When financiers watch “Blossoming Flowers,” their minds are full of ways to make money

In the TV drama “Blossoming Flowers,” the battle between Strong and Bao is dazzling and relishing. The essence is who has the institutional temperament and who can last a long time. In fact, there is no understanding in the drama, but there is no doubt that the job of investing in stocks is a professional technique that may seem easy to get started with, but it is actually a troubling professional technique. Especially when it comes to bear markets, it's easier to fall into a situation where butterflies swim in a cesspit.

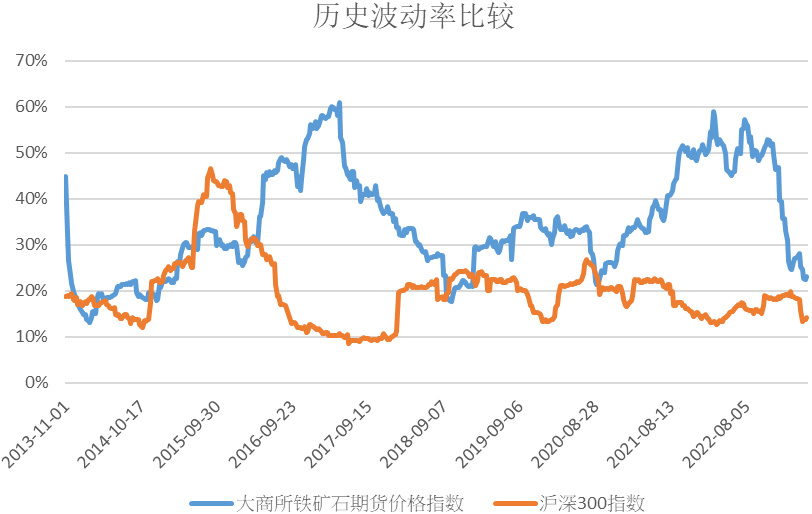

Fortunately for investors, there is another more interesting investment tool, which has become a profitable delivery issue in the bear market — iron ore ETF (3047.HK). Iron ore ETFs don't have as many bosses and tricks behind the stock investments in “Blossoming Flowers”; they are relatively simple and straightforward. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

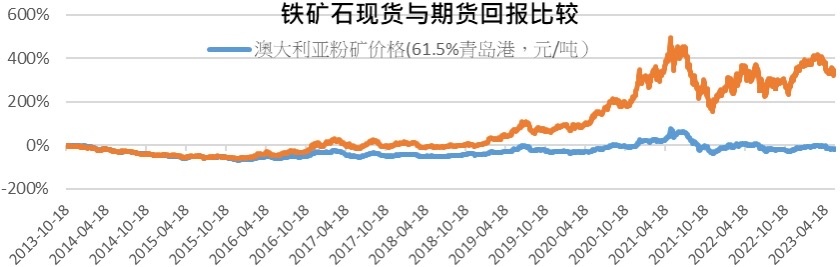

The price fluctuation of iron ore ETFs is divided into two parts. One is the rise and fall of the iron ore spot itself, which is affected by changes in supply and demand at the stage; the other part is tiered income, which allows investors to easily obtain more returns that surpass the rise and fall of iron ore (historical statistics). $SSIF DCE Iron Ore Futures Index ETF (09047.HK)$

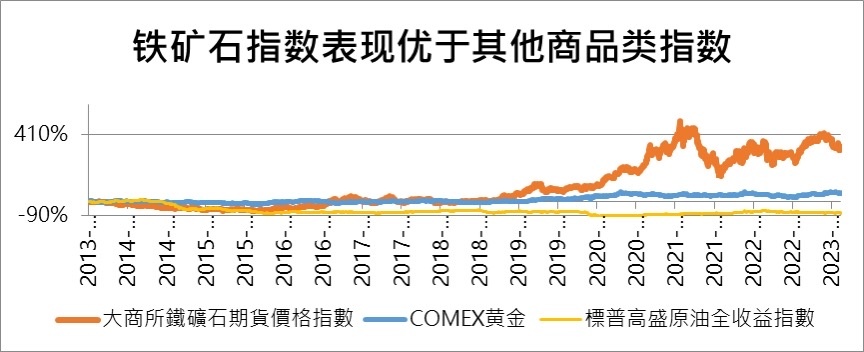

First, price fluctuations in iron ore ETFs are closely related to iron ore spot. Iron ore prices are affected by multiple factors such as the global economic situation, supply-demand relationships, and political factors. However, for investors, there is no need to worry too much about the rise and fall of iron ore stocks, because iron ore ETFs can provide even more excessive returns.

Another advantage of tie-shui tie-iron ore ETFs. Simply put, tie-water earnings refer to earnings obtained by obtaining differences in long-term pricing when switching from a recent to a forward period. For investors, as long as the underlying structure exists, they can be expected when mineral prices enter the next round of rising, and are not affected by the various price manipulations in “Blossoming Flowers” that make retail investors leeks. Therefore, even if it is impossible to accurately determine the short-term rise and fall of the spot price of iron ore, investors can still hold 3047.HK for a long time to obtain more excessive returns through tiered earnings.

In fact, the spot price of iron ore has only risen 44% since the establishment of the iron ore ETF on March 27, 2020. Compared to that, 3047.HK (the stock code for iron ore ETF) increased by 144.4%. Among them, 100% of the increase was contributed by the revenue paid off. This clearly shows the steady return that comes from investing in iron ore ETFs.

Therefore, iron ore ETFs are a relatively easy investment option for investors. There is no need to pay too much attention to individual investors' actions, and there is no need to painstakingly judge the rise and fall of the spot price of iron ore. Instead, by seizing the benefits and enjoying the stable returns it brings, investors can easily reap the benefits of investing in iron ore ETFs.

In the plot of “Blossoming Flowers,” the battle between Strong and General Bao may be exciting, but in the field of investment, we can choose an easier and more stable method. The regular investment method of iron ore ETFs allows us to enjoy investing while receiving stable returns. Let's follow the story of “Blossoming Flowers” and explore how to invest in iron ore ETFs!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment