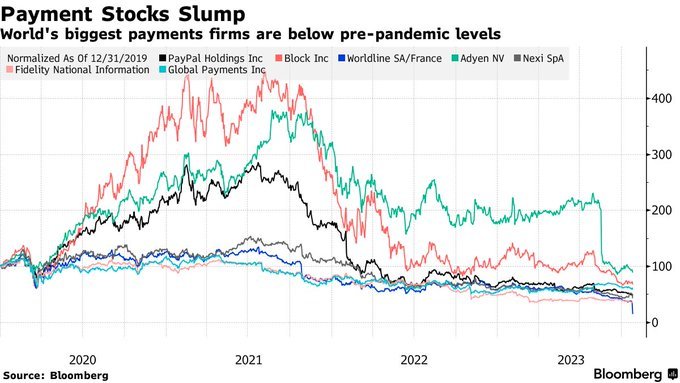

first of all we got the chance to buy these at a multiyear valuation low and for some at a decade and more low.

Now to what most do not realize.

The combination of higher prices and higher borrowing costs has caused consumers to pull back on discretionary spending more broadly.

Typically, merchants swiftly receive deposits for credit and debit card sales within a few days of the transaction. However, the collection of interchange and merchant processing fees is deferred until after the month concludes.

During this interim period, the payment processor covers the interchange fees owed to credit card companies on behalf of the merchant, simplifying the reconciliation process for the merchant's back end.

Effectively, the practice of promptly depositing sales while delaying the collection of interchange and processing fees serves as a temporary loan of processing fees to the merchant.

Often, payment processors utilize short-term bank loans to finance this arrangement. When the Federal Reserve increases interest rates, the expense of these short-term loans rises, leading to higher costs for the payment processor.

Processors face the choice of either absorbing this additional cost or passing it on to the merchants.

Both creates negatives for the company.

The falling bonds/rates as well as the new FED shown dot-plot and the expectation of rate cuts in 2024 will change the nefarious dynamic into a positive into the next year.