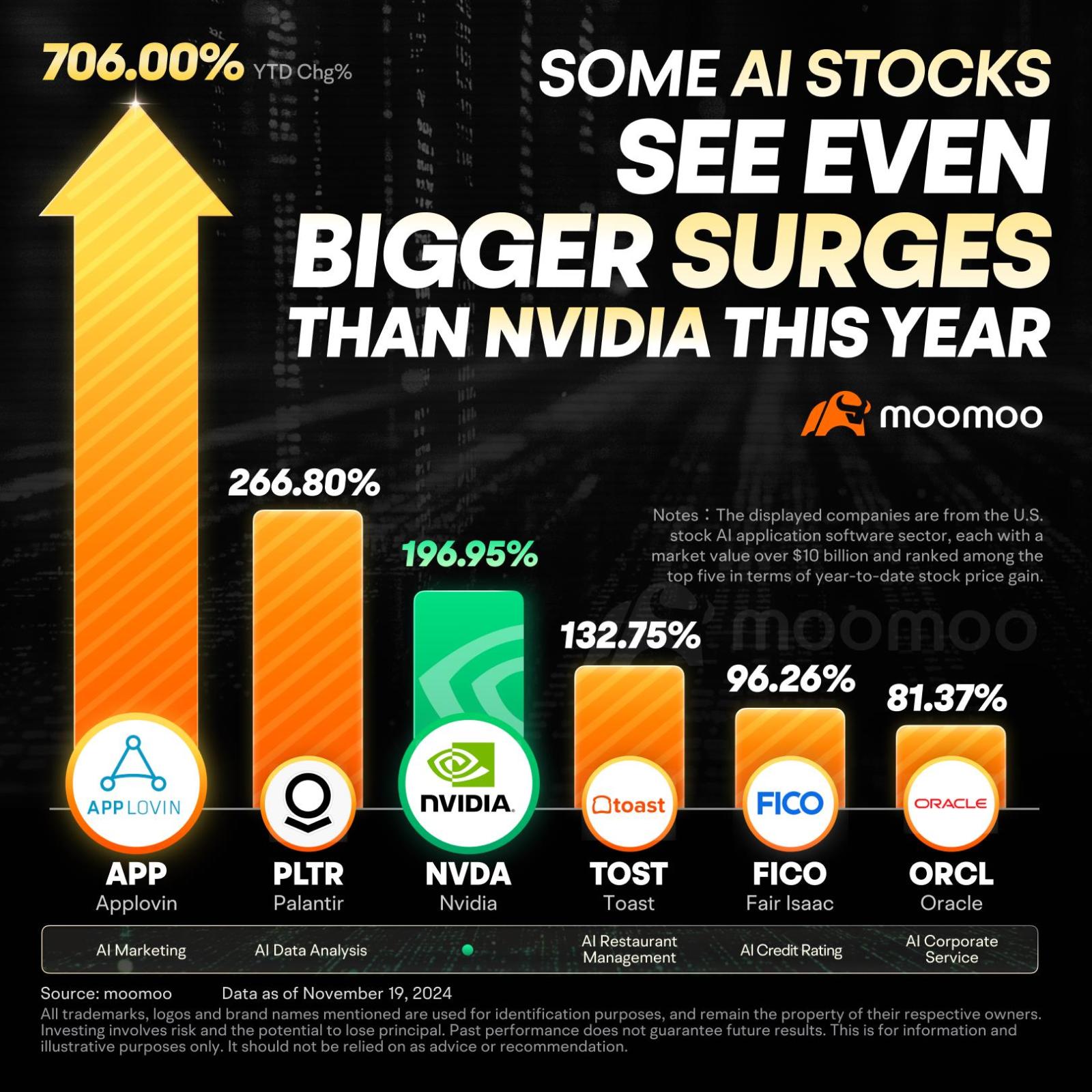

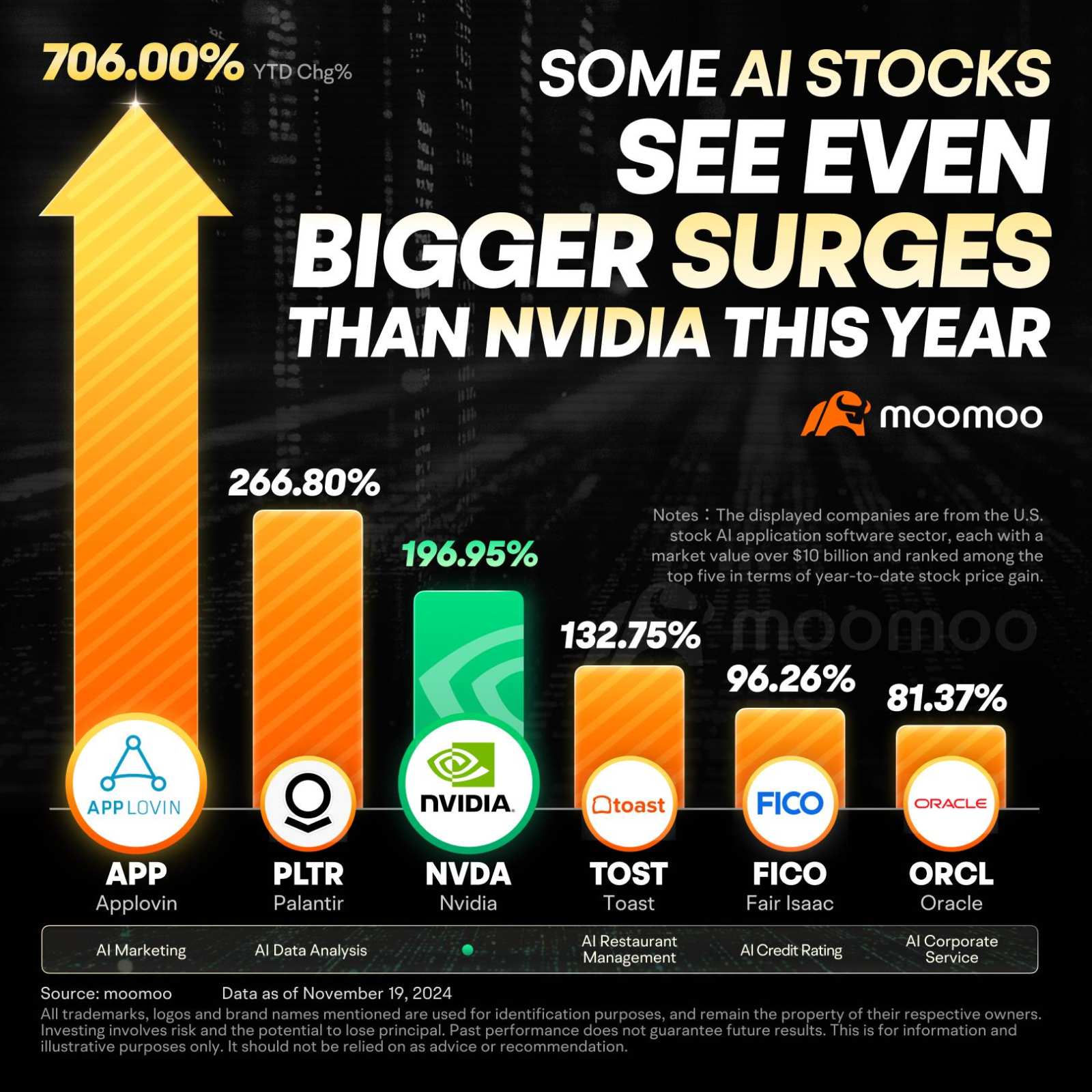

Why Are These AI Stocks Seeing Even Bigger Surges Than Nvidia This Year?

Fueled by robust performance, prominent U.S. AI advertising and marketing firm AppLovin saw its stock price surge over 100% following the release of its Q3 results, with an impressive year-to-date growth exceeding 700%. Financial disclosures highlight that the company's AI recommendation engine, AXON, significantly enhanced the AppDiscovery advertising platform, leading to a rise in software platform revenues to $835 million, which marks a 66% increase from the previous year. This success underscores the effective application and benefits of AI software in driving business growth.

This trend of AI-driven success is not unique to AppLovin, as other companies like Palantir, TOAST, FICO, and Oracle have also seen significant gains. Notably, AppLovin and Palantir have outperformed even Nvidia regarding stock price gains this year.

AppLovin Has Been a Huge AI Winner This Year

$Applovin (APP.US)$ offers a robust end-to-end software platform that enables companies to effectively engage users, expand their operations, and increase revenue.

A key revenue generator for AppLovin, AppDiscovery, utilizes AXON's predictive algorithms to precisely pair advertisers' apps with users most likely to engage with them. This targeted advertising approach emphasizes personalization, helping advertisers connect with the ideal audience and present them with relevant content.

The platform is designed to optimize revenue for advertisers by adapting their campaigns based on user attraction likelihood. Advertisers define their goals and desired returns, and AXON adjusts the campaign costs and specifics accordingly to align with these targets.

AppLovin enhances ad monetization, generating additional revenue for advertisers. Its tools function at microsecond speeds and on a vast scale, improving monetization for developers while preserving a quality experience for end-users.

AppLovin's consistently superior performance underscores the efficacy of its AI-driven marketing model. Advertisers are increasingly willing to invest more for better outcomes, reflecting their trust in the platform's advanced user targeting and conversion capabilities.

Piper Sandler analyst James Callahan initiated coverage of AppLovin with an Overweight rating and $400 price target. The shares have "appropriately re-rated" following an artificial intelligence-driven acceleration, but Piper still sees an upside, the analyst tells investors in a research note. The firm says AppLovin's technology has driven advertising revenue growth well above the market, and there is room to drive monetization and minutes higher. On valuation, the shares trade slightly above the group average, contends Piper.

Palantir Stock: How High is Too High?

$Palantir (PLTR.US)$ stands out as one of the few companies where AI drives substantial returns for the business and delivers significant value to its customers. It consistently outperforms its peers in the software industry regarding AI-driven growth.

In Q3, Palantir reaffirmed its position as a leading AI software company beyond the realm of cloud hyperscalers. The company demonstrated notable AI-fueled growth, maintaining strong business momentum with its AI Product Initiative (AIP), achieving remarkable 30% year-over-year revenue growth and robust profitability—traits seldom seen together in growth stocks.

The results from Q3 marked a significant shift for Palantir, with revenue growth surging over 17 percentage points from Q2 2023 to Q3 2024, the highest since Q1 2022. AIP has been crucial in this rapid revenue acceleration, particularly its widespread adoption in the U.S. commercial sector. The scalability, interoperability, and versatility of AIP allow for swift integration by enterprises. Palantir's commercial clients can leverage AI and machine learning capabilities within the Foundry and Gotham platforms, utilizing the latest large language models (LLMs) for immediate analytics, insights, and enhanced productivity and efficiency.

Goldman Sachs analyst Gabriela Borges recently increased the price target for Palantir to $41 from $16 while maintaining a Neutral rating on the stock. According to Borges, Goldman Sachs had previously "underestimated" the potential momentum Palantir was poised to gain in 2024 as it deployed its core technological strengths—such as data stitching and ontology building—to address bespoke AI software challenges for enterprise clients. However, the neutral rating reflects the current market pricing, which seems to have already factored in the significant achievements of AIP, as Goldman Sachs plans more analysis to ascertain the sustainability of Palantir's competitive edge.

Source: Forbes, the Fly

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

BREEZUSCHRIST : If I hadn’t sold way back when