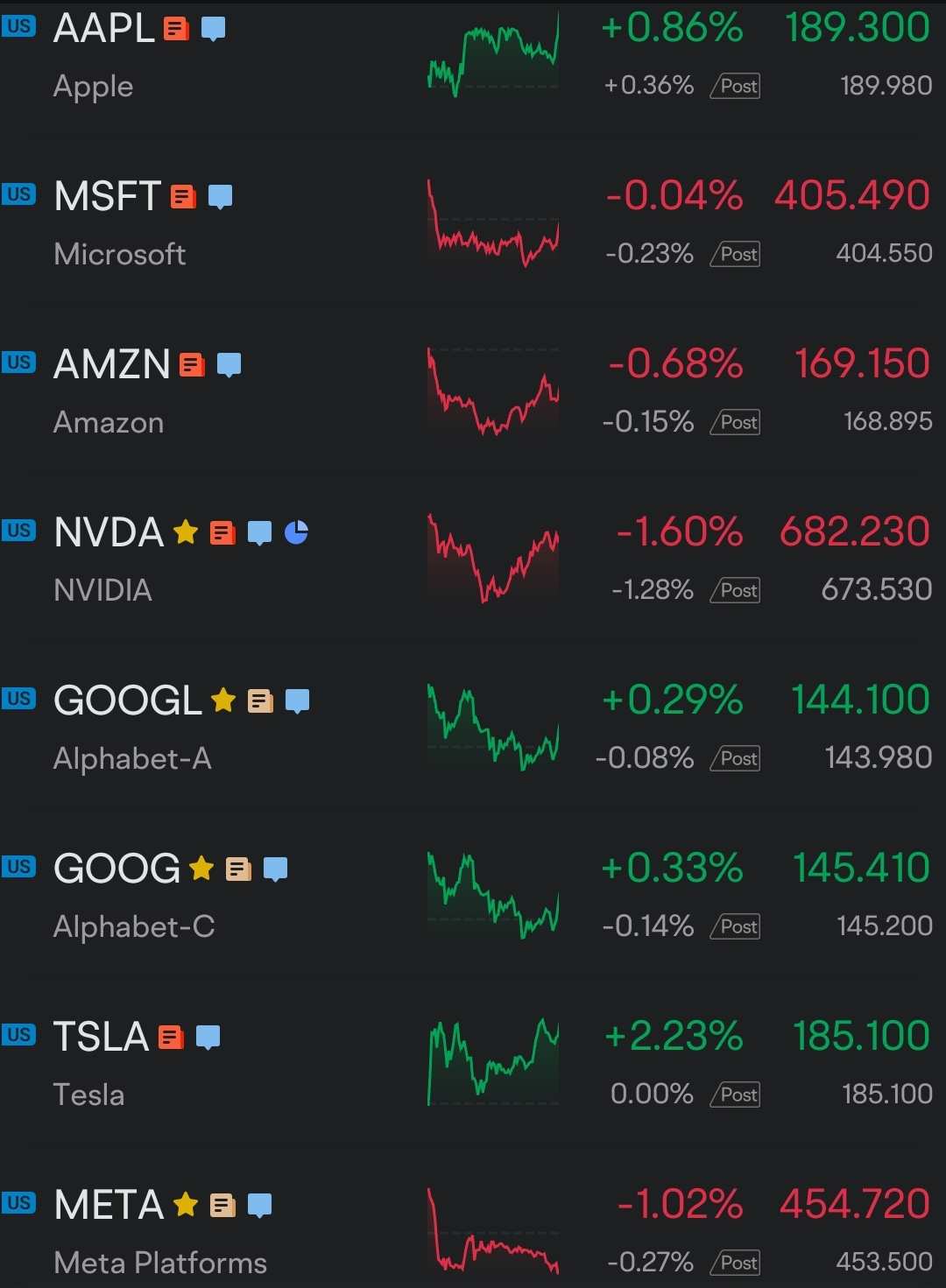

On days like today, when you see tech, communications, and semiconductor companies underperforming, then you might think, what are all of the investors buying? If investors' capital were being deployed in a broad based manner, across all underperforming sectors, then this is a good sign that the rally is broadening out into the entire market. We saw this happen today.

JonnyBets : thanks

SpyderCall OP JonnyBets : For sure![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ZnWC : This article gave more details about Rotation out of Magnificent 7.

2024: A Rotation Out Of The Magnificent 7 - Seekingalpha

SpyderCall OP ZnWC : Thanks for the link

118062799 : I don’t know why Tesla is “Magnificent 7”

SpyderCall OP 118062799 : TSLA has not been very magnificent lately.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

MonkeyGee : I have rotated out already. holding last years losers like DIS, PFE and TRIP.

SpyderCall OP MonkeyGee : I like the idea of rotating I to DIS and PFE. Disney is already in its way up from the bottom. PFE looks like it needs a little more of a push to start climbing.

MonkeyGee SpyderCall OP : Yeah, these are my long-term. You don't have to watch and can sleep at night. Last week, I was thinking of liquidating one of my smaller accounts and just go all in Disney.

SpyderCall OP MonkeyGee : Don't put too much in one name.