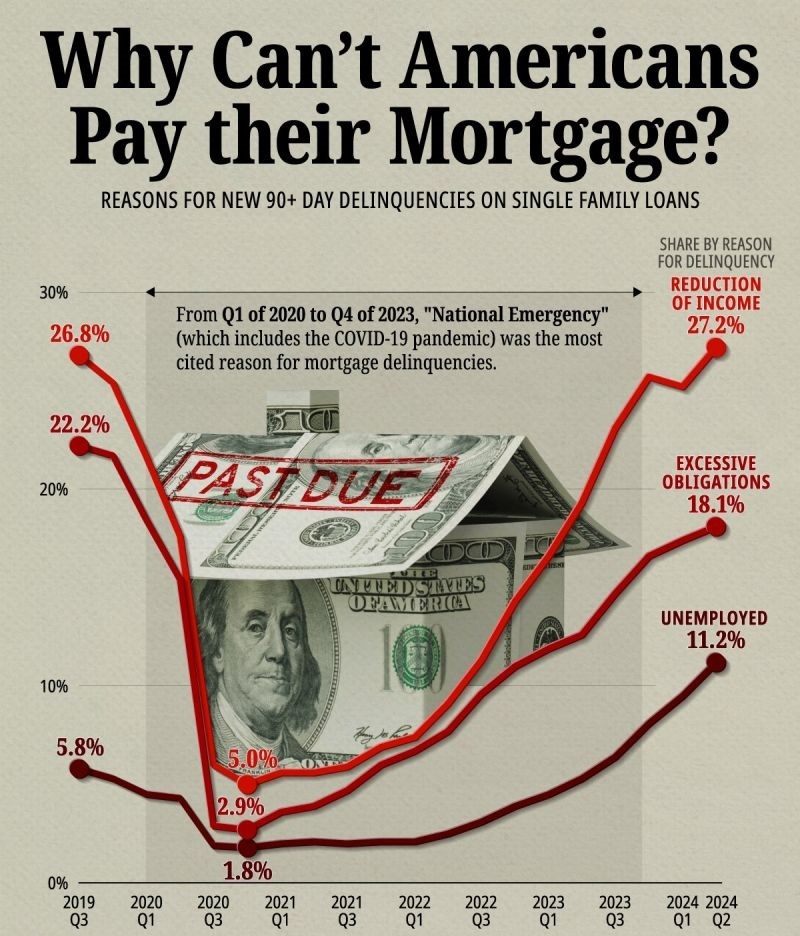

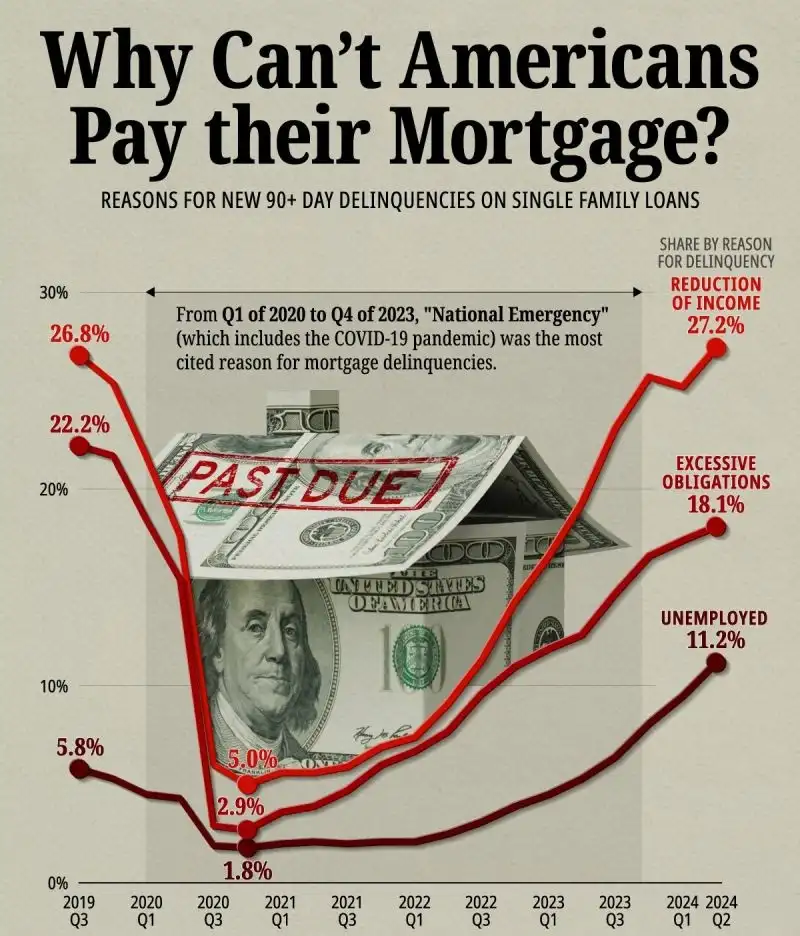

Why Cant Americans Pay their Mortgage

So headline CPI for July dropped to 2.9% from 3% June (12-month basis). This is the first time the index has fallen below 3% since March 2021 of the pandemic era.

But core inflation remains above 3%, largely driven by housing costs which is arguably the area Main Street is struggling the most (see chart below). For example, the shelter index, which accounts for 90% of the monthly increase, rose 0.4% having risen 0.2% in June, according to Bloomberg data.

Since the FED's decision to hold steady on rates in July, all sights have been set on a September cut and this inflation report has done little to change expectations – perhaps with the exception that the odds of a 50bps cut are now under 50%.

Sure, there is an argument to be made that the FED will now be a day late and a dollar short when they do cut in September and that it will be too late to stave off recession. But the number of underlying signals are so numerous that current narrative around 'economic resilience' means current short term performance is always going to be flattering to deceive:

❌ $35 trillion national debt

❌ 122% debt/gdp ratio

❌ Declining real wages

❌ Labor Force Participation Rate struggling to return to pre-pandemic levels

❌ Rising delinquencies

❌ Record credit card debt (now $1.1 trillion)

❌ Interest on national debt now 76% of federal income tax (June)

But core inflation remains above 3%, largely driven by housing costs which is arguably the area Main Street is struggling the most (see chart below). For example, the shelter index, which accounts for 90% of the monthly increase, rose 0.4% having risen 0.2% in June, according to Bloomberg data.

Since the FED's decision to hold steady on rates in July, all sights have been set on a September cut and this inflation report has done little to change expectations – perhaps with the exception that the odds of a 50bps cut are now under 50%.

Sure, there is an argument to be made that the FED will now be a day late and a dollar short when they do cut in September and that it will be too late to stave off recession. But the number of underlying signals are so numerous that current narrative around 'economic resilience' means current short term performance is always going to be flattering to deceive:

❌ $35 trillion national debt

❌ 122% debt/gdp ratio

❌ Declining real wages

❌ Labor Force Participation Rate struggling to return to pre-pandemic levels

❌ Rising delinquencies

❌ Record credit card debt (now $1.1 trillion)

❌ Interest on national debt now 76% of federal income tax (June)

$Vanguard S&P 500 ETF (VOO.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $Invesco QQQ Trust (QQQ.US)$ $Invesco NASDAQ 100 ETF (QQQM.US)$ $iShares Russell 2000 ETF (IWM.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $Bitcoin (BTC.CC)$ $Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $Netflix (NFLX.US)$ $Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

RDK79 : Because they go to McDonald’s too often, and drive their 15 mpg gas engine pickup.

Jaguar8 : One thing is, as prices of commodities and other bills soar, lifestyle of individuals didn’t change, hence the more purchasing power is diminished on all ends

intuitive jackal : that sounded very racist, maybe they could if they had an Asian diet of rice and fish head soup. but then again we have a very different culture you can't possibly understand.

10baggerbamm intuitive jackal :

Airbags Jaguar8 : I agree

kettlebell : live paycheck to paycheck, so many buy now pay later schemes... debt driven economy just like their government budget. 上梁不正下梁歪.

72791323 RDK79 : Healthy food is expensive And when your occupation requires a pickup truck that’s what u drive $50k and above electric cars are a luxury