Which Sector Is Poised to Benefit if Fed Kicks off Easing Cycle?

Wall Street has experienced significant volatility over the past several days, with a relief rally on Tuesday helping to mitigate some of the damage caused by intensified recession fears last week. In the market's eyes, the Federal Reserve is either on the brink of averting a recession or at risk of repeating its past mistakes by failing to recognize an impending economic downturn in time.

Traders are currently pricing in a strong possibility of a half-point rate cut by the Fed in September, followed by aggressive easing that could reduce the Fed's fund rate by 2.25 percentage points by the end of next year, according to 30-day Fed funds futures contracts.

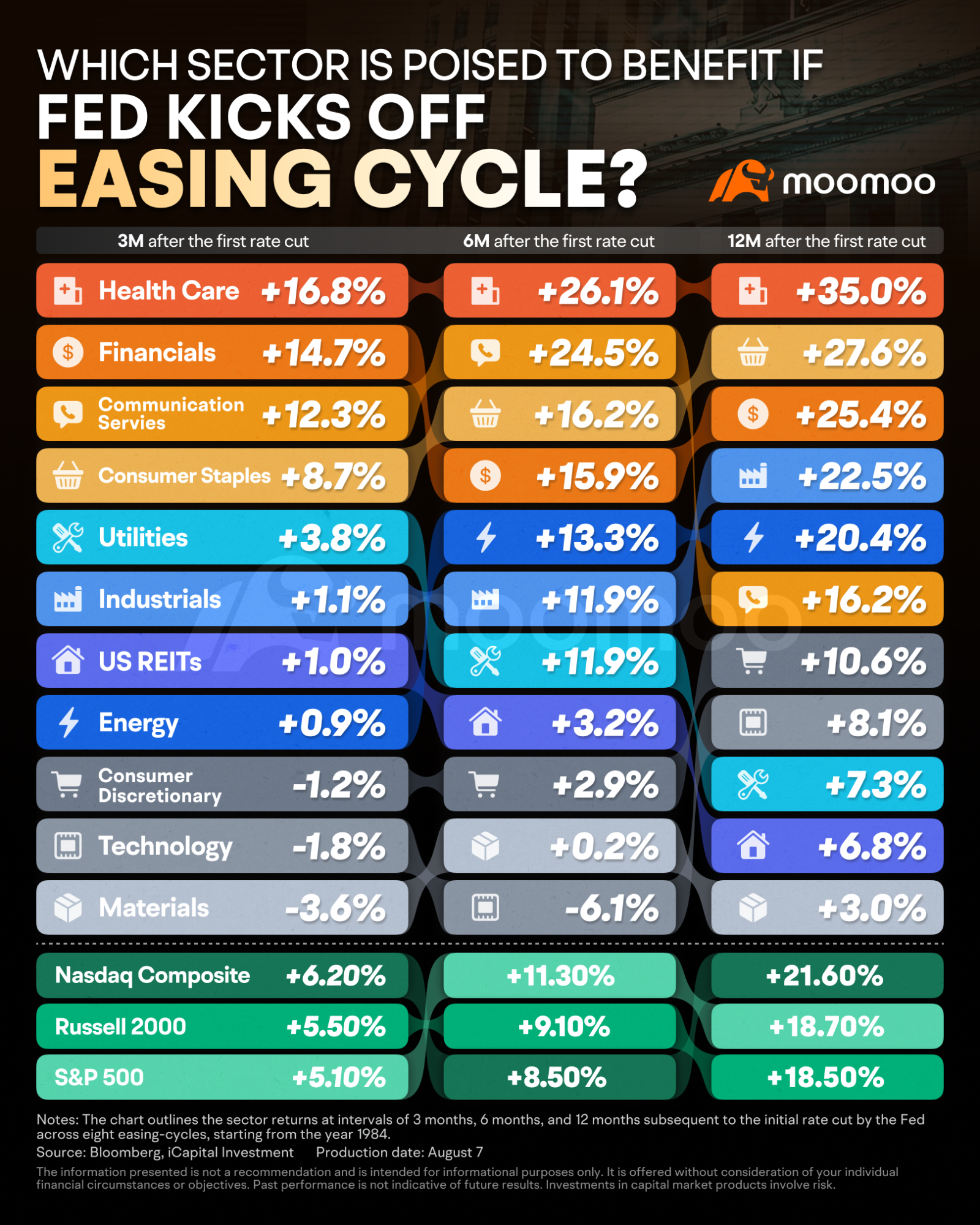

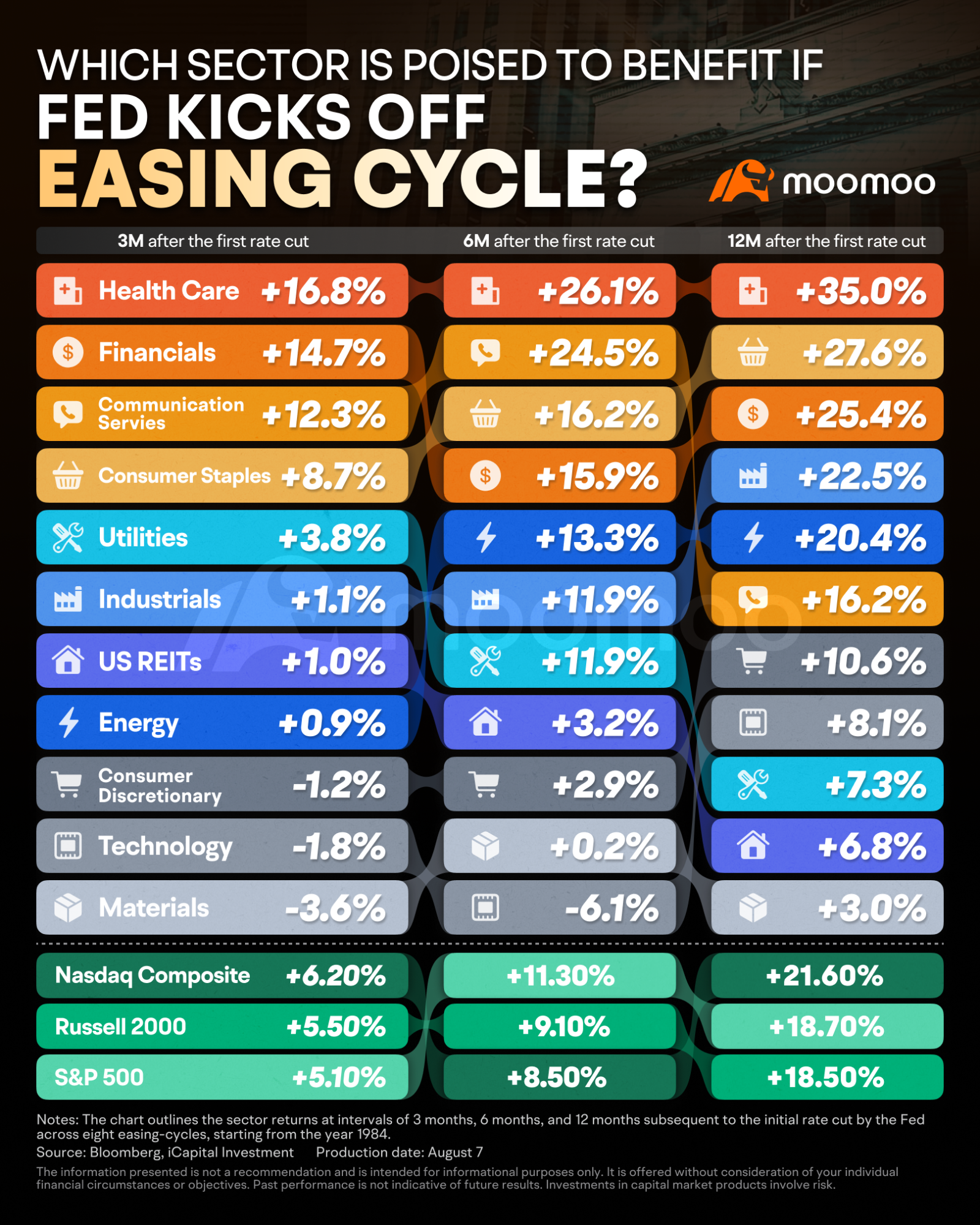

Investors are preparing for a new investing landscape as the possibility of an easing cycle looms. iCapital has analyzed the performance of indexes and sector returns at 3 months, 6 months, and 12 months following the first rate cut by the Fed across eight easing cycles since 1984. According to historical patterns, stocks generally rallied into the first rate cut, consolidated in the one to three months after the first cut, and then resumed their upward trajectory—provided there was no recession. Stocks tended to outperform in the six to 12 months following rate cuts in non-recessionary scenarios.

However, during periods when the Fed cut rates in response to a weakening economy or financial market events, markets did not perform as well. During the recessionary rate-cutting cycles of 2001 and 2007, virtually every sector in the S&P 500 traded lower.

Defensive Sectors Take the Lead

When it comes to sector performance, defensive sectors have historically outperformed cyclicals in the three to six months following a rate cut. In the early stages of a rate-cutting cycle, as the market continues to grapple with macroeconomic uncertainties, investors tend to favor defensive stocks to hedge against the risk of a recession.

Sectors such as Consumer Staples, Health Care, and Utilities have posted the best results during these periods, while cyclical sectors like Consumer Discretionary, Energy, and Materials have generally lagged. Notably, this trend has remained consistent regardless of whether the economy was in a recession.

· Healthcare Stocks: Known for their dividend payments and significant stock buybacks, healthcare stocks become particularly attractive during periods of economic weakness. Their stable revenue streams and defensive nature provide a buffer against economic downturns.

· Consumer Staples: These stocks typically perform well due to their stable demand, defensive characteristics, and minimal impact from interest rate fluctuations. In uncertain economic times, consumers continue to spend on essential items, making this sector a safe haven.

· Utility Stocks: According to FactSet data, utility stocks have had an average yield of 3.4% during the rate-hike periods, making their dividend returns less attractive compared to Treasury bonds. However, with rising concerns about a U.S. economic recession and a possible rate cut by the Fed in September, the 10-year Treasury yield has dropped to around 3.8%, making the dividend yields of utility stocks more appealing.

Tech Sector Faces Uncertainties

Historically, the tech sector doesn't typically perform well in the first three months following the initial rate cut. Given that the S&P 500 has been heavily tech-focused throughout much of 2024, the sector may need to address its overbought conditions and excessive bullish sentiment.

An area of intense focus for market participants this quarter will be how companies plan to monetize artificial intelligence (AI). Hyperscalers, or large cloud service providers, are expected to increase their capital expenditure (capex) and research and development (R&D) spending by an additional $27 billion in 2024 and $38 billion in 2025. Despite these substantial investments, we have yet to see corresponding growth in sales and earnings expectations.

Moreover, the tech sector could face additional headwinds from the heating up of election rhetoric and the possibility of tighter export controls or tariffs from both political parties. These factors could further weigh on the industry and add to the sector's challenges in the near term.

Source: Bloomberg, iCapital Investment

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Paul Bin Anthony : for young children

Paul Bin Anthony : buying the best

Richard Bieber : How do I contact support?

Barren Wuffett Paul Bin Anthony : What is the best one bro?

105323005 : what U want

105323005 : sorry sir I am not very well speaking sir

105323005 : maybe U got person can speak Malay,,

105323005 : what can't buying sir,,form me

151706928 : I don't know ..

..

Paul Bin Anthony : give us more time with this learn how to make money online never mind for future

View more comments...