TSLA

Tesla

-- 462.280 NVDA

NVIDIA

-- 140.220 PLTR

Palantir

-- 82.380 AMD

Advanced Micro Devices

-- 126.290 MSTR

MicroStrategy

-- 358.180

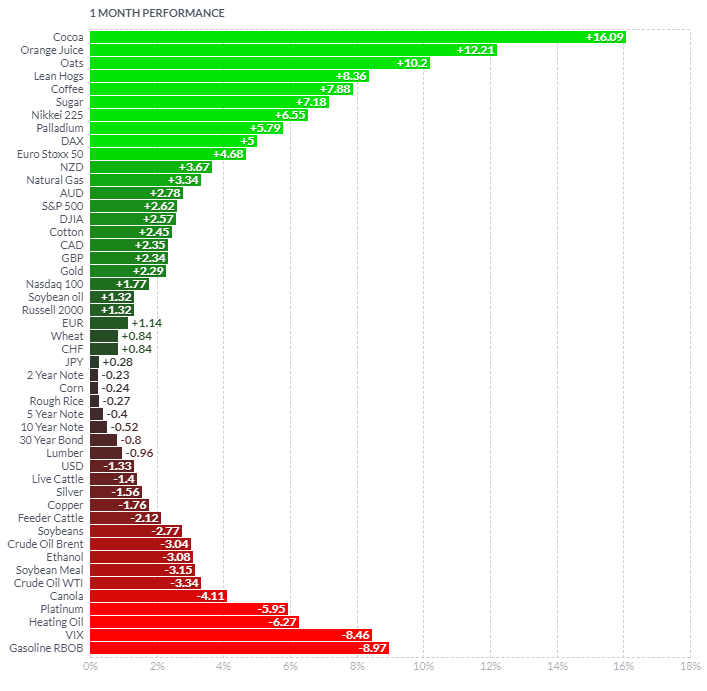

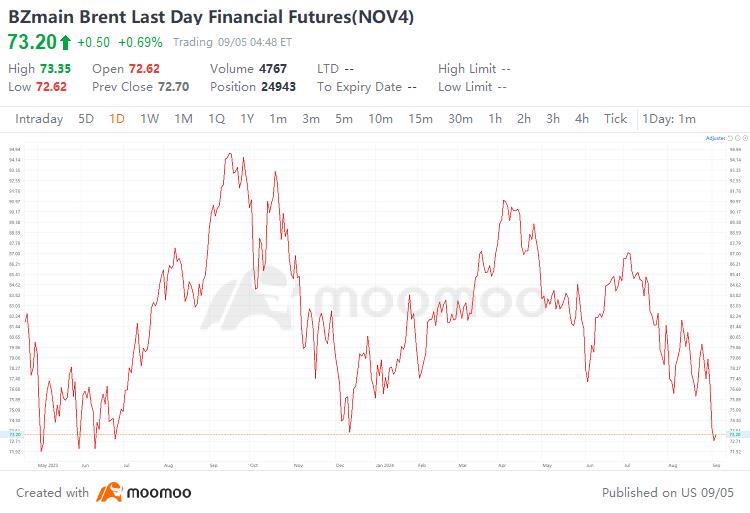

However, with demand set to slow after summer, and both OPEC and non-OPEC supply to increase from the fourth quarter, we foresee a softening balance, turning to surplus in 2025.

Many of the steel mills have to cut down production until the industry gets a tighter balance. We think there's still space for the iron ore price to come down to $90 per tonne.

Softer-than-expected China commodity demand, as well as downside risks to China's forward economic outlook, lead us to a more selective, less constructive tactical view of commodities.

Commodity secular bull market in the 2020s is just getting started as debt, deficits, demographics, reverse-globalization, AI & net zero policies are all inflationary.

warmhearted Puppy_93 : Thank you for the update.

XJ3005 : Atlas Shrugged or Return Of The Jedi.

74423696 : I love that. It’s Fantastic