When transferring funds to deposit into Hong Kong and US stocks, where can you check the bank code and branch code? How can you make it more convenient?

Recently, a friend consulted me. He mentioned that his parents were originally from Hong Kong and have now settled in Guangzhou. They want to open a Hong Kong bank account to receive retirement pensions. Previously, his parents tried to open an account at the Bank of China in Hong Kong but were rejected because they didn't know how to activate online banking. They were required to activate an online banking account during account opening. Hearing this, I suddenly felt that these banks can be quite ruthless. Technology has indeed provided us with convenience and efficiency, but if everyone is forced to use modern methods, it may seem somewhat inhumane. I hope that technology can bring more convenience to different cohorts and benefit the general public.

I have shared a lot about opening accounts with many brokerages before. Besides account opening, there is one more troublesome aspect – depositing funds. During fund deposits, I found that I had no idea what the bank code and branch code were. Today, I will share how to identify the codes for major banks in Hong Kong and other quick and efficient ways to achieve the desired results.

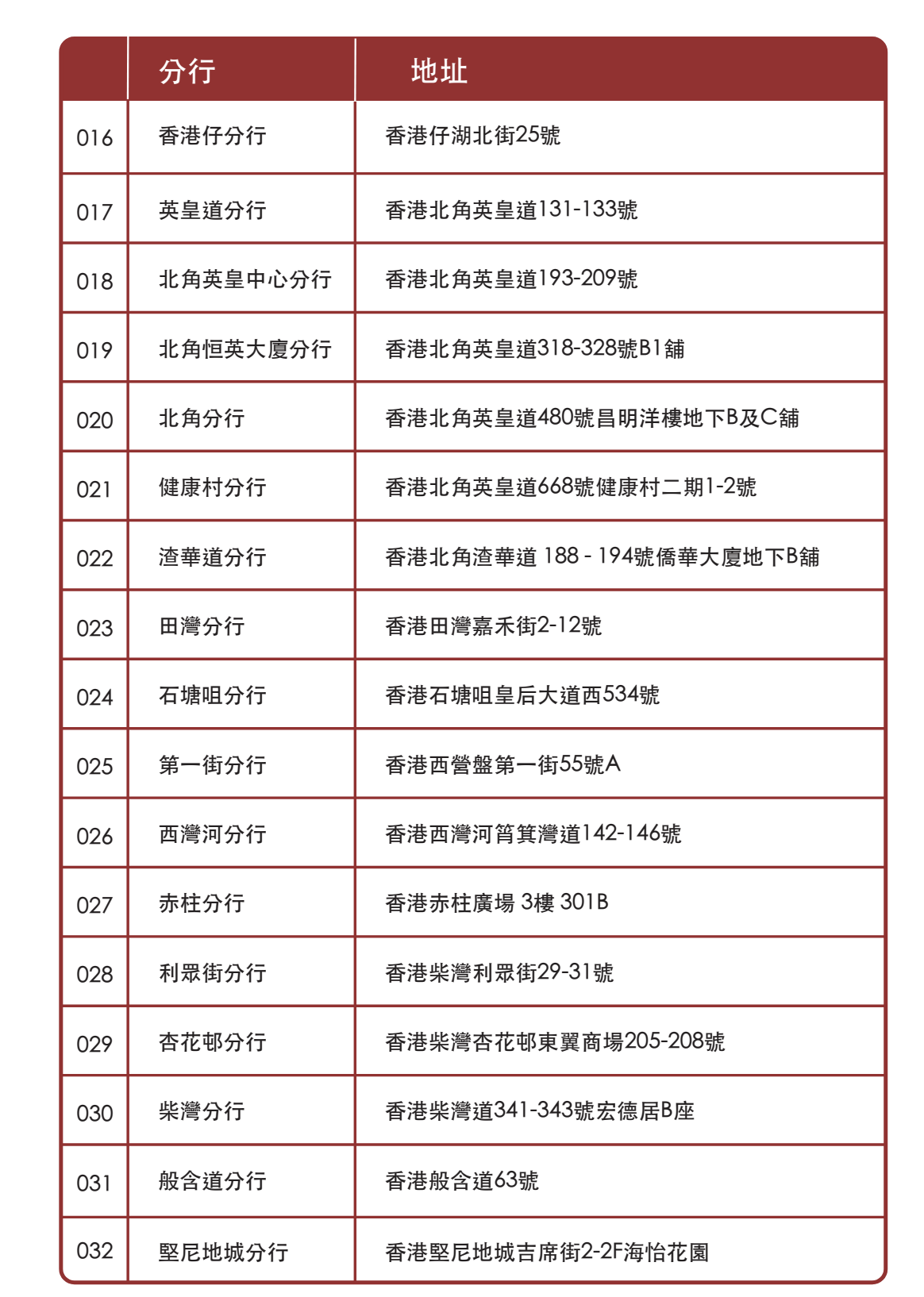

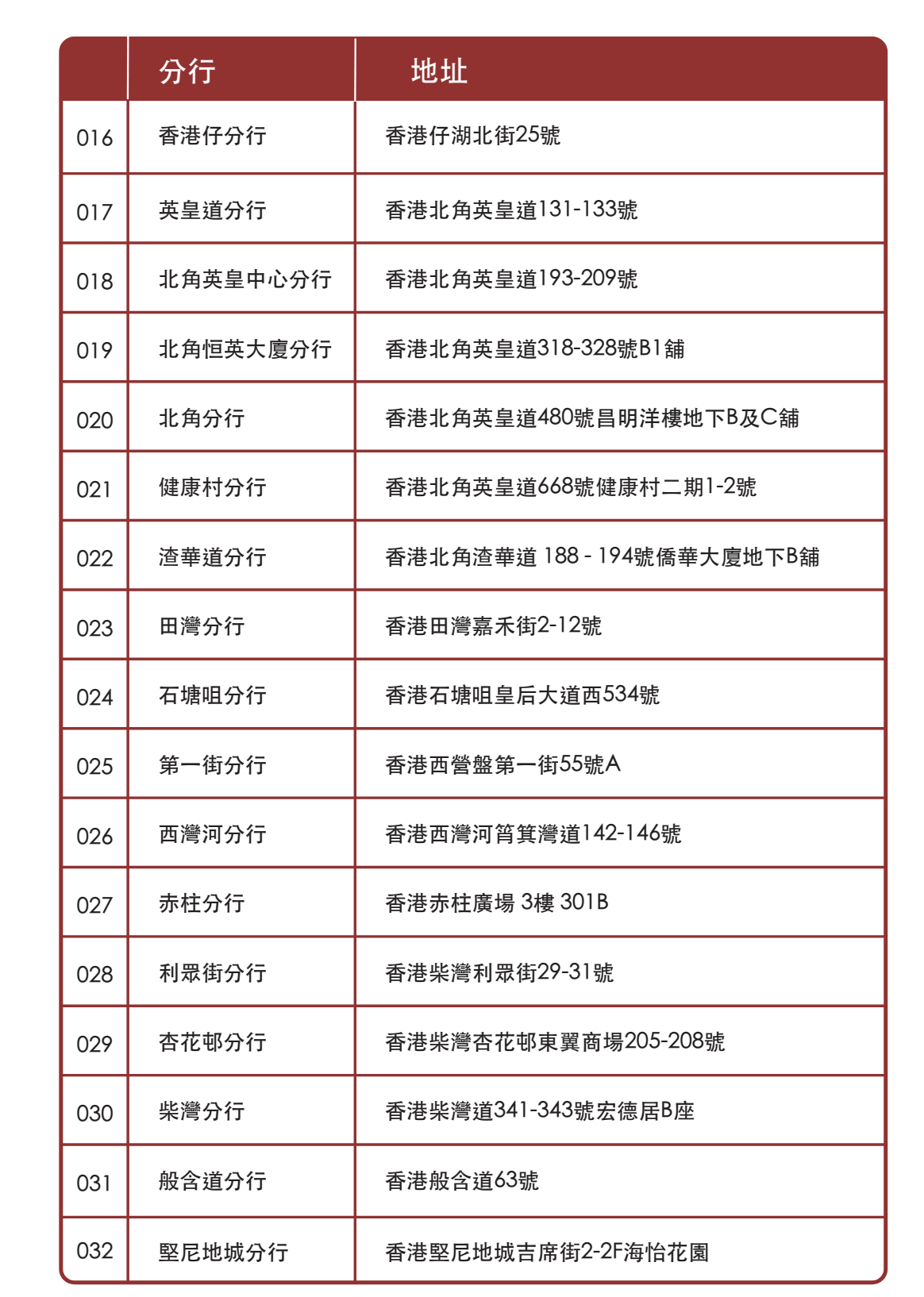

Bank Code: The Bank Code consists of a 3-digit identification code, for example, 004 is the code for Hang Seng Bank, and 024 is the code for BOC Hong Kong. Some banks have multiple bank codes, such as Bank of China (Hong Kong) with codes like 012, 014, 019, and more.

Bank Account Number: The bank account number may differ from the card number displayed on your bank card; you can view the bank account number on mobile banking.

hang seng bank

Your hang seng bank ATM card has a 12-digit number, the first 3 represent your branch code, the following 9 digits are your account number. For example, if your card number is 123 456 789 001, your branch code is 123, and the account number is 456 789 001. Remember the branch and bank codes are different, the bank code for hang seng bank is 004.

Example:

The bank code for hang seng bank: 004 Branch code: 123 Account number: 456 789 001 The SWIFT code for hang seng bank in Hong Kong is HSBCHKHHHKH boc hong kong china citic bank corporation (Hong Kong) account numbers typically consist of 11 digits. Bank code: usually 012. Example account numbers: HKD deposits and withdrawals: 61111*67 (do not enter the first three digits 012); USD, RMB deposits and withdrawals: 61191*63 (do not enter the first three digits 012)

Standard Chartered Bank

Standard Chartered Bank account numbers typically consist of 11 digits or alphanumeric characters.

Bank code: Please consult the bank, usually 003

Example account number: 433888***81

Hang Seng Bank

Hang Seng Bank account numbers usually consist of 10-12 digits.

Bank Code (BankCode): 024 Example Account Number: 123456**9012

Industrial and Commercial Bank of China Asia

ICBC (Asia) account numbers typically consist of 12 digits.

Bank Code (BankCode): Please consult the bank, usually 072 Example Account Number: 8708131**450

Everbright International

China CITIC Bank Corporation (International) account numbers typically consist of12 digitsConsists of numbers.

Bank Code: 018 Example Account Number: For HKD deposit/withdrawal: 7358****8888 (do not need to enter the first three digits 018) For USD deposit/withdrawal: 7350****0000 (do not need to enter the first three digits 018)

CMBC Yinlong

CMBC Yinlong bank account numbers usually consist of 11 digits. Bank Code (BankCode): 020 Example Account Number: 123***8912 (do not need to enter the first three digits 020)

Citibank

Citibank account numbers typically consist of 10-11 digits. Bank Code (Bank Code): 250 (Citibank Hong Kong) / 006 (Citibank N.A) Branch Code: 390 (Citibank Hong Kong) / 790 (Citibank N.A) Example Account Number: 3901234**78

Please note: If the account number you find in the bank statement is an 8-digit number, please append the branch code [390 (Citibank Hong Kong) / 790 (Citibank N.A)] before the 8-digit number for filling in.

Zhongan Bank

ZA Bank Zhongan Bank account numbers typically consist of 12 digits. Bank Code: 387 Example account number: 888812***678

OCBC Bank

OCBC Wing Hang Bank account numbers typically consist of12 digitsdigits.

Bank Code: 035 Branch number: 802 Example OCBC Wing Hang account number: 12345**89 Example to be filled in with account number: 80212345**89 (prefix 802 before the OCBC Wing Hang account number for filling in)

Typically, the basic information needed to open an account and deposit at banks like these is as mentioned above. It can be said that very few people use these cards to receive retirement benefits. Most users use them for investment, wealth management, as well as trading in U.S. and Hong Kong stocks. Through overseas brokerage platforms, various wealth management products and U.S. and Hong Kong stocks can be purchased, such as Firstrade, Interactive Brokers (IBKR), Charles Schwab, Futu, Tiger, etc. (Remember to link to the card you applied for). If you find applying for and depositing in these cards troublesome, along with the certain difficulty in U.S. and Hong Kong stock deposits and withdrawals, I have also explained how you can quickly and easily apply for them and achieve the desired results. In this scenario, I have to mention a tool, BiyaPay, where you can recharge USDT and withdraw U.S. dollars to and from brokerage and bank accounts. BiyaPay's U.S. and Hong Kong stock deposits and withdrawals can achieve same-day withdrawals and deposits, with no limits. Their customer experience includes successfully depositing 3 million into Charles Schwab on a single charge, and depositing into Charles Schwab supports both wire transfer and ACH methods, without the need to open an additional bank account. ACH deposits into the bank are free of charge, basically achieving same-day deposits and withdrawals.

If you have offshore bank accounts in Hong Kong or the USA, withdrawing from BiyaPay and then funding into interactive brokers, tiger, and other brokerages is also super fast, with no limits, basically same-day transfer and reach.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment