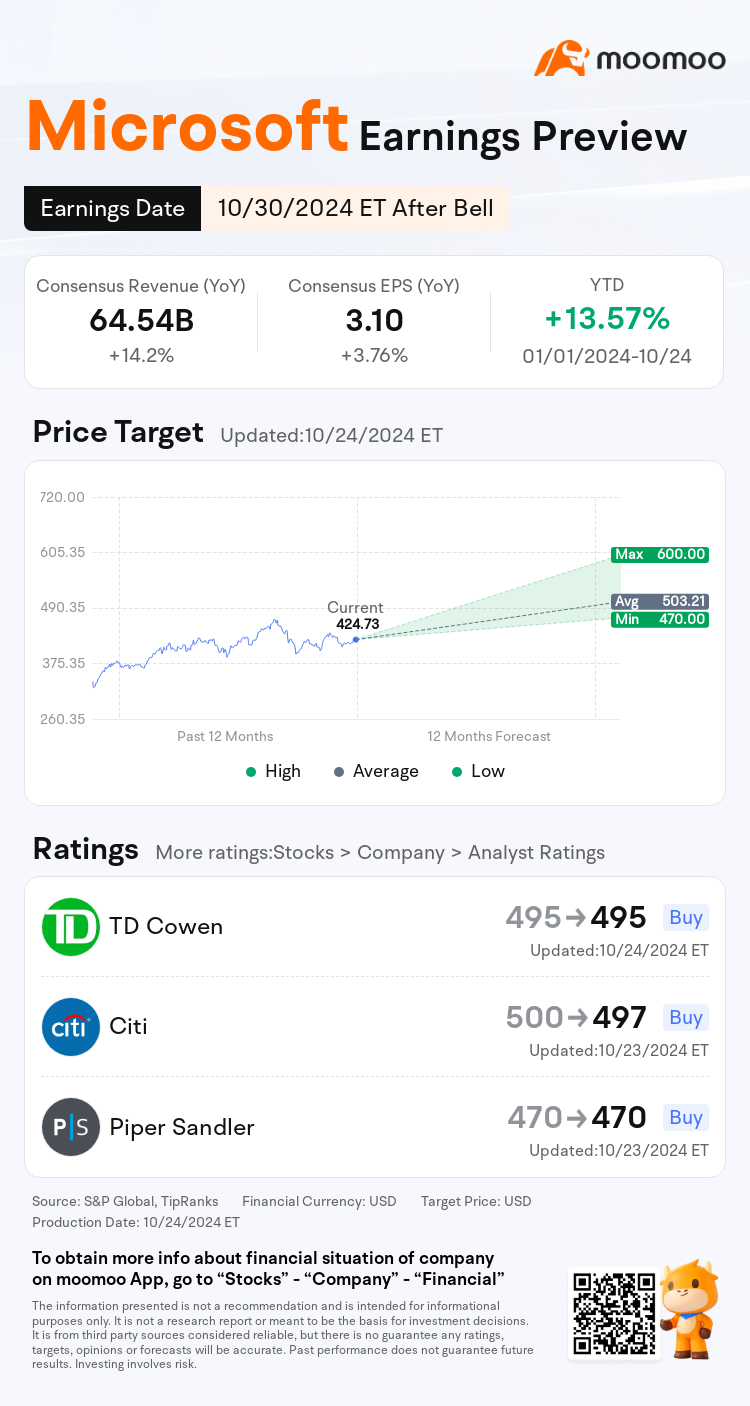

Analysts estimate Microsoft to post revenue of $64.54B for fiscal 2025Q1, up 14.2% YOY; EPS is estimated to be $3.10, up 3.76% YOY.

The company's last quarterly earnings fell short of expectations due to factors like high capital expenditures, and slower growth in Azure, its cloud computing platform, attributed to capacity limitations and general economic conditions.

Despite a mixed outlook for the latest fiscal quarter, there could be a slight positive surprise in terms of the upcoming earnings release, with more moderate expectations from investors.

▶ Microsoft's traditional business is expected to bring a steady stream of cash to the company

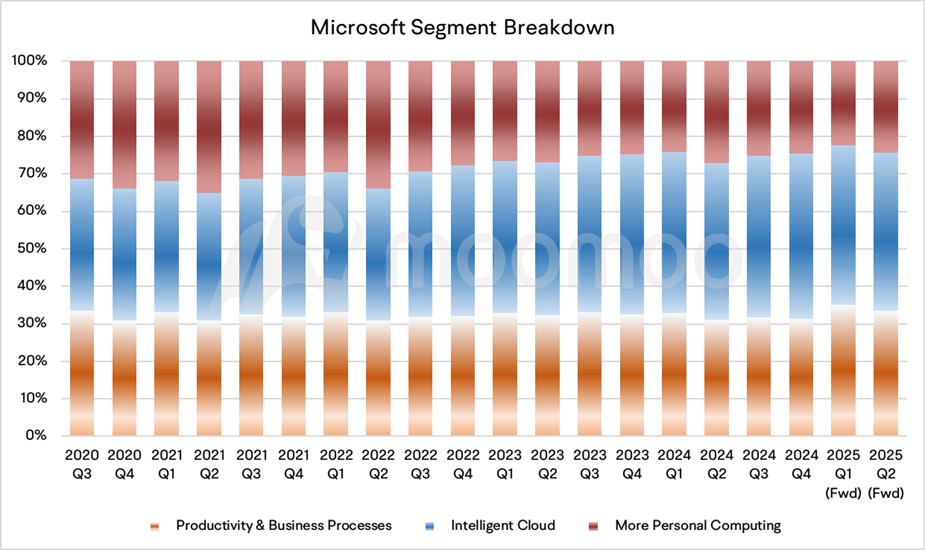

Microsoft's Productivity & Business Processes has consistently contributed a stable share of revenue and robust cash flow growth. After several years of transformation, the sector, which includes the Office 365 suite, has shifted from a one-time sales business model to a subscription-based SaaS model.

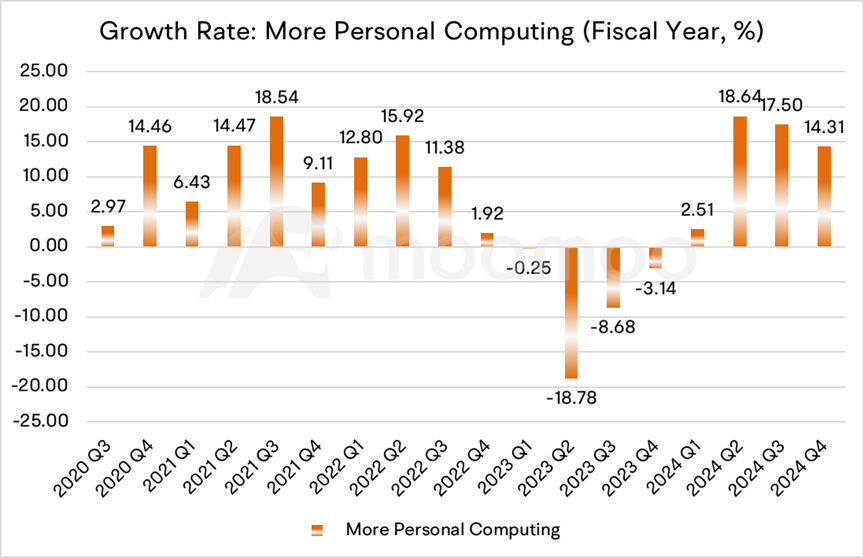

More Personal Computing business is another traditional business of Microsoft. Although it can provide stable cash flow as well, its growth has continued to slow down, and there has even been negative growth in 2023.

As the PC era has become a thing of the past, market expectations for this segment were not high. However, this business segment shows signs of stabilization and rebound in 2024. From the second to the fourth quarter of the 2024 fiscal year, the year-over-year growth rate of Personal Computing exceeded 10%, reflecting to some extent a resurgence in demand in the PC market.

▶ The growth of cloud business is key

During the fiscal years 2018 to 2024, Microsoft successfully transitioned from being primarily focused on personal computer systems to being dominated by cloud computing services.

However, given the fierce competition with Amazon and Google in AI, Microsoft's cloud division has raised concerns about whether it is losing momentum in an increasingly competitive market.

Currently, Azure AI serves over 60,000 customers. However, Microsoft unexpectedly adjusted its business division structure in August this year and accordingly lowered its revenue growth expectations.

Microsoft consolidated the revenues from Microsoft 365 commercial components (Office commercial products and cloud services, Power BI, Enterprise Mobility & Security) into its Productivity and Business Processes division and moved the revenue from the Copilot Pro AI productivity tool to its More Personal Computing division.

Microsoft pointed out that the newly adjusted Azure Intelligent Cloud business "is now closer to the consumer business," more transparently reflecting how business customers actively use computing and storage services in Azure.

Piper Sandler analysts believe that the new adjustments released in August have not yet been fully reflected in expectations, and the upcoming financial results from Microsoft might be mixed.

Some analysts point out that AWS (Amazon Web Services) and GCP (Google Cloud Platform) are more advantageous than Microsoft Azure. DA Davidson analysts believe that the former two are capable of using their in-house developed chips in their data centers, which are much cheaper than Nvidia chips, but Microsoft has not yet produced its own chips.

Still, a survey of sales merchants and business partners by Citi Group shows that Microsoft's quarterly business is stable, and the bank believes Microsoft's performance this quarter might slightly exceed expectations based on signs of cloud services and artificial intelligence demand.

▶ Investors expect Microsoft to transform more of its AI investments into revenue

Microsoft reported $19 billion in capital expenditures in the previous quarter, racing to expand and update its data center infrastructure to keep up with demand for AI. The record capital spending was up 35% from the March quarter.

Renowned analyst Ming-Chi Kuo recently released information on the supply chain orders for Nvidia's Blackwell GB200 chip, showing that Microsoft is currently the largest GB200 customer globally. In the fourth quarter of this year, Microsoft's order volume surged by 3-4 times, exceeding the total of all other cloud service providers combined. This suggests that Microsoft's capital expenditures may continue to increase.

As investors wait for Microsoft to monetize its AI investments, the company announced plans to enable customers to create autonomous AI agents starting in November. These agents, designed to perform routine tasks with minimal human intervention, will be developed using Copilot Studio. This initiative is seen as a significant move to leverage the growing AI market.

Loop Capital continues to recommend a Buy rating on Microsoft's stock, citing expected strong growth trends driven by increased cloud usage and IT expenditures. Additionally, Microsoft's M365 Copilot and its analytics platform, Fabric, are making significant inroads in the market.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

James 101542649 : good

Bullish Law : good advice

金钱游戏 : Good insight.

mamaMia888 : good insights.

Laine Ford : very good stock to have to make money