Bitcoin hits $73,000: Who holds the most BTC? This ASX-listed firm stands among

Bitcoin has surprised us again by soaring past its old record to reach over $73,000 on March 13th with its value jumping over 70% since the beginning of the year. Even more impressive, ![]() Bitcoin's total worth has now surpassed that of silver, making it the world's eighth most valuable asset.

Bitcoin's total worth has now surpassed that of silver, making it the world's eighth most valuable asset.

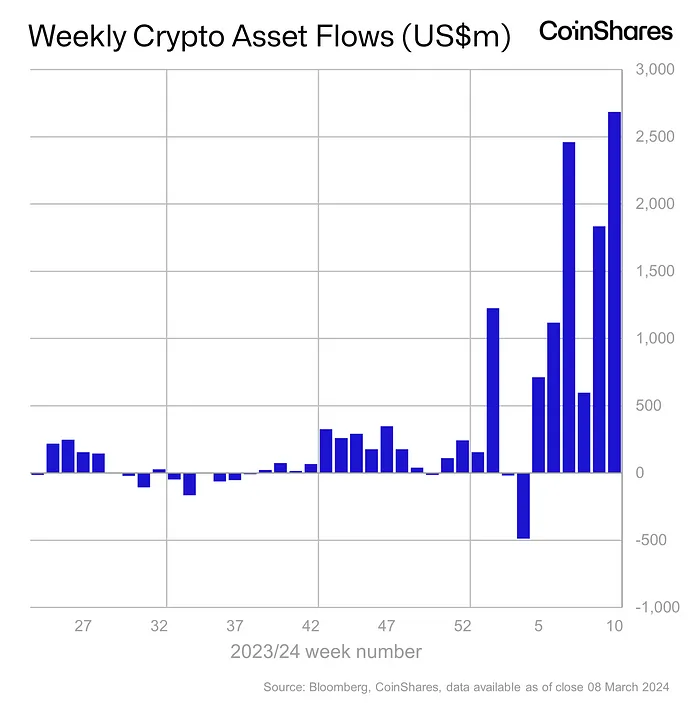

James Butterfill from CoinShares International pointed out that investor interest is on the rise, with around $10.3 billion invested in crypto assets early this year. This is almost as much as the total for the whole of 2021, when Bitcoin reached its then record of nearly $69,000.

1. The peak of the U.S. interest rate cycle makes Bitcoin more attractive.

2. Deteriorating U.S. fiscal conditions are bolstering Bitcoin's appeal as a haven.

3. The growing popularity of Bitcoin ETFs is driving up demand.

4. The excitement for the upcoming Bitcoin "halving."

5. London Stock Exchange is getting ready to accept applications for crypto ETNs

Looking back, we see that Bitcoin's price typically shoots up 6 to 12 months after a "halving" event, which cuts the reward for mining Bitcoin in half, and then reaches new highs.

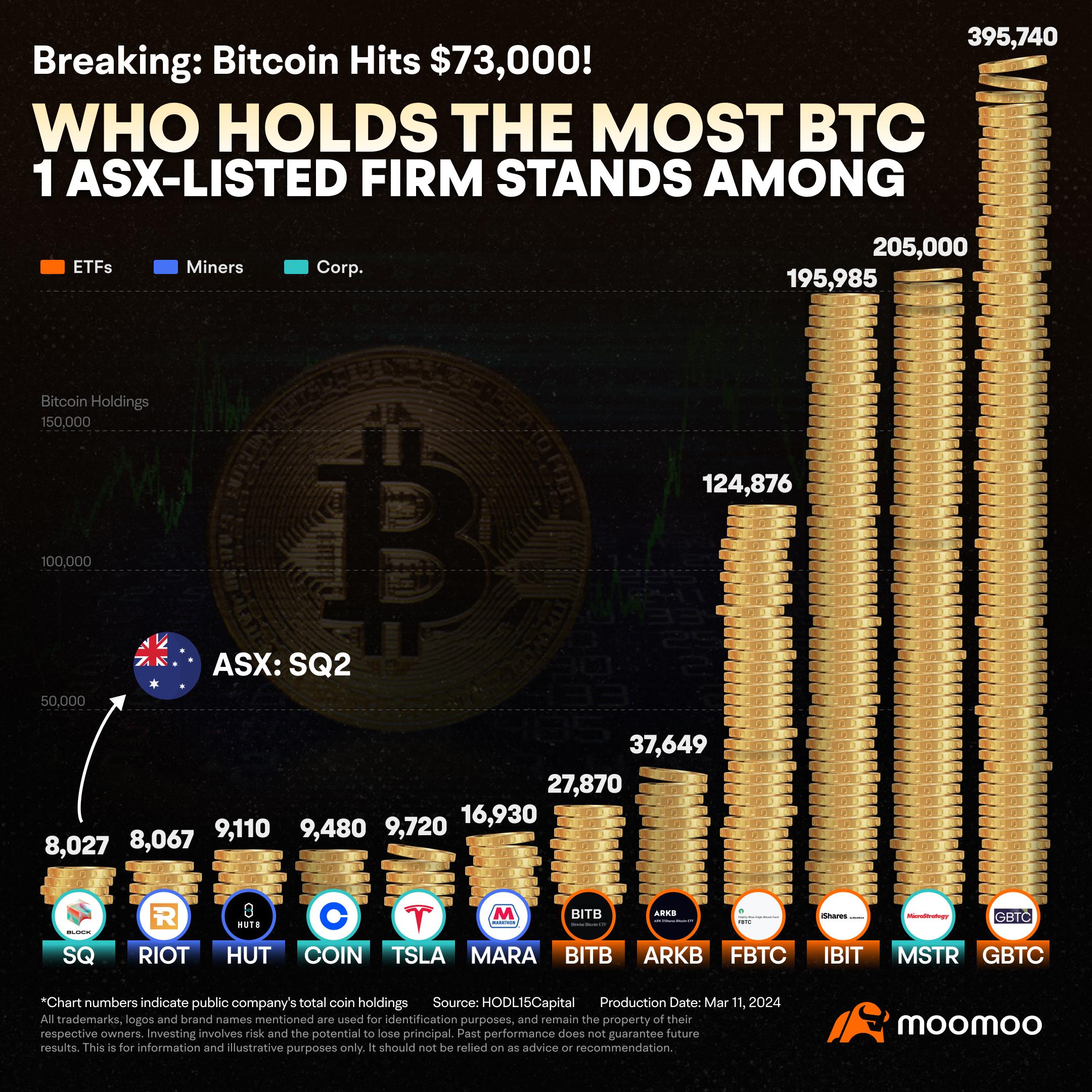

The following pic demonstrates the publicly traded companies that hold the most Bitcoin, with $Grayscale Bitcoin Trust (GBTC.US)$ as world's largest Spot Bitcoin ETF, holding the largest amount at 395,740 BTC. $MicroStrategy (MSTR.US)$ , the public company with the biggest stash of Bitcoin of 205,000, has seen its value shoot up over 135% this year, with its share price increasing nearly ten times since 2023. $MARA Holdings (MARA.US)$ , the world's largest pure-play Bitcoin miner, owns 16,930 BTC and EV giant $Tesla (TSLA.US)$ holds 9,720 BTC.

moomoo strategist Jessica Amir said,

Block is the company behind the Square terminal that you may tap on to pay for a doctor's visit, a coffee or a meal. It's also the company that bought the buy now pay later app Afterpay and it has a mobile payment service, Cash App.

As crypto becomes more accessible to investors, the market is growing up but still comes with much higher risks than traditional financial markets. Since Bitcoin first appeared, its price has been on a wild ride of dramatic ups and downs, with a range of risks that shouldn't be overlooked.

Also Read:

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RVLTN : Follow the math….

ETFs are eating well over available daily supply. Miners will only produce half , even that amount after April 20th (ish). The ETFs are just getting started, there are more ETFs coming, retail is finally fomo’ing , and Sovereign nations see much like many business owners that money just invested in BTC would’ve made them wealthy and free of the IMF tactics. What a time to be alive

heiPando : $MicroStrategy (MSTR.US)$ Part of the reason is that the company isn't just a Bitcoin bet; its core operating revenue still come from enterprise software, and it issues debt to buy more Bitcoins, making it a leveraged bet on the token. The stock trades at a steep premium to its Bitcoin holdings

heiPando RVLTN : FACT

David Gustavsson : I will