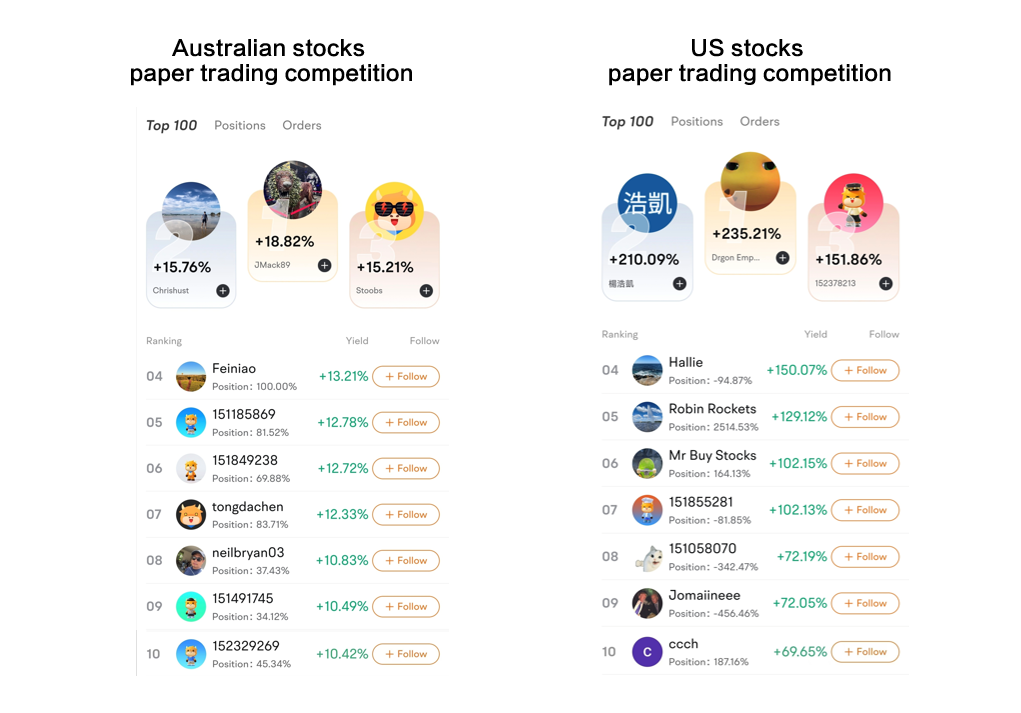

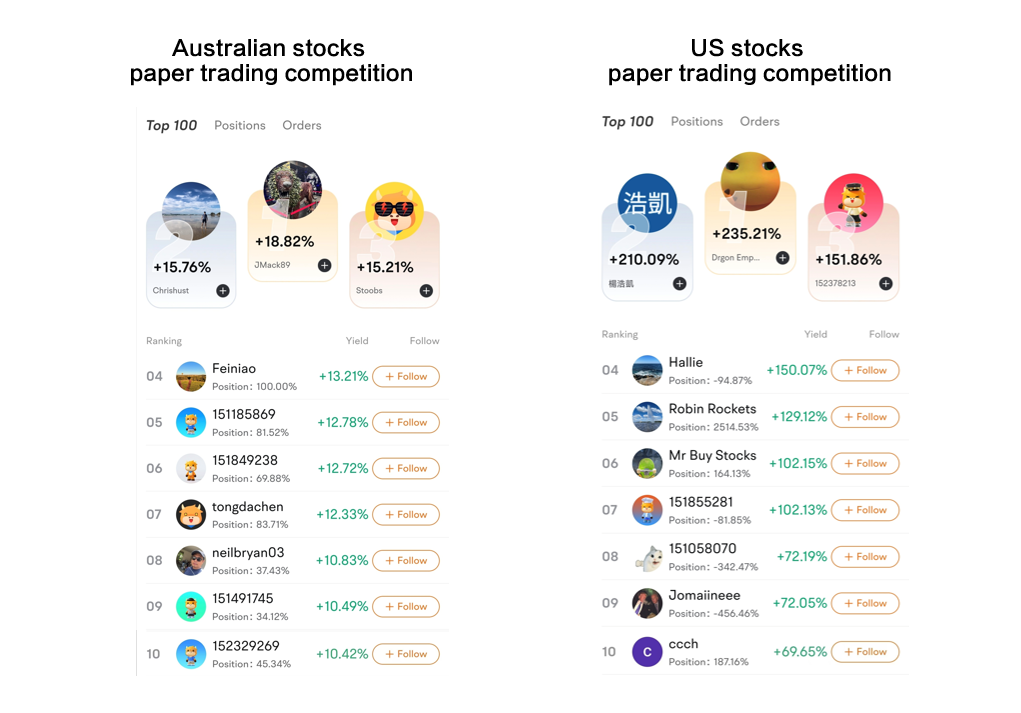

Who emerged victorious in the 2024 papertrading competition season2?

Hello mooers! The Australian Paper Trading Competition Season 2 has officially come to a close. It was amazing to see so many mooers embark on their trading journey and achieve great success!

Let us congratulate the champion of the competition!

@Drgon Empty Drg ranked first in the US stock paper trading and won a total return of 235% (as of August 5th). Let's take a look at how this user achieved it.

This investor is an enthusiast of options trading. We can see that he has made a total of 45 options trades on $NVIDIA (NVDA.US)$ alone. He also enjoys high-frequency trading within the day. This trading pattern has several main advantages:

Smaller risk exposure: Day traders usually do not hold positions overnight, which avoids the uncertainty brought by overnight market news and reduces risk.

Accumulated profits: Successful day traders can accumulate small profits through multiple trades, eventually achieving substantial overall profits.

Flexibility and liquidity: The high liquidity of the options market allows day traders to execute trades quickly and adapt to market changes.

Recently, technology stocks have been affected by factors such as high valuation pressures, concerns about slowing earnings growth, and external risk volatility. In addition, most technology stocks have performed poorly during this earnings season, resulting in a sluggish market for technology stocks.

We can see that this trader utilizes various options strategies to make money in different market phases. For example, by buying puts on Nvidia to profit from a decline in stock prices, or by selling calls on Nvidia to earn a premium.

It is an exchange-traded fund (ETF) designed to provide double the daily return of the Chicago Board Options Exchange Volatility Index (VIX) futures. This means that if the VIX futures price rises by 1%, UVIX should theoretically rise by approximately 2% (without considering costs, slippage, and other factors). It can amplify the returns of short-term VIX futures, allowing investors to obtain higher returns from increased volatility in the short term.

$CBOE Volatility S&P 500 Index (.VIX.US)$ is often referred to as the "fear index" because it reflects market expectations of implied volatility in the S&P 500 index for the next 30 days. During periods of market instability, VIX usually rises. UVIX can serve as a hedging tool to help protect investors' portfolios from the impact of market downturns.

It should be noted that such products are generally not suitable for long-term holding. Their prices fluctuate more dramatically than non-leveraged products, which increases the risks faced by investors and may result in significant deviations between actual returns and expected targets due to the compounding effect. Therefore, UVIX is more suitable for experienced traders for short-term trading strategies.

@JMack89 ranked first in the Australian stock paper trading and won a total return of 18.8% (as of August 5th). Let's take a look at how this user achieved it.

CU6.AU rose by 17.53% in July and has increased by over 180% since the beginning of the year. In April, Clarity announced that a prostate cancer patient had achieved a "complete response" after two cycles of Clarity's 67Cu-SAR-bisPSMA treatment, with no detectable levels of cancer in the six months following the treatment. This news was well-received by investors, and the ASX pharmaceuticals stock has been on an upward trend since then.

Furthermore, there are reports that CU6.AU will soon be meeting with the US Food and Drug Administration (FDA). The company is preparing for a discussion with the FDA regarding an approval study in patients with biochemical recurrence of prostate cancer. If approved, 64Cu-SAR-bisPSMA would directly compete with currently marketed PSMA agents.

The Zip share price also performed well, gaining 30.8% in July. Zip was added to the benchmark index during the month, and its share price surged following a successful capital raising and the release of its quarterly update.

The market was impressed by Zip's strong profitable growth in the fourth quarter, which likely contributed to its share price increase. Additionally, its inclusion in the ASX 200 index would have attracted interest from index funds, as they need to adjust their holdings to reflect the changes in the index.

And congratulations to the top 10 mooers who topped the leaderboard!

Once again, thank you to all mooers for making the paper trading competition such a memorable experience!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Laine Ford : no more read today

Laine Ford : good bye